Consultant Self Employed Form

What is the Consultant Self Employed

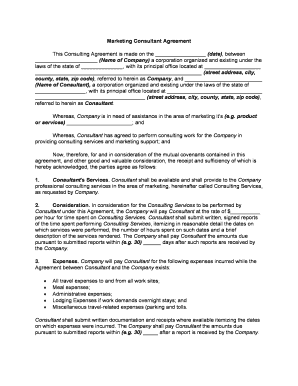

The term "consultant self employed" refers to individuals who operate their own consulting business, providing expert advice in a specific field. These professionals are not tied to a single employer and often work on a contract basis. They may offer services in various industries, including marketing, finance, and technology. Being self-employed allows consultants to have flexibility in their work schedules and the ability to choose their clients. However, it also requires them to manage their own business operations, including finances, contracts, and compliance with tax regulations.

How to use the Consultant Self Employed

Using the consultant self employed form involves several key steps. First, individuals must gather all necessary information related to their business activities, including client details and services offered. Next, they should accurately fill out the form, ensuring that all sections are completed to reflect their self-employment status. After completing the form, it is crucial to review it for accuracy before submission. Depending on the requirements, the form may need to be submitted to tax authorities or other relevant organizations to ensure compliance with legal standards.

Key elements of the Consultant Self Employed

Several key elements define the consultant self employed form. These include personal identification information, such as name and address, as well as details about the nature of the consulting services provided. Additionally, the form typically requires information about income sources and any applicable deductions. Understanding these elements is essential for accurate reporting and compliance with tax regulations. It is also important to include any relevant certifications or licenses that may enhance credibility in the consulting field.

IRS Guidelines

The IRS provides specific guidelines for individuals who are self-employed, including consultants. These guidelines outline the tax obligations that self-employed individuals must fulfill, such as estimated tax payments and reporting income accurately. Consultants must also be aware of deductions they can claim, including business expenses related to their consulting activities. Familiarity with these IRS guidelines helps ensure compliance and can lead to potential tax savings for self-employed consultants.

Filing Deadlines / Important Dates

Consultants who are self employed must adhere to specific filing deadlines to remain compliant with tax regulations. Typically, self-employed individuals must file their annual tax returns by April fifteenth of each year. Additionally, estimated tax payments are usually due quarterly, with deadlines falling on April fifteenth, June fifteenth, September fifteenth, and January fifteenth of the following year. Keeping track of these important dates is crucial to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the consultant self employed form accurately, several documents are typically required. These may include proof of income, such as invoices or payment records from clients, and any relevant business licenses or permits. Additionally, maintaining records of business expenses, such as office supplies, travel costs, and marketing expenses, is essential for accurate reporting and potential deductions. Having these documents organized and readily available can streamline the filing process.

Examples of using the Consultant Self Employed

Consultants can utilize the self employed form in various scenarios. For instance, a marketing consultant may need to report income from multiple clients throughout the year, ensuring that all earnings are accurately documented. Another example is a financial consultant who must track expenses related to client meetings and travel. Each of these examples highlights the importance of maintaining accurate records and understanding the implications of self-employment on tax obligations.

Quick guide on how to complete consultant self employed 481377736

Accomplish Consultant Self Employed seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly replacement for conventional printed and signed documents, enabling you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly and without interruptions. Manage Consultant Self Employed on any device with airSlate SignNow applications for Android or iOS and improve any document-oriented task today.

The easiest method to alter and electronically sign Consultant Self Employed effortlessly

- Locate Consultant Self Employed and click on Obtain Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Completed button to secure your changes.

- Choose the method for delivering your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and electronically sign Consultant Self Employed to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for airSlate SignNow for a consultant self employed?

airSlate SignNow offers a variety of pricing plans tailored for a consultant self employed, ranging from individual to team solutions. Depending on your needs, you can choose plans that allow unlimited signatures and document storage, ensuring you get the best value. Additionally, our pricing model is flexible, catering to the varying requirements of self-employed consultants.

-

How can airSlate SignNow benefit a consultant self employed?

For a consultant self employed, airSlate SignNow provides a streamlined process to send, sign, and manage documents efficiently. This not only saves time but also enhances professionalism when dealing with clients. By reducing paperwork and automating tasks, you can focus more on growing your consulting business.

-

What features make airSlate SignNow suitable for a consultant self employed?

airSlate SignNow includes features that are particularly advantageous for a consultant self employed, such as customizable templates, real-time tracking, and secure signing. These tools help you maintain organization and transparency in your document management process, which is crucial for self-employed professionals. Additionally, the user-friendly interface makes it easy to navigate.

-

Are there any integration options for a consultant self employed using airSlate SignNow?

Yes, airSlate SignNow offers integrations with popular business tools, making it ideal for a consultant self employed. You can connect it with CRM systems, project management software, and cloud storage platforms to enhance workflow efficiency. These integrations ensure that your document management fits seamlessly into your existing processes.

-

Is airSlate SignNow compliant with legal standards for a consultant self employed?

Absolutely, airSlate SignNow complies with major legal standards, making it a reliable choice for a consultant self employed. Our eSignature solution adheres to the ESIGN Act and UETA, ensuring that your signed documents are legally binding. This compliance protects you and your clients throughout the signing process.

-

How does airSlate SignNow ensure document security for a consultant self employed?

Security is paramount for airSlate SignNow, especially for a consultant self employed handling sensitive documents. Our platform employs enterprise-grade security measures, including encryption and access controls, to protect your information. You can trust that your documents are safe while utilizing our eSigning capabilities.

-

Can I try airSlate SignNow for free as a consultant self employed?

Yes, airSlate SignNow offers a free trial that allows a consultant self employed to experience all our features risk-free. This trial helps you evaluate how our eSignature solution can streamline your business processes. Sign up today to see how airSlate SignNow can simplify your document management needs.

Get more for Consultant Self Employed

- Adverse possessor 481369843 form

- Listing agreement commercial estate form

- South carolina custody form

- Quitclaim deed form 481369846

- Oklahoma llc form

- Ohio general durable power of attorney for property and finances or financial effective upon disability form

- Ohio quitclaim deed form

- Time share deed form

Find out other Consultant Self Employed

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple