Mt Llc Form

What is the MT LLC?

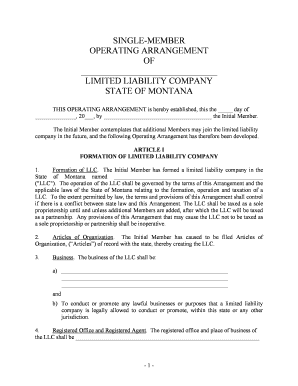

The MT LLC, or Montana Limited Liability Company, is a popular business structure that combines the benefits of both a corporation and a partnership. It provides personal liability protection to its owners, known as members, shielding their personal assets from business debts and liabilities. This structure is particularly advantageous for small business owners and entrepreneurs in Montana, as it allows for flexibility in management and tax treatment. An MT LLC can be owned by one or more individuals or entities, making it a versatile option for various business ventures.

How to Obtain the MT LLC

To obtain an MT LLC, you must follow a series of steps that ensure compliance with state regulations. First, choose a unique name for your LLC that adheres to Montana's naming requirements. Next, designate a registered agent who will be responsible for receiving legal documents on behalf of the LLC. After that, you will need to file Articles of Organization with the Montana Secretary of State, which includes essential details about your business. There is a filing fee associated with this process, and you may also want to draft an operating agreement to outline the management structure and operating procedures of your LLC.

Steps to Complete the MT LLC

Completing the formation of an MT LLC involves several key steps:

- Choose a unique name that complies with Montana naming rules.

- Select a registered agent who will handle legal correspondence.

- File the Articles of Organization with the Montana Secretary of State.

- Pay the required filing fee.

- Consider creating an operating agreement to define management roles and responsibilities.

Once these steps are completed, your MT LLC will be officially recognized, allowing you to operate your business legally within the state.

Legal Use of the MT LLC

The MT LLC is legally recognized as a separate entity, which means it can enter into contracts, own property, and sue or be sued in its own name. This legal status provides members with protection against personal liability for business debts, making it an attractive option for entrepreneurs. However, it is essential to maintain compliance with state regulations, including filing annual reports and paying any necessary fees, to ensure the continued legal standing of the LLC.

Required Documents

When forming an MT LLC, several documents are required to ensure compliance with state laws. The primary document is the Articles of Organization, which must be filed with the Montana Secretary of State. Additionally, while not mandatory, it is advisable to draft an operating agreement to clarify the management structure and operational procedures of the LLC. Other documents may include a business license, depending on the nature of your business and local regulations.

IRS Guidelines

For tax purposes, the IRS treats LLCs as pass-through entities by default, meaning that profits and losses are reported on the members' personal tax returns. However, LLCs can also elect to be taxed as a corporation if it benefits the business. It is crucial for members of an MT LLC to understand their tax obligations and maintain accurate financial records to comply with IRS guidelines. Consulting a tax professional can provide additional clarity on the best tax strategy for your specific situation.

Quick guide on how to complete mt llc

Finish Mt Llc effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Mt Llc on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Mt Llc effortlessly

- Locate Mt Llc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searching, or errors requiring you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Mt Llc and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit my mt company?

airSlate SignNow offers an easy-to-use platform that allows your mt company to send and eSign documents quickly. This service streamlines your document workflow, reducing paper usage and saving time. With customizable templates and a user-friendly interface, your team can enhance productivity and efficiency.

-

How much does airSlate SignNow cost for mt companies?

The pricing for airSlate SignNow is designed to be cost-effective for mt companies of all sizes. Several plans are available, allowing businesses to choose one that best fits their needs and budget. Each plan includes different features, ensuring your mt company only pays for what it requires.

-

What features does airSlate SignNow offer for mt companies?

airSlate SignNow provides numerous features for mt companies, including electronic signature capabilities, document templates, and advanced security options. It also allows for collaboration among team members and integration with various business applications to enhance your workflow. This versatility makes it an ideal choice for modern businesses.

-

Is airSlate SignNow secure for my mt company’s documents?

Yes, airSlate SignNow prioritizes the security of your mt company's documents by utilizing state-of-the-art encryption and compliance certifications. This ensures that all your sensitive information is protected during the signing process. Rest assured, your data remains confidential and secured.

-

Can I integrate airSlate SignNow with other tools used by my mt company?

Absolutely! airSlate SignNow offers seamless integration with a variety of tools commonly used by mt companies, such as Google Workspace, Salesforce, and Zapier. These integrations enhance workflow automation and improve overall productivity, ensuring your team has access to the tools they need.

-

How does airSlate SignNow improve the document signing process for mt companies?

By utilizing airSlate SignNow, mt companies can signNowly improve their document signing process. The platform allows users to sign documents from anywhere at any time, reducing delays associated with traditional signing methods. This not only speeds up transactions but also enhances customer satisfaction.

-

Is there customer support available for mt companies using airSlate SignNow?

Yes, airSlate SignNow provides exceptional customer support for mt companies. Users can access various resources, including live chat, email support, and extensive documentation to troubleshoot any issues. This ensures that your team can always rely on airSlate SignNow for assistance whenever needed.

Get more for Mt Llc

- Quitclaim deed one individual grantor to four individual grantees arizona form

- Az limited liability company form

- Arizona renunciation and disclaimer of joint tenant or tenancy interest arizona form

- Affidavit of mailing mechanic liens individual arizona form

- Quitclaim deed by two individuals to llc arizona form

- Warranty deed from two individuals to llc arizona form

- Deed husband wife 497296986 form

- Arizona death deed form

Find out other Mt Llc

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free