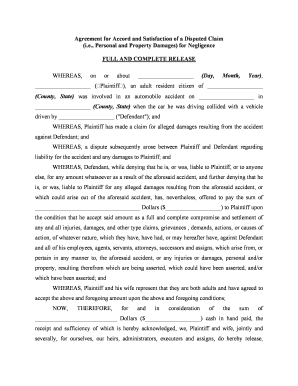

Disputed Claim Form

What makes the disputed claim form legally binding?

As the world ditches office working conditions, the completion of documents more and more takes place electronically. The disputed claim form isn’t an any different. Working with it utilizing electronic means differs from doing this in the physical world.

An eDocument can be regarded as legally binding provided that specific needs are met. They are especially critical when it comes to signatures and stipulations related to them. Typing in your initials or full name alone will not ensure that the institution requesting the sample or a court would consider it performed. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your disputed claim form when completing it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make form execution legitimate and secure. Furthermore, it gives a lot of possibilities for smooth completion security smart. Let's rapidly run through them so that you can be assured that your disputed claim form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties' identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information securely to the servers.

Submitting the disputed claim form with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete disputed claim

Complete Disputed Claim effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Disputed Claim on any device with the airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

How to modify and eSign Disputed Claim with ease

- Locate Disputed Claim and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Disputed Claim and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

Which insurance company is best for claim settlement?

Max Life Insurance has the greatest claim settlement ratio in terms of claim number, with 99.34% for the fiscal year 2021-22. Exide Life Insurance and Bharti Axa Life Insurance came in second with a 99.09 percent death settlement percentage. Why is there a claim settlement ratio greater than 100%?

-

How a dispute between an insurer and an insured is usually resolved?

Private, voluntary, or court-ordered mediations have become the most common way of resolving claim disputes. Mediation pros are that it can be fast, and relatively cheap compared to a lawsuit.

-

How do you challenge an insurance claim?

Steps to Appeal a Health Insurance Claim Denial Step 1: Find Out Why Your Claim Was Denied. ... Step 2: Call Your Insurance Provider. ... Step 3: Call Your Doctor's Office. ... Step 4: Collect the Right Paperwork. ... Step 5: Submit an Internal Appeal. ... Step 6: Wait For An Answer. ... Step 7: Submit an External Review. ... Review Your Plan Coverage.

-

What happens when you dispute an insurance claim?

They'll ask whether you believe it to be a valid claim or a false claim. If you dispute the claim, tell the car insurance adjuster and provide any evidence you might have. They'll then investigate the accident and build a case against the claimant.

-

What is a disputable claim?

Quick Answer to 'Claims Dispute': – What It Is: A disagreement between you and your insurer over the coverage of your claim. – Why It Happens: Differences in interpreting policy details, scope of damage, or cost of repairs.

-

What does it mean when a case is disputed?

A dispute is a disagreement, argument, or controversy—often one that gives rise to a legal proceeding (such as arbitration, mediation, or a lawsuit). The opposing parties are said to be adverse to one another (see also adverse party). To dispute is the corresponding verb.

-

What are the odds of winning an insurance appeal?

Only half of denied claims are appealed, and of those appeals, half are overturned! Undivided's Head of Health Plan Advocacy, Leslie Lobel, says that if you have a winner argument and patience to get through all the levels of "no," there is a good chance you can get your denial overturned.

-

What does disputed claim mean?

Disputed Claims means any pre-petition, unsecured claim that is not an Allowed Claim, by virtue of its being scheduled by the Debtor as disputed, contingent or unliquidated, and proof of which has not been timely filed, or as to which an objection has been interposed and which is pending as of Closing.

Get more for Disputed Claim

- Georgia change form

- Agreed written termination of lease by landlord and tenant georgia form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497303777 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497303778 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497303779 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497303780 form

- Business credit application georgia form

- Individual credit application georgia form

Find out other Disputed Claim

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online