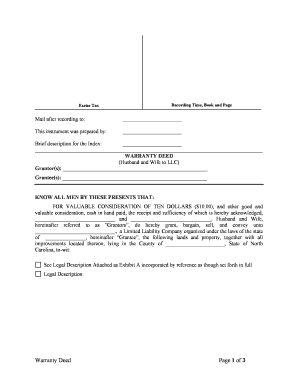

Deed Husband Wife Form

What is the Deed Husband Wife

The Deed Husband Wife is a legal document that allows a married couple to transfer property ownership between themselves. This deed is particularly useful for couples who wish to clarify ownership rights or make changes to property titles without involving third parties. It serves as a formal record of the transfer, ensuring that both parties are recognized as co-owners of the property. The deed typically includes essential information such as the names of both spouses, a description of the property, and the signatures of both parties to validate the transfer.

Key elements of the Deed Husband Wife

Several key elements must be included in the Deed Husband Wife to ensure its legality and effectiveness:

- Names of the parties: Both spouses' full legal names must be clearly stated.

- Property description: A detailed description of the property being transferred, including its address and any relevant parcel numbers.

- Intent to transfer: A clear statement indicating the intention to transfer ownership from one spouse to the other.

- Signatures: Both spouses must sign the document to validate the transfer.

- Notarization: While not always required, having the deed notarized can add an extra layer of legal protection.

Steps to complete the Deed Husband Wife

Completing the Deed Husband Wife involves several straightforward steps:

- Gather necessary information: Collect the full names of both spouses and the property details.

- Draft the deed: Use a template or legal software to create the deed, ensuring all key elements are included.

- Review the document: Both parties should carefully review the deed for accuracy and completeness.

- Sign the deed: Both spouses must sign the document in the presence of a notary if required.

- File the deed: Submit the completed deed to the appropriate local government office, such as the county clerk or recorder's office, to officially record the transfer.

Legal use of the Deed Husband Wife

The Deed Husband Wife is legally recognized in many states as a valid means of transferring property between spouses. This document can be used to clarify ownership, protect assets, and facilitate estate planning. However, it is essential to ensure compliance with state-specific laws regarding property transfers. In some jurisdictions, additional requirements may apply, such as filing fees or specific forms that need to be completed alongside the deed.

How to obtain the Deed Husband Wife

Obtaining a Deed Husband Wife can be accomplished through various means:

- Legal templates: Many online legal services provide templates for the Deed Husband Wife that can be customized to fit your needs.

- Consult a lawyer: For those who prefer professional assistance, consulting a real estate attorney can ensure the document is correctly prepared and compliant with local laws.

- County recorder’s office: Some local government offices may offer forms or guidance on how to create a valid deed.

State-specific rules for the Deed Husband Wife

Each state in the U.S. may have unique regulations regarding the use and acceptance of the Deed Husband Wife. It is crucial to research the specific requirements in your state, as some may require additional documentation or have different notarization rules. Checking with the local county recorder's office can provide clarity on what is necessary to ensure the deed is valid and enforceable.

Quick guide on how to complete deed husband wife 481377430

Complete Deed Husband Wife effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without complications. Handle Deed Husband Wife on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Deed Husband Wife effortlessly

- Obtain Deed Husband Wife and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Edit and eSign Deed Husband Wife and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a husband wife LLC and how does it work?

A husband wife LLC is a limited liability company owned and managed by a married couple. It allows both partners to operate their business jointly while providing liability protection and tax benefits. In essence, it simplifies the process of running a business together, making it a popular option for couples.

-

What are the benefits of forming a husband wife LLC?

Forming a husband wife LLC offers several benefits, including liability protection for personal assets, tax advantages like pass-through taxation, and flexibility in management structure. Additionally, it can strengthen the partnership between spouses and streamline the business decision-making process. Overall, a husband wife LLC is an effective way to combine business and personal objectives.

-

How much does it cost to set up a husband wife LLC?

The cost to set up a husband wife LLC varies by state, including filing fees and any necessary legal assistance. Typically, the overall expense can range from a few hundred to over a thousand dollars. It's important to consider ongoing maintenance costs as well, such as annual report fees and tax preparation expenses.

-

Can I use airSlate SignNow for my husband wife LLC?

Yes, airSlate SignNow is an excellent solution for managing documents for your husband wife LLC. It enables you to create, send, and eSign important documents with ease, ensuring that your business operations run smoothly. With its user-friendly interface, you'll find it simple to keep your LLC organized and compliant.

-

What features does airSlate SignNow offer for my husband wife LLC?

airSlate SignNow offers a variety of features tailored for your husband wife LLC, including document templates, electronic signatures, and collaboration tools. These features simplify document management and provide a secure platform for storing and sharing important files. With tracking and reminder options, you'll stay organized and on top of your LLC's tasks.

-

Are there any integrations available for airSlate SignNow that benefit a husband wife LLC?

Absolutely! airSlate SignNow integrates with numerous applications that can enhance the operations of your husband wife LLC, such as CRM systems, project management tools, and cloud storage services. These integrations facilitate smooth workflows and data management across various platforms, simplifying your business processes.

-

How secure is airSlate SignNow for my husband wife LLC documents?

airSlate SignNow prioritizes security, offering encrypted storage and secure signing processes for your husband wife LLC documents. With features like multiple authentication options and compliance with data protection regulations, you can be assured that your business information is well-protected and confidential.

Get more for Deed Husband Wife

- California contract contractor form

- Renovation contract for contractor california form

- Concrete mason contract for contractor california form

- Demolition contract for contractor california form

- Framing contract for contractor california form

- California contract contractor 497298117 form

- California contract contractor 497298118 form

- Paving contract for contractor california form

Find out other Deed Husband Wife

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now