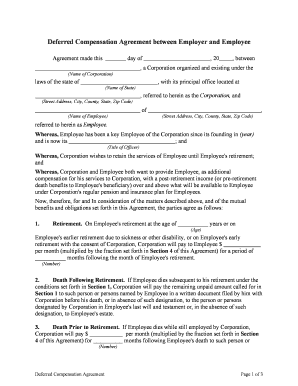

Deferred Compensation Plan Form

What is the deferred compensation plan?

A deferred compensation plan is a financial arrangement that allows employees to set aside a portion of their income to be paid out at a later date. This type of plan is often used as a tax-advantaged way to save for retirement or other long-term financial goals. The funds are typically withheld from the employee's paycheck and invested, allowing them to grow over time. In the United States, these plans can take various forms, including non-qualified plans and qualified plans, each with its own tax implications and regulations.

Key elements of the deferred compensation plan

Understanding the key elements of a deferred compensation plan is essential for both employers and employees. Key components include:

- Deferral Amount: The specific percentage or dollar amount of salary that an employee chooses to defer.

- Vesting Schedule: The timeline over which employees earn the right to their deferred compensation, which can vary by plan.

- Distribution Options: The methods by which employees can receive their deferred compensation, such as lump-sum payments or installments.

- Investment Options: The choices available for how deferred funds are invested, which can impact overall growth.

- Tax Implications: Understanding how deferring compensation affects income taxes, including potential tax benefits.

Steps to complete the deferred compensation plan

Completing a deferred compensation plan involves several steps to ensure compliance and optimal benefits. Here are the typical steps:

- Review Plan Options: Understand the different types of deferred compensation plans available and select the one that fits your needs.

- Determine Deferral Amount: Decide how much of your income you want to defer based on your financial goals.

- Complete Required Forms: Fill out the necessary paperwork provided by your employer to initiate the plan.

- Understand Vesting and Distribution: Familiarize yourself with the vesting schedule and how and when you will receive your deferred compensation.

- Monitor Investments: Regularly check the performance of your investments within the plan to ensure they align with your financial objectives.

Legal use of the deferred compensation plan

The legal framework surrounding deferred compensation plans is crucial for ensuring that both employers and employees comply with tax laws and regulations. These plans must adhere to guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies. Key legal considerations include:

- Compliance with IRS Regulations: Ensure that the plan complies with IRS rules regarding contributions, distributions, and taxation.

- Written Agreements: Maintain a formal written agreement outlining the terms of the deferred compensation plan.

- Non-Discrimination Rules: Ensure that the plan does not favor highly compensated employees over others, in accordance with federal regulations.

Eligibility criteria

Eligibility for participating in a deferred compensation plan can vary based on the specific plan and employer policies. Common eligibility criteria include:

- Employment Status: Typically, only full-time employees are eligible, though some plans may allow part-time employees.

- Minimum Salary Requirements: Some plans may require participants to meet a minimum salary threshold to qualify.

- Length of Service: Employees may need to have worked for the company for a certain period before becoming eligible.

IRS guidelines

The IRS provides specific guidelines regarding deferred compensation plans to ensure proper tax treatment and compliance. Key points from these guidelines include:

- Taxation Timing: Deferred compensation is generally taxed when it is received, not when it is earned.

- Limits on Contributions: There may be limits on how much can be deferred, particularly for qualified plans.

- Reporting Requirements: Employers must report deferred compensation on employee W-2 forms and adhere to other reporting obligations.

Quick guide on how to complete deferred compensation plan

Complete Deferred Compensation Plan effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Deferred Compensation Plan on any platform with the airSlate SignNow Android or iOS applications and simplify any document-centric operation today.

How to modify and eSign Deferred Compensation Plan with ease

- Find Deferred Compensation Plan and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Deferred Compensation Plan and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deferred compensation contract?

A deferred compensation contract is a financial arrangement where a portion of an employee's income is paid out at a later date, often to provide tax advantages. This contract can be particularly beneficial for executives and highly compensated employees, allowing them to save for retirement while reducing their current tax burden.

-

How does airSlate SignNow support deferred compensation contracts?

airSlate SignNow simplifies the process of creating and managing deferred compensation contracts by providing an intuitive eSignature platform. Users can easily design templates, send contracts for signatures, and securely store all documents, allowing for an efficient and trackable process.

-

What are the benefits of using airSlate SignNow for my deferred compensation contract?

The main benefits of using airSlate SignNow for your deferred compensation contract include cost-effectiveness, ease of use, and enhanced security. The platform ensures that your contracts are executed quickly and accurately, reducing administrative overhead and allowing you to focus on your core business functions.

-

What features does airSlate SignNow offer for managing contracts?

airSlate SignNow offers a range of features for managing deferred compensation contracts, including customizable templates, automated reminders, and real-time tracking of document status. These features help streamline the contract management process, ensuring that you never miss a deadline or signature.

-

Is airSlate SignNow compliant with regulations for deferred compensation contracts?

Yes, airSlate SignNow complies with relevant regulations for deferred compensation contracts, including guidelines set forth by the IRS and various state laws. The platform incorporates robust security measures to protect sensitive information and maintain compliance throughout the contract process.

-

Can I integrate airSlate SignNow with other platforms for managing deferred compensation contracts?

Absolutely! airSlate SignNow offers integration with various platforms, such as CRM systems and HR software, to enhance your workflow for managing deferred compensation contracts. This connectivity ensures that your data flows seamlessly across different applications, improving efficiency and reducing errors.

-

What pricing options are available for using airSlate SignNow for deferred compensation contracts?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. You can choose from a variety of subscription models, ensuring that you find a solution that fits your budget while allowing you to effectively manage your deferred compensation contracts.

Get more for Deferred Compensation Plan

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent georgia form

- Ga landlord 497303747 form

- Ga landlord 497303748 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497303749 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement georgia form

- Letter about increase form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants georgia form

- Tenant landlord utility 497303753 form

Find out other Deferred Compensation Plan

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast