Maryland Gift Deed from Two Grantors to a Non Profit Corporation as Grantee Form

Understanding the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

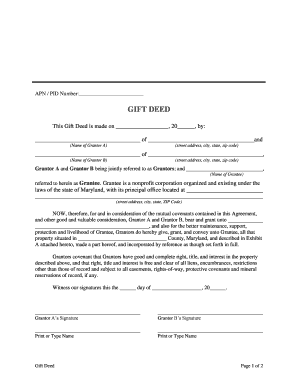

The Maryland gift deed from two grantors to a non profit corporation as grantee is a legal document that facilitates the transfer of property or assets from individuals to a non-profit organization. This form is particularly useful for those who wish to make charitable contributions while ensuring that the transfer is legally recognized. The deed outlines the terms of the gift, including the description of the property being transferred and the intent of the grantors. It is essential to ensure that all legal requirements are met for the deed to be valid and enforceable.

Steps to Complete the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

Completing the Maryland gift deed requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including the names and addresses of the grantors and the non-profit corporation.

- Clearly describe the property being gifted, including its location and any relevant details.

- Include the intent of the grantors to make the gift, ensuring that it is explicitly stated.

- Sign the deed in the presence of a notary public to validate the document.

- File the deed with the appropriate local government office, if required.

Legal Use of the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

The legal use of the Maryland gift deed is crucial for ensuring that the transfer of property is recognized by law. To be legally binding, the deed must comply with Maryland state laws, including proper execution and notarization. Additionally, the deed should clearly outline the terms of the gift to avoid any potential disputes in the future. Understanding these legal requirements helps protect both the grantors and the non-profit organization involved in the transaction.

Key Elements of the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

Several key elements must be included in the Maryland gift deed to ensure its validity:

- Grantors' Information: Full names and addresses of the individuals making the gift.

- Grantee's Information: Name and address of the non-profit corporation receiving the gift.

- Property Description: A detailed description of the property being transferred, including any identifying details.

- Intent Statement: A clear statement indicating the grantors' intention to gift the property.

- Signatures: Signatures of both grantors, along with a notary's acknowledgment.

Obtaining the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

Obtaining the Maryland gift deed can be accomplished through various means. Many individuals choose to consult with an attorney to ensure that the deed is drafted correctly and meets all legal requirements. Alternatively, templates for the deed may be available online, but it is crucial to verify that these templates comply with Maryland state laws. Once the deed is prepared, it should be reviewed for accuracy before being signed and notarized.

State-Specific Rules for the Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

Maryland has specific rules governing the execution and recording of gift deeds. These rules include requirements for notarization, as well as any applicable filing fees. It is important for grantors to familiarize themselves with these regulations to ensure compliance. Additionally, certain tax implications may arise from the transfer of property, so consulting with a tax advisor may also be beneficial.

Quick guide on how to complete maryland gift deed from two grantors to a non profit corporation as grantee

Effortlessly prepare Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee with ease

- Obtain Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specially designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to share your form, either by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MD gift form and how can airSlate SignNow help with it?

An MD gift form is a legal document used to facilitate the gifting of assets or property in Maryland. airSlate SignNow simplifies the process of creating and signing MD gift forms with its user-friendly platform, ensuring that both parties can complete the necessary paperwork efficiently and securely.

-

How do I create an MD gift form using airSlate SignNow?

To create an MD gift form with airSlate SignNow, simply log into your account, select the option to create a new document, and choose from our customizable templates. You can then fill in the required information and send it for eSignature, making the process quick and paperless.

-

Is there a cost associated with using airSlate SignNow for MD gift forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Depending on the features you require for handling MD gift forms, you can choose an affordable plan that suits your budget while enjoying the benefits of electronic signature and document management.

-

What features does airSlate SignNow offer for managing MD gift forms?

airSlate SignNow provides a range of features for managing MD gift forms, including customizable templates, real-time tracking of document statuses, and automated reminders for signers. These tools help streamline the signing process and ensure that your documents are handled promptly.

-

Can I integrate airSlate SignNow with other applications for managing MD gift forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRM systems and cloud storage services, making it easier to manage your MD gift forms alongside your existing workflows. This integration enhances productivity and reduces the time spent on document management.

-

What are the benefits of using airSlate SignNow for MD gift forms?

Using airSlate SignNow for MD gift forms offers numerous benefits, including increased efficiency, enhanced security, and the ability to sign documents from anywhere. Moreover, the electronic signature process is legally binding, ensuring that your assets are transferred effectively.

-

Is airSlate SignNow compliant with legal standards for MD gift forms?

Yes, airSlate SignNow complies with all relevant legal standards required for MD gift forms, including eSignature laws. This compliance ensures that your electronic documents and signatures are legally valid, providing you with peace of mind when finalizing your gifts.

Get more for Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

- Arizona mineral lease form

- Quitclaim deed two individuals to one individual arizona form

- Az special warranty deed form

- Az husband wife 497296972 form

- Warranty trust form

- Transfer on death deed or tod beneficiary deed for husband and wife to four individuals arizona form

- Revocation of transfer on death deed or tod beneficiary deed for husband and wife grantors arizona form

- Warranty deed individual to three individuals arizona form

Find out other Maryland Gift Deed From Two Grantors To A Non Profit Corporation As Grantee

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors