Newark Payroll Tax Statement the City of Newark, New Jersey Ci Newark Nj Form

Understanding the Newark Payroll Tax Statement

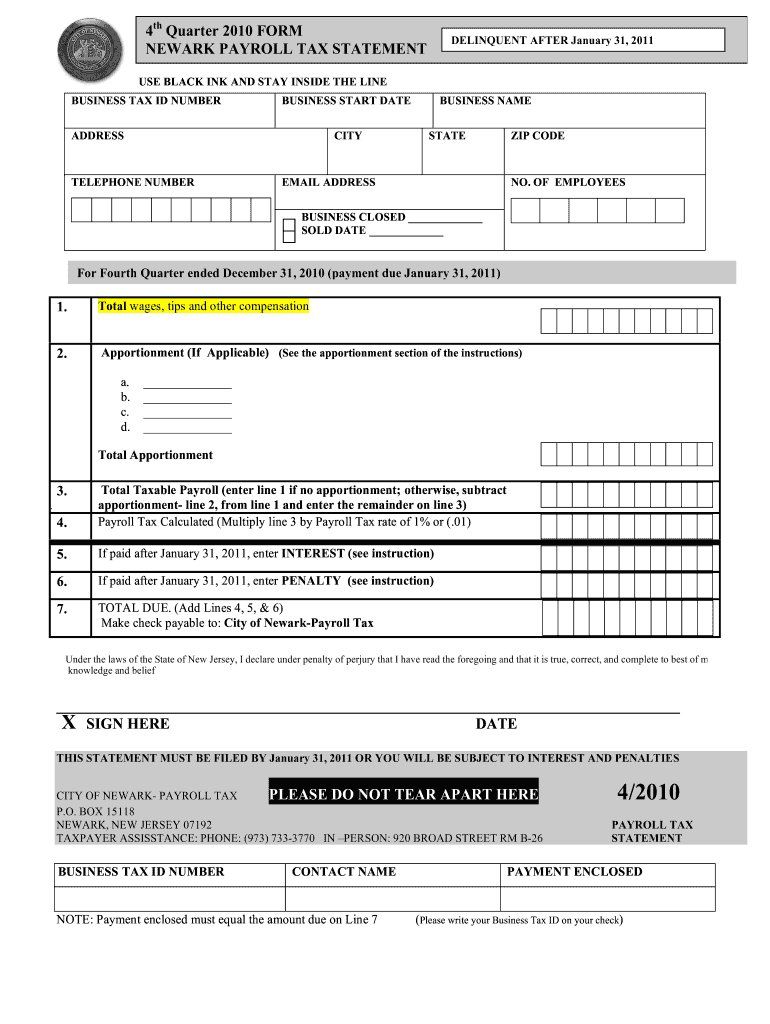

The Newark Payroll Tax Statement is a crucial document for residents and businesses in Newark, New Jersey. This statement serves as a record of payroll taxes withheld from employees' wages, which are essential for funding local services and infrastructure. It includes details such as the total amount of payroll tax withheld, the employee's information, and the employer's identification. Understanding this statement is vital for both employees and employers to ensure compliance with local tax regulations.

Steps to Complete the Newark Payroll Tax Statement

Completing the Newark Payroll Tax Statement involves several key steps. First, gather all necessary information, including employee details and payroll records. Next, accurately calculate the total payroll tax withheld for the reporting period. This calculation should align with the rates set by the city of Newark. After filling out the statement, review it for accuracy to avoid any potential issues. Finally, submit the completed statement to the appropriate city office, ensuring that all deadlines are met.

How to Obtain the Newark Payroll Tax Statement

Obtaining the Newark Payroll Tax Statement can be done through the city’s official tax collection office. Residents and businesses can request this document online or in person. If applying online, users may need to provide identification and relevant business information. It is advisable to check the city of Newark’s official website for specific instructions and any required forms. Keeping track of deadlines for obtaining this statement is essential to ensure timely compliance.

Key Elements of the Newark Payroll Tax Statement

The Newark Payroll Tax Statement contains several key elements that are important for accurate reporting. These include the employer's name and identification number, employee details such as name and social security number, and the total payroll tax withheld. Additionally, the statement may include the reporting period and any relevant deductions. Understanding these elements helps ensure that both employees and employers are aware of their tax obligations.

Legal Use of the Newark Payroll Tax Statement

The legal use of the Newark Payroll Tax Statement is significant for compliance with local tax laws. This document serves as proof of tax payments made on behalf of employees, which can be essential during audits or tax assessments. Properly completed statements can protect both employees and employers from potential legal issues related to tax compliance. It is important to retain copies of these statements for record-keeping and future reference.

Filing Deadlines and Important Dates

Filing deadlines for the Newark Payroll Tax Statement are critical for compliance. Typically, these deadlines align with the end of each payroll period, and it is essential to submit the statement promptly to avoid penalties. Employers should be aware of specific dates set by the city of Newark to ensure that they are meeting their tax obligations. Keeping a calendar of these important dates can help streamline the filing process.

Quick guide on how to complete 2010 newark payroll tax statement the city of newark new jersey ci newark nj

Complete Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any holdups. Handle Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj effortlessly

- Find Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How does Indeed search work? What is the methodology to show the list of locations in the search? If I search “New”, it shows me New York, NY, New Jersey, then Newark, NJ. Is it based on the IP address?

I assume you are looking for a job. If that is not the case, then you might need to rephrase your question to be more clear on what it is you want to know.If you are looking to change jobs, or looking for a job, it might be better to join internet organization who specialize in that, such as LinkedIn.com, which generally a network of people with particular skills or professions.Not every organization looking to hire uses LinkIn, however. If you are looking for government jobs, you generally have to go the each agencies web sites to look for job postings. The federal government generally advertises jobs with the Office of personnel Management (www.OPM.gov) and they have a website where you can post resumes and apply for advertised jobs.You should also be able to use your local unemployment agency to look for jobs.

Create this form in 5 minutes!

How to create an eSignature for the 2010 newark payroll tax statement the city of newark new jersey ci newark nj

How to make an electronic signature for your 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj online

How to make an eSignature for your 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj in Chrome

How to create an electronic signature for putting it on the 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj in Gmail

How to create an electronic signature for the 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj right from your mobile device

How to make an electronic signature for the 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj on iOS devices

How to generate an electronic signature for the 2010 Newark Payroll Tax Statement The City Of Newark New Jersey Ci Newark Nj on Android

People also ask

-

What is the Newark Payroll Tax Statement from The City Of Newark, New Jersey, Ci Newark Nj?

The Newark Payroll Tax Statement is a crucial document required by The City Of Newark, New Jersey, Ci Newark Nj, for reporting employee wages and tax contributions. This statement helps ensure compliance with local tax regulations and provides essential information for both employers and employees regarding payroll taxes.

-

How can airSlate SignNow assist with the Newark Payroll Tax Statement?

airSlate SignNow simplifies the process of preparing and eSigning the Newark Payroll Tax Statement for The City Of Newark, New Jersey, Ci Newark Nj. With its user-friendly interface, businesses can quickly fill out, send, and securely sign the document, ensuring timely submission and compliance with local tax requirements.

-

What are the benefits of using airSlate SignNow for the Newark Payroll Tax Statement?

Using airSlate SignNow for the Newark Payroll Tax Statement from The City Of Newark, New Jersey, Ci Newark Nj, provides several benefits, including enhanced efficiency, reduced paperwork, and improved compliance. The platform's electronic signature capabilities also streamline the approval process, allowing businesses to manage their payroll tax documents with ease.

-

Is airSlate SignNow cost-effective for handling the Newark Payroll Tax Statement?

Yes, airSlate SignNow offers a cost-effective solution for managing the Newark Payroll Tax Statement for The City Of Newark, New Jersey, Ci Newark Nj. With flexible pricing plans, businesses can choose a package that meets their needs while benefiting from the platform's robust features designed to save time and resources.

-

Can airSlate SignNow integrate with other payroll systems for the Newark Payroll Tax Statement?

Absolutely! airSlate SignNow seamlessly integrates with various payroll systems, making it easier to manage the Newark Payroll Tax Statement for The City Of Newark, New Jersey, Ci Newark Nj. This integration allows for automatic data transfer and simplifies the process of generating and submitting tax statements.

-

What features does airSlate SignNow offer to facilitate the Newark Payroll Tax Statement process?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all tailored to streamline the Newark Payroll Tax Statement for The City Of Newark, New Jersey, Ci Newark Nj. These tools ensure that businesses can efficiently handle their payroll tax documentation while maintaining compliance.

-

How secure is airSlate SignNow when handling the Newark Payroll Tax Statement?

Security is a top priority at airSlate SignNow. When managing the Newark Payroll Tax Statement for The City Of Newark, New Jersey, Ci Newark Nj, users can trust that their sensitive information is protected with advanced encryption and secure storage, ensuring confidentiality and compliance with data protection regulations.

Get more for Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj

- Time and attendance policy for nonexempt employees form

- The e form

- Offer by borrower of deed in lieu of foreclosureus legal forms

- Name of plaintiffs department no las vegas justice court form

- Difference between state vs defendant and plaintiff vs form

- Plaintiff name on complaint was wrong should the plaintiff form

- Waiver and release in favor of organizer of bike ride form

- Motionto amend or correct judgmentto include additional party defendantas real party in interest form

Find out other Newark Payroll Tax Statement The City Of Newark, New Jersey Ci Newark Nj

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form