Uniform Transfers to Minors Act

What is the Uniform Transfers To Minors Act

The Uniform Transfers To Minors Act (UTMA) is a legal framework that allows for the transfer of property to minors without the need for a formal trust. This act simplifies the process of gifting assets to children, enabling parents or guardians to manage these assets until the minor reaches a specified age, typically 18 or 21, depending on state laws. Under the UTMA, various types of property, including cash, stocks, and real estate, can be transferred, providing a flexible way to secure a minor's financial future.

Key elements of the Uniform Transfers To Minors Act

Several essential components define the Uniform Transfers To Minors Act:

- Custodianship: An adult custodian is appointed to manage the assets on behalf of the minor until they reach the age of majority.

- Types of Transfers: The act allows for various property types to be transferred, including financial accounts and tangible assets.

- Tax Implications: Gifts made under the UTMA may have tax implications, including potential gift tax considerations.

- State Variations: Each state may have specific rules and regulations regarding the implementation of the UTMA, affecting how transfers are executed.

Steps to complete the Uniform Transfers To Minors Act

Completing the Uniform Transfers To Minors Act involves several straightforward steps:

- Choose a Custodian: Select a responsible adult to manage the assets for the minor.

- Determine the Property: Decide which assets will be transferred under the act.

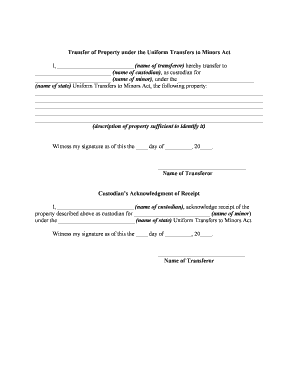

- Prepare the Transfer Document: Fill out the required forms, ensuring all necessary information is included.

- Submit the Transfer: Execute the transfer according to state-specific guidelines, which may involve filing documents with a financial institution or court.

Legal use of the Uniform Transfers To Minors Act

The legal use of the Uniform Transfers To Minors Act is critical for ensuring that transfers are valid and enforceable. Compliance with state laws is essential, as each state may have different requirements regarding the act's application. Proper execution of the transfer documents and adherence to the age requirements for custodianship are necessary to maintain the legality of the transfer. Additionally, understanding the tax implications and ensuring the transfer does not exceed annual gift tax limits can help avoid complications.

State-specific rules for the Uniform Transfers To Minors Act

Each state has its own regulations regarding the Uniform Transfers To Minors Act. These rules can influence various aspects, such as the age at which a minor gains control of the assets, the types of property that can be transferred, and the specific procedures for executing a transfer. It is important for custodians and guardians to familiarize themselves with their state's provisions to ensure compliance and effective management of the transferred assets.

Examples of using the Uniform Transfers To Minors Act

Utilizing the Uniform Transfers To Minors Act can take various forms, such as:

- A parent transferring a savings account to their child, allowing the parent to manage the funds until the child reaches the age of majority.

- Gifting stocks to a minor, enabling the custodian to oversee the investment until the child is old enough to take control.

- Transferring real estate, where the custodian manages the property and any associated income until the minor is legally able to manage it themselves.

Quick guide on how to complete uniform transfers to minors act

Prepare Uniform Transfers To Minors Act seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Uniform Transfers To Minors Act on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to edit and electronically sign Uniform Transfers To Minors Act with ease

- Obtain Uniform Transfers To Minors Act and press Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Uniform Transfers To Minors Act and ensure effective communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the transfer minors act in relation to document signing?

The transfer minors act provides guidelines on how documents can be signed on behalf of minors. With airSlate SignNow, you can ensure compliance while efficiently managing the eSigning process for minors, leveraging our platform’s features to facilitate smooth transactions.

-

How does airSlate SignNow handle the legal requirements of the transfer minors act?

airSlate SignNow is designed to adhere to legal standards, including those stipulated in the transfer minors act. Our solution enables you to collect necessary permissions and provide a secure environment for signing documents involving minors, ensuring that all legalities are met.

-

What pricing plans does airSlate SignNow offer that support the transfer minors act?

We offer various pricing plans tailored to different business needs, all of which comply with the transfer minors act. Whether you are a small business or a large enterprise, our plans are cost-effective and designed to make eSigning accessible while ensuring legal compliance.

-

What are the key features of airSlate SignNow relevant to the transfer minors act?

Key features of airSlate SignNow include customizable signing workflows, document templates, and secure eSigning authentication methods. These features are particularly useful for navigating the requirements set by the transfer minors act, streamlining the process of obtaining signatures from guardians.

-

Can airSlate SignNow integrate with other software for managing the transfer minors act?

Yes, airSlate SignNow offers seamless integrations with popular business applications. This allows you to easily manage documents related to the transfer minors act alongside your existing tools, enhancing productivity while ensuring adherence to legal standards.

-

How does airSlate SignNow benefit organizations dealing with the transfer minors act?

By using airSlate SignNow, organizations can efficiently manage the signing process required under the transfer minors act. This not only saves time but also reduces paperwork and enhances compliance, making it easier for businesses to operate while serving minors.

-

Is training available for using airSlate SignNow in the context of the transfer minors act?

Absolutely, we provide comprehensive training resources and support for users focusing on the transfer minors act. Our tutorials and customer service team are dedicated to helping you utilize our platform effectively while ensuring legal compliance.

Get more for Uniform Transfers To Minors Act

- Sd divorce form

- South dakota general durable power of attorney for property and finances or financial effective upon disability form

- South dakota general durable power of attorney for property and finances or financial effective immediately form

- Tennessee warranty deed from individual to husband and wife form

- Tennessee quitclaim deed from corporation to corporation form

- Tennessee trust form

- Quitclaim deed husband wife 481377570 form

- Tn quitclaim form

Find out other Uniform Transfers To Minors Act

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter