An4554 DOC Rurdev Usda Form

What is the An4554 doc Rurdev Usda

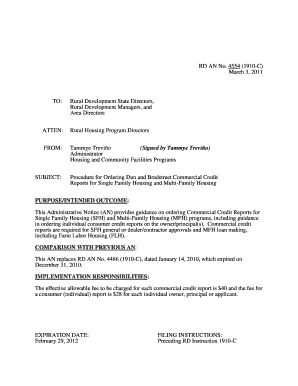

The An4554 document, issued by the Rural Development (Rurdev) division of the U.S. Department of Agriculture (USDA), is primarily used for various applications related to rural development programs. This form is essential for individuals and businesses seeking assistance or funding for projects that promote economic growth and sustainability in rural areas. It serves as a formal request for aid and outlines the necessary information required for processing applications.

How to use the An4554 doc Rurdev Usda

Using the An4554 document involves several steps to ensure accurate completion and submission. Applicants must first gather all necessary information, including personal and project details. The form must be filled out completely, providing all requested data to avoid delays in processing. Once completed, the document should be submitted according to the instructions provided by the USDA, either online or through traditional mail.

Steps to complete the An4554 doc Rurdev Usda

Completing the An4554 document requires careful attention to detail. Here are the steps to follow:

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documentation, including identification and project proposals.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form through the designated submission method.

Key elements of the An4554 doc Rurdev Usda

Key elements of the An4554 document include personal identification information, project details, and financial data. Each section of the form is designed to capture specific information that helps the USDA assess the application. Understanding these elements is crucial for ensuring that the form is filled out correctly and meets all requirements for approval.

Eligibility Criteria

Eligibility for using the An4554 document is determined by several factors, including the applicant's residency in a rural area and the nature of the project proposed. Applicants must demonstrate that their project aligns with USDA goals for rural development, such as improving infrastructure, enhancing economic opportunities, or promoting community services. It is important to review the specific eligibility requirements outlined by the USDA before applying.

Form Submission Methods

The An4554 document can be submitted through various methods, depending on the preferences of the applicant and the guidelines provided by the USDA. Common submission methods include:

- Online submission through the USDA's official portal.

- Mailing the completed form to the appropriate USDA office.

- In-person submission at designated USDA locations.

Quick guide on how to complete an4554 doc rurdev usda

Effortlessly prepare [SKS] on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal sustainable substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you would like to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to An4554 doc Rurdev Usda

Create this form in 5 minutes!

How to create an eSignature for the an4554 doc rurdev usda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the An4554 doc Rurdev Usda?

The An4554 doc Rurdev Usda is a specific document used in the USDA Rural Development program. It is essential for applicants seeking financial assistance for rural housing projects. Understanding this document is crucial for ensuring compliance and successful application.

-

How can airSlate SignNow help with the An4554 doc Rurdev Usda?

airSlate SignNow simplifies the process of completing and signing the An4554 doc Rurdev Usda. Our platform allows users to easily fill out, eSign, and send this document securely. This streamlines the application process for USDA funding.

-

What are the pricing options for using airSlate SignNow for the An4554 doc Rurdev Usda?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large organization, you can find a plan that fits your budget while efficiently managing the An4554 doc Rurdev Usda. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for managing the An4554 doc Rurdev Usda?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically for the An4554 doc Rurdev Usda. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Are there any benefits to using airSlate SignNow for the An4554 doc Rurdev Usda?

Using airSlate SignNow for the An4554 doc Rurdev Usda offers numerous benefits, including time savings and improved accuracy. Our solution reduces the risk of errors and allows for faster processing of your USDA applications, helping you meet deadlines more effectively.

-

Can I integrate airSlate SignNow with other software for the An4554 doc Rurdev Usda?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your workflow for the An4554 doc Rurdev Usda. This allows you to connect with CRM systems, cloud storage, and other tools to streamline your document management process.

-

Is airSlate SignNow secure for handling the An4554 doc Rurdev Usda?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your An4554 doc Rurdev Usda is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for An4554 doc Rurdev Usda

Find out other An4554 doc Rurdev Usda

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease