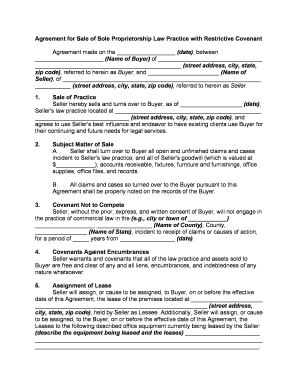

Sole Proprietorship Document Form

What is the Sole Proprietorship Document

The sole proprietorship document is a legal form that establishes a business owned and operated by a single individual. This document outlines the owner's rights and responsibilities, as well as the nature of the business operations. It is essential for legal recognition and may be required for tax purposes, opening a business bank account, or obtaining licenses and permits. The sole proprietorship document typically includes information such as the business name, owner's name, address, and the nature of the business activities.

How to Use the Sole Proprietorship Document

Using the sole proprietorship document involves several steps to ensure that it meets legal requirements. First, the owner should gather all necessary information, including personal details and business specifics. Next, the document should be filled out accurately, ensuring all required sections are completed. After filling it out, the owner should review the document for any errors before submitting it to the appropriate state or local authorities. This process may also include obtaining an Employer Identification Number (EIN) from the IRS if the business will have employees.

Steps to Complete the Sole Proprietorship Document

Completing the sole proprietorship document involves a series of straightforward steps:

- Gather personal information, including your name, address, and Social Security number.

- Decide on a business name and check for availability in your state.

- Fill out the document, including all required sections such as business activities and ownership details.

- Review the document for accuracy and completeness.

- Submit the document to the relevant state or local office, along with any required fees.

Legal Use of the Sole Proprietorship Document

The sole proprietorship document serves several legal purposes. It provides official recognition of the business, which can be crucial for legal liability and tax obligations. This document can help protect the owner’s personal assets by clearly delineating business activities. Additionally, having a properly executed sole proprietorship document can facilitate smoother interactions with banks, clients, and suppliers, as it establishes the legitimacy of the business.

Key Elements of the Sole Proprietorship Document

When creating a sole proprietorship document, certain key elements must be included to ensure its effectiveness:

- Business Name: The official name under which the business will operate.

- Owner's Information: Full name, address, and contact information of the owner.

- Business Activities: A description of the nature of the business and its operations.

- Signature: The owner's signature, which indicates agreement and acknowledgment of the information provided.

Examples of Using the Sole Proprietorship Document

Examples of situations where the sole proprietorship document is utilized include:

- Opening a business bank account, which often requires proof of business ownership.

- Applying for business licenses or permits, which may necessitate documentation of the business structure.

- Filing taxes, where the document can clarify the business's legal status to the IRS.

Quick guide on how to complete sole proprietorship document

Effortlessly Prepare Sole Proprietorship Document on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Sole Proprietorship Document on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Edit and eSign Sole Proprietorship Document with Ease

- Find Sole Proprietorship Document and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Sole Proprietorship Document to ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to sale law practice?

airSlate SignNow is an eSignature platform that streamlines document management for businesses, including those focused on sale law practice. It allows attorneys to send, sign, and manage legal documents efficiently, ensuring compliance and quick turnaround times. By integrating airSlate SignNow into your sale law practice, you can enhance your productivity and reduce paperwork.

-

What features does airSlate SignNow offer for sale law practice?

airSlate SignNow provides a variety of features ideal for sale law practice, including customizable templates, automated workflows, and secure cloud storage. These tools help law practitioners automate repetitive tasks, maintain accurate records, and manage client documents without hassle. Additionally, users can track document status in real-time, which is crucial for timely processing.

-

How cost-effective is airSlate SignNow for sale law practice?

airSlate SignNow offers competitive pricing plans tailored for various business sizes, making it a cost-effective solution for sale law practice. With no hidden fees and flexible subscriptions, law firms can choose a plan that fits their budget while benefiting from extensive features. This affordability helps firms allocate resources effectively without compromising service quality.

-

Can airSlate SignNow integrate with other tools used in sale law practice?

Yes, airSlate SignNow integrates seamlessly with various applications commonly used in sale law practice, including CRM systems and cloud storage solutions. This integration allows lawyers to manage their documents within the tools they already use, simplifying workflows and enhancing productivity. It's crucial for firms looking to maintain efficient operations.

-

What are the security features of airSlate SignNow for sale law practice?

airSlate SignNow prioritizes security by implementing advanced measures like encryption, two-factor authentication, and compliant practices for processing sensitive legal documents in a sale law practice. These features protect your data and ensure that all eSigned documents meet legal standards. Law firms can have peace of mind knowing their information is secure.

-

How does airSlate SignNow improve client communication in sale law practice?

With airSlate SignNow, sale law practice can enhance client communication by providing a straightforward way for clients to review and sign documents electronically. This method reduces delays in the document flow and fosters better client relationships through efficient service. By leveraging this technology, lawyers can keep clients informed and engaged in the process.

-

Is there a trial version of airSlate SignNow for my sale law practice?

Yes, airSlate SignNow offers a free trial that enables sale law practice professionals to explore its features and capabilities before committing. This allows law firms to assess whether the platform meets their needs in managing documents and obtaining eSignatures. It's a great opportunity to experience the benefits firsthand.

Get more for Sole Proprietorship Document

- Colorado unsecured installment payment promissory note for fixed rate colorado form

- Colorado installments fixed rate promissory note secured by residential real estate colorado form

- Colorado installments fixed rate promissory note secured by personal property colorado form

- Colorado note form

- Notice of option for recording colorado form

- Life documents planning package including will power of attorney and living will colorado form

- General durable power of attorney for property and finances or financial effective upon disability colorado form

- Essential legal life documents for baby boomers colorado form

Find out other Sole Proprietorship Document

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online