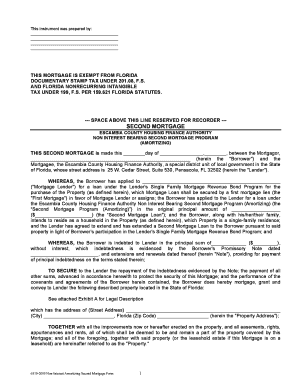

Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable Form

What is the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

The Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable is a financial product designed to assist homeowners in Florida by providing a second mortgage option without interest charges. This program allows borrowers to secure additional funds while maintaining their primary mortgage. The term "assumable" indicates that the mortgage can be transferred to another party, making it an attractive option for buyers interested in taking over an existing mortgage without the need for refinancing. This feature can enhance the property’s marketability, especially in a fluctuating real estate market.

How to use the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

Using the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable involves several steps. First, homeowners should assess their financial needs and determine the amount they wish to borrow. Next, they can consult with lenders who participate in this program to understand the specific terms and conditions. Once the terms are agreed upon, the borrower can complete the necessary paperwork, which includes providing documentation of income, credit history, and property details. After approval, the funds can be used for various purposes, such as home improvements, debt consolidation, or educational expenses.

Steps to complete the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

Completing the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable requires a systematic approach:

- Gather necessary financial documents, including income verification and credit reports.

- Contact lenders to inquire about their participation in the program and request specific terms.

- Complete the application form for the second mortgage, ensuring all information is accurate and up to date.

- Submit the application along with required documentation to the lender.

- Once approved, review the loan agreement carefully before signing.

- Receive the funds and use them as intended.

Eligibility Criteria

To qualify for the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable, borrowers typically need to meet certain criteria. These may include having a stable income, a satisfactory credit score, and sufficient equity in their home. Lenders may also consider the borrower’s debt-to-income ratio to ensure they can manage additional debt. It is advisable for potential borrowers to check with specific lenders for detailed eligibility requirements, as these can vary.

Legal use of the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

The legal framework surrounding the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable is guided by state and federal regulations. Borrowers must ensure compliance with these laws to validate the mortgage agreement. Key legal aspects include proper documentation, adherence to disclosure requirements, and understanding the implications of assuming a mortgage. It is essential for borrowers to consult legal professionals or financial advisors to navigate these legalities effectively.

State-specific rules for the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

Florida has specific regulations that govern second mortgages, including the Non Interest Bearing Second Mortgage Program Assumable. These rules may dictate the maximum loan amounts, interest rates, and the process for transferring the mortgage to another party. Additionally, Florida law requires lenders to provide clear disclosures regarding the terms of the mortgage, including any fees or penalties associated with the loan. Familiarizing oneself with these state-specific rules is crucial for potential borrowers to ensure compliance and protect their interests.

Quick guide on how to complete florida second mortgage non interest bearing second mortgage program assumable

Complete Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without obstacles. Manage Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable with ease

- Obtain Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries exactly the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable and maintain exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable?

The Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable is a financial solution designed to help homeowners tap into their equity without incurring interest charges. This program allows borrowers to secure a second mortgage that can be transferred to a new buyer, making it an attractive option for real estate transactions in Florida.

-

How does the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable benefit borrowers?

Borrowers benefit from the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable by having the ability to access funds without paying interest. This program also provides increased flexibility for selling the property, as the assumable nature of the mortgage can make the home more appealing to potential buyers.

-

What are the eligibility requirements for the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable?

To qualify for the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable, borrowers must meet specific credit criteria and demonstrate sufficient income and equity in their home. Each lender may have different criteria, so it's essential to check with your financial institution for detailed requirements.

-

Are there any fees associated with the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable?

While the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable typically has lower costs due to its non-interest nature, there may still be associated fees related to application processing, appraisal, and closing. Always review the terms with your lender to understand the total costs involved.

-

Can the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable be used for home renovations?

Yes, one of the key benefits of the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable is the ability to use the funds for home renovations or other financial needs. This flexibility allows homeowners to invest in their property without the burden of interest, enhancing both their living space and its market value.

-

How does the assumable feature of the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable work?

The assumable feature of the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable allows a new buyer to take over the mortgage without needing to renegotiate terms or interest rates. This can simplify the selling process and provide a substantial selling point when marketing the property.

-

Is the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable available to first-time homebuyers?

Yes, the Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable can be available to first-time homebuyers, depending on lender requirements. First-time buyers may find this program particularly appealing due to its non-interest feature and the financial flexibility it offers.

Get more for Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

- Delaware praecipe form

- Waiver of notice and consent guardianship fill in form pro se only delaware

- Waiver of rights under the quotservicemembers civil relief actquot delaware form

- Petition specific performance

- Affidavit of mailing delaware 497302414 form

- Final order for appointment of co guardians of the person and property delaware form

- Final order for appointment of guardians of the person delaware form

- Notice guardian form

Find out other Florida Second Mortgage Non Interest Bearing Second Mortgage Program Assumable

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document