Application for Refund Pennsylvania Realty Transfer Tax REV 1651 Application for Refund Pennsylvania Realty Transfer Tax REV 165 2022-2026

Understanding the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

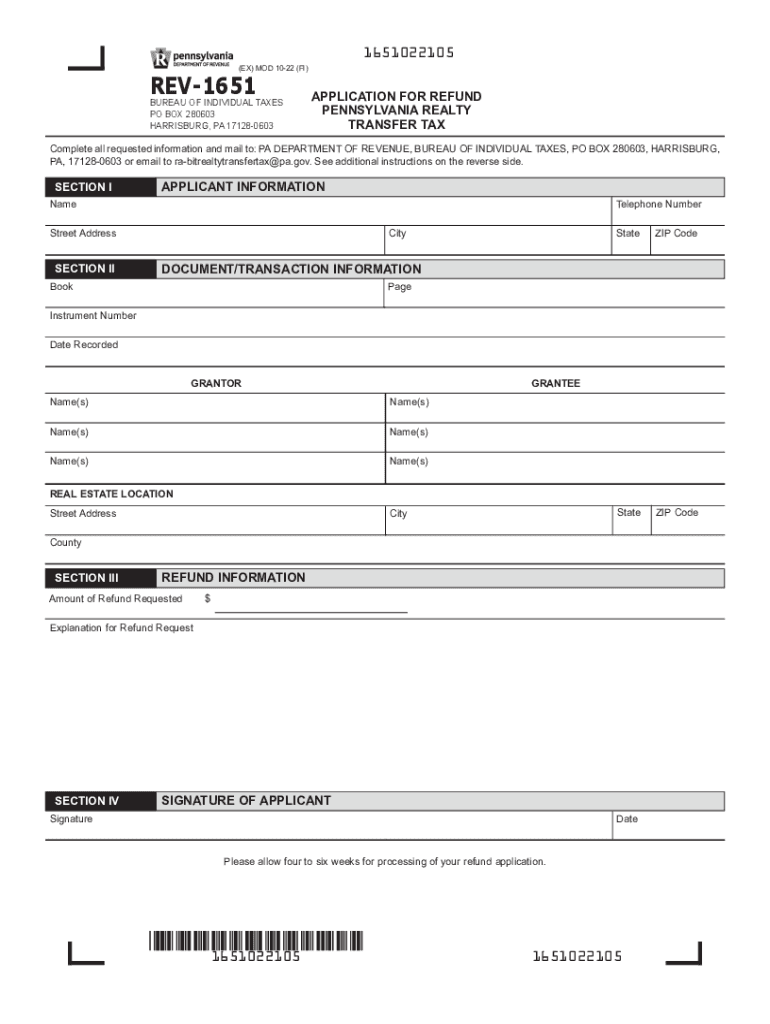

The Application For Refund Pennsylvania Realty Transfer Tax REV 1651 is a specific form used by taxpayers in Pennsylvania to request a refund of the realty transfer tax. This tax is typically imposed on the sale of real estate properties within the state. The application serves as a formal request to reclaim any overpaid taxes or taxes that were incorrectly assessed during a real estate transaction. Understanding the purpose of this form is crucial for ensuring compliance and maximizing potential refunds.

Steps to Complete the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

Completing the Application For Refund Pennsylvania Realty Transfer Tax REV 1651 involves several key steps:

- Gather necessary documentation, including proof of payment and any relevant transaction records.

- Fill out the application form with accurate information, including your contact details and the specifics of the transaction.

- Clearly state the reason for the refund request, providing any supporting evidence as needed.

- Review the completed application for accuracy before submission.

- Submit the form through the designated method, either online or via mail, as outlined by the Pennsylvania Department of Revenue.

Eligibility Criteria for the Application For Refund Pennsylvania Realty Transfer Tax REV 1651

To be eligible for a refund using the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, taxpayers must meet specific criteria. Generally, eligibility includes:

- Proof of overpayment of the realty transfer tax during a property transaction.

- Documentation that supports the claim for a refund, such as closing statements or receipts.

- Filing the application within the required timeframe set by the Pennsylvania Department of Revenue.

Required Documents for Submission

When submitting the Application For Refund Pennsylvania Realty Transfer Tax REV 1651, it is essential to include the following documents:

- A copy of the original deed or transaction documents.

- Proof of payment of the realty transfer tax, such as receipts or bank statements.

- Any additional documentation that supports the refund request, including correspondence with the tax authority.

Form Submission Methods

The Application For Refund Pennsylvania Realty Transfer Tax REV 1651 can be submitted through multiple methods, ensuring convenience for taxpayers. These methods include:

- Online submission via the Pennsylvania Department of Revenue's official website.

- Mailing the completed form and supporting documents to the appropriate address as specified in the instructions.

- In-person submission at designated tax offices or service centers within Pennsylvania.

Important Filing Deadlines

Timeliness is crucial when filing the Application For Refund Pennsylvania Realty Transfer Tax REV 1651. Taxpayers should be aware of the following deadlines:

- Refund requests must typically be submitted within three years from the date of the transaction.

- Specific deadlines may vary based on the nature of the transaction or any changes in tax law, so it is advisable to check for updates regularly.

Quick guide on how to complete application for refund pennsylvania realty transfer tax rev 1651 application for refund pennsylvania realty transfer tax rev

Complete Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165 effortlessly

- Locate Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for refund pennsylvania realty transfer tax rev 1651 application for refund pennsylvania realty transfer tax rev

Create this form in 5 minutes!

How to create an eSignature for the application for refund pennsylvania realty transfer tax rev 1651 application for refund pennsylvania realty transfer tax rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA realty transfer tax?

The PA realty transfer tax is a tax imposed on the transfer of real estate property in Pennsylvania. It is calculated based on the sale price of the property and is typically paid by the seller. Understanding this tax is crucial for anyone involved in real estate transactions in Pennsylvania.

-

How does airSlate SignNow help with PA realty transfer tax documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to the PA realty transfer tax. With our easy-to-use platform, you can quickly create, send, and eSign necessary documents, ensuring compliance with state regulations. This streamlines your real estate transactions and reduces the risk of errors.

-

What are the costs associated with the PA realty transfer tax?

The costs of the PA realty transfer tax vary depending on the property's sale price and the county in which the property is located. Typically, the tax rate is 1% for the state, with additional local taxes that can increase the total. It's essential to calculate these costs accurately to avoid surprises during a real estate transaction.

-

Are there any exemptions for the PA realty transfer tax?

Yes, there are certain exemptions for the PA realty transfer tax, including transfers between family members or certain types of nonprofit organizations. It's important to consult with a tax professional or legal advisor to determine if you qualify for any exemptions when transferring property in Pennsylvania.

-

How can I calculate the PA realty transfer tax for my property?

To calculate the PA realty transfer tax, multiply the sale price of the property by the applicable tax rate, which is typically 1% for the state plus any local rates. You can also use online calculators or consult with a real estate professional for assistance. Accurate calculations are vital to ensure compliance and avoid penalties.

-

What features does airSlate SignNow offer for real estate transactions?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, making it ideal for real estate transactions involving the PA realty transfer tax. Our platform allows users to collaborate in real-time, track document status, and ensure that all necessary paperwork is completed efficiently. This enhances the overall transaction experience.

-

Can airSlate SignNow integrate with other real estate software?

Yes, airSlate SignNow can integrate with various real estate software solutions, enhancing your workflow when dealing with the PA realty transfer tax. This integration allows for seamless data transfer and document management, ensuring that all aspects of your real estate transactions are streamlined. Check our integrations page for specific software compatibility.

Get more for Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165

Find out other Application For Refund Pennsylvania Realty Transfer Tax REV 1651 Application For Refund Pennsylvania Realty Transfer Tax REV 165

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document