Revolving Line of Credit Template Form

What is the revolving line of credit template

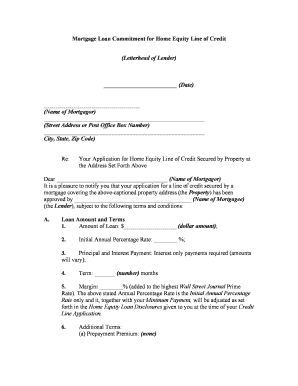

A revolving line of credit template is a structured document that outlines the terms and conditions of a revolving line of credit agreement between a lender and a borrower. This type of credit allows borrowers to access funds up to a specified limit, repay them, and then borrow again as needed. The template typically includes essential elements such as interest rates, repayment terms, and fees associated with the credit line. It serves as a foundational tool for both parties to understand their rights and obligations under the agreement.

How to use the revolving line of credit template

To effectively use the revolving line of credit template, start by carefully reviewing the document to ensure it meets your specific needs. Fill in the required fields with accurate information, such as the names of the parties involved, the credit limit, and the interest rate. It is crucial to read through the terms and conditions outlined in the template to ensure mutual understanding. Once completed, both parties should sign the document electronically to validate the agreement, ensuring compliance with eSignature laws.

Key elements of the revolving line of credit template

The revolving line of credit template includes several key elements that are vital for a comprehensive agreement. These elements typically feature:

- Credit limit: The maximum amount that can be borrowed.

- Interest rate: The cost of borrowing, often expressed as an annual percentage rate (APR).

- Repayment terms: Details on how and when the borrower must repay the borrowed amount.

- Fees: Any associated costs, such as annual fees or transaction fees.

- Default terms: Conditions under which the lender may consider the borrower in default.

Steps to complete the revolving line of credit template

Completing the revolving line of credit template involves several straightforward steps:

- Review the template to understand its structure and requirements.

- Fill in the necessary information, including borrower and lender details.

- Specify the credit limit and interest rate clearly.

- Outline repayment terms and any applicable fees.

- Ensure both parties review the completed document for accuracy.

- Sign the document electronically to finalize the agreement.

Legal use of the revolving line of credit template

The legal use of a revolving line of credit template hinges on compliance with relevant laws governing eSignatures and credit agreements. In the United States, the ESIGN Act and UETA provide the legal framework for electronic signatures, ensuring that eDocuments are legally binding when specific criteria are met. It is essential to ensure that both parties consent to the use of electronic signatures and that the document is stored securely to maintain its integrity.

Examples of using the revolving line of credit template

Examples of using a revolving line of credit template can vary based on the borrower's needs. For instance, a small business may use the template to secure a line of credit for inventory purchases, allowing them to manage cash flow effectively. Alternatively, an individual may utilize the template for personal expenses, such as home renovations or unexpected medical bills, providing them with flexible access to funds as needed. Each scenario highlights the template's adaptability for different financial situations.

Quick guide on how to complete revolving line of credit template

Effortlessly Prepare Revolving Line Of Credit Template on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hindrances. Manage Revolving Line Of Credit Template on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Revolving Line Of Credit Template without Stress

- Obtain Revolving Line Of Credit Template and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Revolving Line Of Credit Template and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revolving line of credit template?

A revolving line of credit template is a standardized document that outlines the terms for a credit agreement between a lender and a borrower. This template helps businesses manage their cash flow by allowing them to borrow up to a specified limit and repay it as needed.

-

How can a revolving line of credit template benefit my business?

Using a revolving line of credit template allows businesses to have flexible access to funds whenever necessary. This flexibility can help address short-term operational expenses and manage financial emergencies more effectively.

-

Are there any costs associated with using a revolving line of credit template?

While the template itself can be cost-effective, businesses should consider potential interest rates and fees associated with the line of credit from lenders. airSlate SignNow provides a budget-friendly solution that simplifies the process of utilizing a revolving line of credit template.

-

Can I customize the revolving line of credit template?

Yes, airSlate SignNow allows users to easily customize the revolving line of credit template to meet their specific financial needs. You can edit terms, interest rates, and repayment options to suit your business requirements.

-

What features does airSlate SignNow offer for managing revolving line of credit templates?

airSlate SignNow offers a range of features including secure e-signatures, document tracking, and automated reminders to manage revolving line of credit templates effectively. These features enhance collaboration and streamline the signing process.

-

How does airSlate SignNow integrate with existing financial systems?

airSlate SignNow seamlessly integrates with various accounting and financial management software, enabling easy access to your revolving line of credit template within your established workflows. This integration helps ensure your financial data is synchronized across platforms.

-

Is e-signing effective for revolving line of credit agreements?

Yes, e-signing is not only effective but also secure for revolving line of credit agreements. Utilizing an electronic signature on a revolving line of credit template ensures a faster turnaround and preserves document integrity.

Get more for Revolving Line Of Credit Template

- Terminate maintenance form

- Modify child colorado form

- Instructions for motion for modification of child support colorado form

- Co child support form

- Colorado child support online form

- Motion parenting time form

- Instructions for motion to modify restrict parenting time colorado form

- Motion jdf 497300281 form

Find out other Revolving Line Of Credit Template

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors