Promissory Note Form

What is the Promissory Note

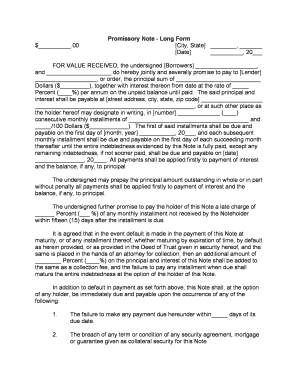

A promissory note is a written financial instrument that contains a promise by one party to pay a specified sum of money to another party at a predetermined date or on demand. This document serves as a formal agreement outlining the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. Promissory notes can be used in various scenarios, such as personal loans, business transactions, or real estate agreements. Understanding the structure and purpose of a promissory note is essential for both lenders and borrowers to ensure clarity and legal enforceability.

Key elements of the Promissory Note

Each promissory note should include several critical elements to be considered valid and enforceable. These elements typically include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Payment Schedule: Details on when payments are due, including the frequency (monthly, quarterly) and the duration of the loan.

- Maturity Date: The date by which the entire loan amount must be repaid.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

- Signatures: Signatures of both parties, which can be executed electronically to enhance convenience and security.

Steps to complete the Promissory Note

Completing a promissory note involves several straightforward steps to ensure that all necessary information is accurately captured. Here’s how to proceed:

- Identify the Parties: Clearly state the names and addresses of the borrower and lender.

- Specify the Loan Amount: Enter the principal amount being borrowed.

- Set the Interest Rate: Determine and document the interest rate applicable to the loan.

- Outline the Payment Terms: Define the payment schedule, including due dates and amounts.

- Include a Maturity Date: Specify when the loan must be fully repaid.

- Review and Sign: Both parties should review the document for accuracy before signing.

Legal use of the Promissory Note

For a promissory note to be legally binding, it must meet specific requirements outlined by state laws. Generally, the note must be in writing, signed by the borrower, and include clear terms regarding the repayment. Additionally, it is crucial to comply with federal and state regulations concerning interest rates and lending practices to avoid potential legal issues. When executed properly, a promissory note can serve as a robust legal document in case of disputes or defaults.

How to use the Promissory Note

Using a promissory note effectively involves understanding its purpose and how it fits into the broader context of financial transactions. Here are some practical applications:

- Personal Loans: Individuals can use promissory notes for informal loans between friends or family members.

- Business Financing: Companies may issue promissory notes to secure funds from investors or lenders.

- Real Estate Transactions: Promissory notes can facilitate financing for property purchases, outlining the terms of repayment.

Examples of using the Promissory Note

Examples of promissory notes can vary widely based on the context of the loan. Here are a few scenarios:

- Personal Loan Example: A friend lends $5,000 to another friend with a promise to repay within two years at a five percent interest rate.

- Business Loan Example: A startup borrows $50,000 from an investor, agreeing to repay the amount over five years with a six percent interest rate.

- Real Estate Example: A buyer finances a home purchase with a $200,000 promissory note, agreeing to monthly payments over 30 years at a four percent interest rate.

Quick guide on how to complete promissory note 481377808

Effortlessly prepare Promissory Note on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Promissory Note on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and electronically sign Promissory Note with ease

- Obtain Promissory Note and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Promissory Note and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note contract?

A promissory note contract is a legal document that outlines a borrower's promise to repay a specific amount to a lender under agreed-upon terms. This contract typically includes details such as the loan amount, interest rate, payment schedule, and maturity date. Using airSlate SignNow, you can easily create and eSign your promissory note contract online.

-

How does airSlate SignNow improve the creation of a promissory note contract?

airSlate SignNow streamlines the process of drafting a promissory note contract with user-friendly templates and customizable fields. You can quickly add or modify terms to suit your needs, ensuring that your contract is tailored for your specific situation. This saves time and reduces the risk of errors, making contract management efficient.

-

What are the benefits of using airSlate SignNow for a promissory note contract?

Using airSlate SignNow for your promissory note contract offers several benefits including easy eSigning, secure document storage, and real-time updates. You can also track who has signed your contract and when, ensuring better management and compliance. This all-in-one solution provides peace of mind for both lenders and borrowers.

-

Is airSlate SignNow affordable for businesses needing promissory note contracts?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. With a range of options, you can choose a plan that fits your budget while still getting the functionality needed to manage your promissory note contract effectively. This makes it a cost-effective solution for document management.

-

Can I integrate airSlate SignNow with other tools for managing my promissory note contracts?

Absolutely! airSlate SignNow easily integrates with various tools and platforms, allowing you to manage your promissory note contracts seamlessly alongside your existing workflows. Integration options include popular applications like Google Drive, Salesforce, and more, ensuring you can maintain efficiency across your operations.

-

How secure is my promissory note contract when using airSlate SignNow?

Security is a top priority at airSlate SignNow, and your promissory note contract is protected with encryption and advanced security protocols. All documents are stored securely, and user access can be customized to ensure that only authorized individuals can view or sign the contract. This provides a safe environment for your sensitive information.

-

Can I customize my promissory note contract on airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your promissory note contract based on your specific needs. You can modify terms, add clauses, and insert personalized branding to ensure the document reflects your business's identity. This flexibility enhances the relevance and usability of your contract.

Get more for Promissory Note

- Hvac contract for contractor connecticut form

- Landscape contract for contractor connecticut form

- Commercial contract for contractor connecticut form

- Excavator contract for contractor connecticut form

- Renovation contract for contractor connecticut form

- Concrete mason contract for contractor connecticut form

- Demolition contract for contractor connecticut form

- Framing contract for contractor connecticut form

Find out other Promissory Note

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple