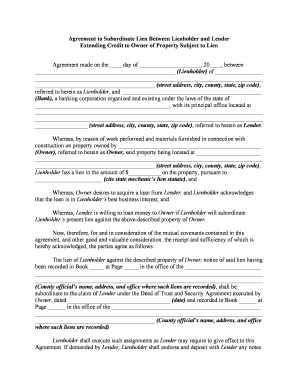

Lien Property Form PDF

What is the agreement credit form?

The agreement credit form is a crucial document used in financial transactions, particularly when a lender extends credit to a borrower. This form outlines the terms and conditions of the credit being offered, including the amount, interest rates, repayment schedule, and any collateral involved. It serves as a legally binding agreement between the lender and the borrower, ensuring both parties understand their rights and responsibilities. The form may also include provisions for default, late fees, and other relevant details that protect the lender's interests while providing clarity to the borrower.

Key elements of the agreement credit form

Understanding the key elements of the agreement credit form is essential for both lenders and borrowers. The primary components typically include:

- Borrower Information: Details about the individual or entity receiving the credit, including name, address, and contact information.

- Lender Information: Information about the lending institution or individual providing the credit.

- Credit Amount: The total amount of credit being extended.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Repayment Terms: A detailed schedule outlining how and when payments will be made.

- Collateral: Any assets pledged by the borrower to secure the credit.

- Default Terms: Conditions that define what constitutes a default and the consequences thereof.

Steps to complete the agreement credit form

Completing the agreement credit form involves several important steps to ensure accuracy and compliance with legal standards. Follow these steps for a smooth process:

- Gather Necessary Information: Collect all required information about both the borrower and lender.

- Fill Out the Form: Carefully input the details into the form, ensuring all fields are completed accurately.

- Review Terms: Both parties should review the terms of the agreement to ensure mutual understanding.

- Sign the Document: Both the lender and borrower must sign the form to make it legally binding.

- Distribute Copies: Provide copies of the signed agreement to all parties involved for their records.

Legal use of the agreement credit form

The agreement credit form holds legal significance in the United States, as it establishes the terms of the credit arrangement. For the document to be enforceable, it must comply with relevant federal and state laws governing lending practices. This includes adherence to regulations such as the Truth in Lending Act, which mandates clear disclosure of credit terms. Additionally, both parties should ensure that the form is signed in the presence of a witness or notary, if required, to further validate the agreement.

Examples of using the agreement credit form

There are various scenarios in which an agreement credit form may be utilized. Common examples include:

- Personal Loans: Individuals borrowing money from friends, family, or financial institutions.

- Business Loans: Companies seeking funding for operations, expansion, or purchasing equipment.

- Mortgages: Homebuyers securing loans to purchase real estate.

- Credit Lines: Businesses or individuals establishing lines of credit for ongoing expenses.

Form Submission Methods

Submitting the completed agreement credit form can be done through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow for electronic submission of the form via their websites.

- Mail: The form can be printed and sent to the lender's physical address.

- In-Person: Borrowers may also choose to deliver the form directly to the lender's office.

Quick guide on how to complete lien property form pdf

Complete Lien Property Form Pdf effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Handle Lien Property Form Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Lien Property Form Pdf with ease

- Find Lien Property Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Lien Property Form Pdf while ensuring outstanding communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement credit form, and why is it important?

An agreement credit form is a document used to outline the terms of credit agreements between parties. It is important because it provides clarity and legal protection for both the lender and the borrower, ensuring that all terms are agreed upon and documented.

-

How can airSlate SignNow help with my agreement credit form?

airSlate SignNow allows you to create, send, and eSign your agreement credit form quickly and easily. With its user-friendly interface, you can streamline the process, ensuring that all necessary parties can review and sign the document without hassle.

-

Is there a cost associated with using airSlate SignNow for my agreement credit form?

Yes, airSlate SignNow offers various pricing plans depending on your needs, with options that are cost-effective for businesses of all sizes. Each plan includes features that make managing your agreement credit form efficient and straightforward.

-

What features does airSlate SignNow provide for agreement credit forms?

AirSlate SignNow provides numerous features for managing your agreement credit form, including customizable templates, secure eSigning, document tracking, and storage. These features help enhance productivity, ensuring your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other applications for my agreement credit form?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow efficiency. This means you can easily link your agreement credit form with CRM systems, cloud storage, and project management tools.

-

How secure is my agreement credit form when using airSlate SignNow?

AirSlate SignNow prioritizes security and takes comprehensive measures to protect your agreement credit form. With encryption, secure access controls, and compliance with global security standards, your documents are safe throughout the signing process.

-

Can multiple users sign the same agreement credit form using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to eSign the same agreement credit form, making it ideal for agreements that require several signatures. The platform ensures that all signers receive notifications and can sign at their convenience.

Get more for Lien Property Form Pdf

- Special or limited power of attorney for real estate purchase transaction by purchaser california form

- Limited power of attorney where you specify powers with sample powers included california form

- Limited power of attorney for stock transactions and corporate powers california form

- Ca durable poa form

- California cancel form

- California small business startup package california form

- Eviction form

- California property 497299458 form

Find out other Lien Property Form Pdf

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF