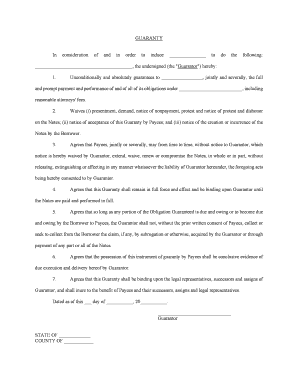

Corporate Guaranty Form

What is the corporate guaranty?

A corporate guaranty is a legally binding document in which a corporation agrees to assume responsibility for the debt or obligations of another party, typically a subsidiary or partner. This form serves as a security measure for lenders, ensuring that they have recourse to the corporation's assets if the primary borrower defaults. The corporate guaranty can be essential in various business transactions, including loans and leases, as it provides additional assurance to financial institutions and other stakeholders.

Key elements of the corporate guaranty

Several critical components make a corporate guaranty effective and enforceable:

- Identifying Information: The guarantor's name, the entity being guaranteed, and relevant details about the transaction must be clearly stated.

- Scope of Guarantee: The document should specify the extent of the obligations being guaranteed, whether it is for a specific loan amount or a broader range of debts.

- Signature and Authority: The guaranty must be signed by an authorized representative of the corporation, demonstrating that the individual has the legal authority to bind the company.

- Terms and Conditions: Any specific conditions or limitations related to the guaranty should be outlined, including duration and circumstances under which the guaranty may be revoked.

Steps to complete the corporate guaranty

Filling out a corporate guaranty requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather Necessary Information: Collect all relevant details about the parties involved, including names, addresses, and the nature of the obligation.

- Draft the Document: Use a corporate guaranty template to ensure all key elements are included. Tailor the language to fit the specific transaction.

- Review for Accuracy: Double-check all information for accuracy and completeness. Ensure that the terms reflect the agreement between the parties.

- Obtain Signatures: Have the authorized representative of the corporation sign the document. Consider using an electronic signature for efficiency.

- Distribute Copies: Provide copies of the signed guaranty to all relevant parties, including lenders and internal stakeholders.

Legal use of the corporate guaranty

The legal enforceability of a corporate guaranty depends on compliance with applicable laws and regulations. In the United States, the guaranty must meet the requirements set forth by the Uniform Commercial Code (UCC) and other relevant statutes. Additionally, the document should align with the principles of contract law, including mutual consent, consideration, and lawful purpose. It's advisable to consult legal counsel to ensure that the guaranty is drafted correctly and meets all legal standards.

Examples of using the corporate guaranty

Corporate guaranties are commonly utilized in various business scenarios:

- Loan Agreements: A corporation may guarantee a loan taken by a subsidiary, providing the lender with confidence in repayment.

- Lease Contracts: Businesses often use corporate guaranties to secure lease agreements, ensuring landlords that the corporation will cover rental payments if the tenant defaults.

- Supplier Contracts: Companies may issue a corporate guaranty to suppliers, assuring them of payment for goods and services provided to a subsidiary.

How to use the corporate guaranty

To effectively utilize a corporate guaranty, businesses should consider the following steps:

- Identify the Need: Determine when a corporate guaranty is necessary, typically in situations involving significant financial commitments.

- Draft the Document: Use a reliable template to create the corporate guaranty, ensuring all essential elements are included.

- Execute Properly: Ensure that the document is signed by an authorized representative and that all parties understand the terms.

- Maintain Records: Keep a copy of the signed guaranty in corporate records for future reference and compliance purposes.

Quick guide on how to complete corporate guaranty

Easily prepare Corporate Guaranty on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Corporate Guaranty on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to adjust and eSign Corporate Guaranty effortlessly

- Find Corporate Guaranty and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Corporate Guaranty and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a corporate guaranty and how does it work?

A corporate guaranty is a legal commitment from a business to be responsible for the debts or obligations of another party. With airSlate SignNow, you can quickly create and sign documents that incorporate corporate guaranty clauses, ensuring all parties understand their responsibilities. This feature aids in facilitating transparency and trust in business transactions.

-

How can airSlate SignNow help with the execution of a corporate guaranty?

airSlate SignNow simplifies the creation and signing of corporate guaranty documents by providing an intuitive platform for eSigning. You can easily upload your agreements, specify signers, and send them out for quick signatures, all while ensuring compliance with legal standards. This process signNowly reduces turnaround time and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for corporate guaranty documents?

airSlate SignNow offers a range of pricing plans designed to suit businesses of all sizes. Our flexible subscription options allow companies to select a plan that matches their needs for managing corporate guaranty documents without overspending. You can explore our pricing page to compare features and find the best option for your organization.

-

Are there any key features in airSlate SignNow that support corporate guaranty agreements?

Yes, airSlate SignNow includes several features that enhance the management of corporate guaranty agreements. Features such as customizable templates, advanced security protocols, and real-time tracking of document status empower businesses to create effective and compliant agreements effortlessly. These capabilities help ensure that your corporate guaranty documents are handled with utmost care.

-

Can I integrate airSlate SignNow with other business tools for managing corporate guaranties?

Absolutely! airSlate SignNow seamlessly integrates with various business applications such as CRMs, document management systems, and project management tools. This allows you to automate workflows involving corporate guaranty documents, making the entire process more efficient. By connecting to your existing ecosystem, you can streamline operations and enhance productivity.

-

What industries benefit from using corporate guaranty documents in airSlate SignNow?

Corporate guaranty documents are pivotal across various industries, including finance, real estate, and construction. Businesses in these sectors often require guarantees to mitigate risks and ensure compliance. AirSlate SignNow's easy-to-use platform helps organizations in these industries manage their corporate guaranty agreements efficiently, ensuring all legal obligations are met.

-

How secure is airSlate SignNow for managing corporate guaranty documents?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and industry-standard security measures to protect your corporate guaranty documents from unauthorized access. Businesses can confidently store and manage sensitive agreements, knowing that their data is safeguarded at all times.

Get more for Corporate Guaranty

Find out other Corporate Guaranty

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now