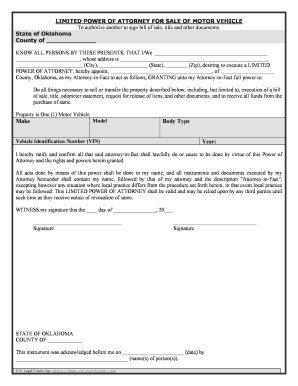

Oklahoma Vehicle Form

What is the website design agreement?

A website design agreement is a legal document that outlines the terms and conditions between a client and a web designer or agency. This agreement serves as a foundation for the working relationship, specifying the scope of work, timelines, deliverables, and payment terms. It ensures that both parties have a clear understanding of their responsibilities and expectations, which can help prevent disputes and misunderstandings throughout the project.

Key elements of the website design agreement

Several essential components should be included in a website design agreement to ensure clarity and protection for both parties:

- Scope of Work: Clearly define the services to be provided, including design, development, and any additional features.

- Timeline: Establish deadlines for project milestones and final delivery to keep the project on track.

- Payment Terms: Outline the total cost, payment schedule, and any deposit requirements.

- Intellectual Property Rights: Specify who owns the rights to the design and any related materials upon project completion.

- Confidentiality: Include clauses to protect sensitive information shared during the project.

Steps to complete the website design agreement

Completing a website design agreement involves several key steps to ensure that all necessary details are captured:

- Draft the Agreement: Begin by drafting the agreement, including all essential elements and terms.

- Review and Revise: Both parties should review the document, suggesting any necessary changes or clarifications.

- Negotiate Terms: Discuss any terms that may need adjustment to meet both parties' needs.

- Finalize the Agreement: Once both parties are satisfied, finalize the document for signatures.

- Sign the Agreement: Both parties should sign the agreement, either digitally or in person, to make it legally binding.

Legal use of the website design agreement

A website design agreement is legally binding once signed by both parties, provided it meets the necessary legal requirements. It is important to ensure that the agreement adheres to relevant laws and regulations in the United States. This includes compliance with contract law, which dictates that all parties must have the legal capacity to enter into a contract and that the terms must be lawful and not against public policy.

How to use the website design agreement

Once the website design agreement is finalized and signed, it serves as a reference point throughout the project. It can be used to:

- Guide the project workflow and ensure all deliverables are met.

- Resolve any disputes that may arise by referring back to the agreed terms.

- Provide clarity on payment schedules and obligations.

- Protect both parties' rights and interests regarding intellectual property and confidentiality.

Who issues the website design agreement?

The website design agreement is typically drafted by the web designer or agency offering the services. However, it is advisable for both parties to collaborate on the document to ensure that it accurately reflects their mutual understanding. In some cases, clients may seek legal counsel to review the agreement before signing, ensuring that it meets their needs and protects their interests.

Quick guide on how to complete oklahoma vehicle form

Complete Oklahoma Vehicle Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Oklahoma Vehicle Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign Oklahoma Vehicle Form with ease

- Obtain Oklahoma Vehicle Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate producing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Oklahoma Vehicle Form and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a website design agreement?

A website design agreement is a legal contract between a client and a web designer outlining the terms of the website design project. This document typically includes details such as project scope, deadlines, payment terms, and ownership of the final website design. Having a clear website design agreement ensures both parties understand their responsibilities and helps prevent disputes.

-

How much does a website design agreement cost?

The cost of a website design agreement varies depending on the designer's experience, the complexity of the project, and the specific services included. Typically, you can expect fees to range from a few hundred to several thousand dollars. It's important to discuss these costs upfront, ensuring your website design agreement reflects the agreed-upon price.

-

What features should be included in a website design agreement?

A comprehensive website design agreement should include key features such as project scope, payment terms, timelines, deliverables, and maintenance responsibilities. Additionally, it should outline intellectual property rights and any confidentiality clauses. Including these features in your website design agreement helps to clarify expectations and protect both parties.

-

What are the benefits of having a website design agreement?

Having a website design agreement provides clarity for both the client and the designer, reducing the risk of misunderstandings. This contract can enhance accountability, ensuring that both parties adhere to the agreed-upon timelines and obligations. Furthermore, a well-structured website design agreement can help protect your rights as a client or designer.

-

Can I customize my website design agreement?

Yes, you can and should customize your website design agreement to suit the specific needs of your project. Each project may have different requirements, and personalizing your agreement ensures that all necessary details are addressed. This adaptability enhances transparency and sets clear expectations for both parties involved.

-

Are there any integrations available with the website design agreement process?

Yes, many platforms offer integrations that can streamline the website design agreement process. Tools such as airSlate SignNow enable easy eSigning, allowing clients and designers to sign and manage contracts electronically. These integrations can enhance your workflow, making it easier to create, send, and store your website design agreements.

-

How can I ensure my website design agreement is legally binding?

To ensure your website design agreement is legally binding, it should be signed by both parties involved, clearly indicating their acceptance of the terms. Additionally, it is advisable to consult with a legal professional to review the agreement for compliance with the applicable laws in your jurisdiction. This extra step can safeguard your interests in case of disputes.

Get more for Oklahoma Vehicle Form

- Appearance bond 481375108 form

- Civil court clerk form

- Js 44 civil cover sheet federal district court official form

- Notice of assignment sale or transfer of servicing rights mortgage loans form

- Amendment rental agreement form

- Virginia letter from landlord to tenant as notice to remove unauthorized pets from premises form

- Va increase rent form

- Virginia letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and form

Find out other Oklahoma Vehicle Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT