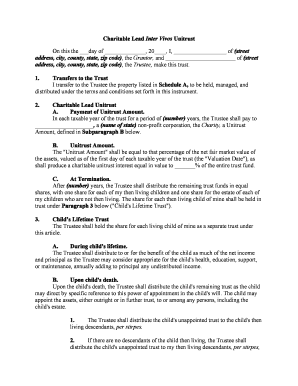

Unitrust Form

What is the charitable lead unitrust?

A charitable lead unitrust is a type of irrevocable trust designed to provide income to a charitable organization for a specified period, after which the remaining assets are distributed to non-charitable beneficiaries. This structure allows individuals to support charitable causes while also benefiting from potential tax advantages. The income generated during the trust’s term is typically based on a percentage of the trust's assets, which are revalued annually. This arrangement can be particularly appealing for those looking to make a significant charitable contribution while retaining some control over their assets.

Steps to complete the charitable lead unitrust

Completing a charitable lead unitrust involves several important steps to ensure proper setup and compliance with legal requirements. Here’s a general outline:

- Determine the charitable organization(s) to receive the income.

- Decide on the trust term length, which can range from a specific number of years to the lifetime of an individual.

- Choose the percentage payout for the charitable organization, ensuring it meets IRS guidelines.

- Draft the trust document, specifying all necessary details, including the trustee's responsibilities and the distribution of remaining assets.

- Execute the trust document with the required signatures and notarization.

- Fund the trust by transferring assets into it, which can include cash, stocks, or real estate.

Legal use of the charitable lead unitrust

The charitable lead unitrust must comply with specific legal requirements to be considered valid and enforceable. It is essential to adhere to IRS regulations regarding charitable contributions, including the requirement that the charitable organization must be a qualified entity under IRS guidelines. Additionally, the trust must be irrevocable, meaning that once established, the terms cannot be altered. Proper documentation and adherence to state laws regarding trusts are also critical to ensure the trust's legality and effectiveness.

Key elements of the charitable lead unitrust

Several key elements define the structure and function of a charitable lead unitrust:

- Trustee: The individual or entity responsible for managing the trust and ensuring compliance with its terms.

- Charitable Beneficiary: The organization that receives income from the trust during its term.

- Non-charitable Beneficiary: The individual(s) or organization(s) receiving the remaining assets after the trust term ends.

- Payout Rate: The percentage of the trust's assets paid to the charitable beneficiary, which must be at least five percent to qualify for tax benefits.

- Term Length: The duration for which the trust will provide income to the charitable organization, which can be fixed or based on the lifetime of an individual.

IRS Guidelines

IRS guidelines are crucial for the establishment and maintenance of a charitable lead unitrust. To qualify for tax deductions, the trust must meet specific criteria, including the requirement that the charitable organization is a qualified 501(c)(3) entity. The payout to the charity must also adhere to minimum percentage requirements, and the trust must be structured to ensure that the non-charitable beneficiaries receive the remaining assets after the trust term. Regular reporting and compliance with tax regulations are necessary to maintain the trust's status and benefits.

Eligibility Criteria

To establish a charitable lead unitrust, individuals must meet certain eligibility criteria. Generally, the grantor must have sufficient assets to fund the trust, and the chosen charitable organization must be recognized as tax-exempt under IRS regulations. Additionally, the grantor should be aware of the irrevocable nature of the trust, as once it is established, they cannot alter its terms or reclaim the assets placed into it. Consulting with a financial advisor or legal expert is advisable to ensure that all eligibility requirements are met.

Quick guide on how to complete unitrust

Complete Unitrust effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Unitrust on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Unitrust without hassle

- Locate Unitrust and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow manages all your document management needs in just a few clicks from any gadget of your choosing. Modify and eSign Unitrust and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable lead unitrust?

A charitable lead unitrust is an irrevocable trust that provides income to a charitable organization for a specified period, after which the remaining assets are transferred to non-charitable beneficiaries. This structure can provide signNow tax benefits for donors while supporting charitable causes. It's a strategic way to combine charitable giving with financial planning.

-

How does a charitable lead unitrust work?

In a charitable lead unitrust, the donor transfers assets into the trust, which then pays a fixed percentage of its value to the charity annually. This percentage can vary but is usually between 5-7%. After the trust term ends, the remaining assets are distributed to the non-charitable beneficiaries, allowing donors to support their favorite causes while retaining some financial benefits.

-

What are the tax benefits of establishing a charitable lead unitrust?

Establishing a charitable lead unitrust can provide substantial tax deductions for donors, as they can claim a charitable deduction at the time of funding the trust. Additionally, assets that appreciate in value during the trust term are not subject to capital gains tax when transferred to the charity. This dual benefit makes it an attractive option for charitable giving.

-

Can I integrate airSlate SignNow with my charitable lead unitrust documentation?

Yes, airSlate SignNow allows you to easily integrate eSignature features into your charitable lead unitrust documentation. Our platform streamlines the signing process, ensuring that all parties can securely sign documents from anywhere. This makes managing your charitable lead unitrust both efficient and convenient.

-

What features does airSlate SignNow offer for charitable lead unitrust management?

airSlate SignNow offers a variety of features that enhance the management of charitable lead unitrusts, including customizable templates, automated workflows, and document tracking. Our user-friendly interface simplifies the process of sending and receiving documents, ensuring compliance and efficiency in managing your charitable lead unitrust.

-

How does a charitable lead unitrust benefit both charities and donors?

A charitable lead unitrust benefits charities by providing them with a reliable income stream while allowing donors to receive tax benefits and retain control over their assets. This structure creates a win-win situation, as charities gain financial support, while donors can fulfill their philanthropic goals without sacrificing personal financial needs.

-

What is the difference between a charitable lead unitrust and other charitable giving vehicles?

Unlike simple charitable contributions, a charitable lead unitrust allows donors to receive back a portion of the assets after a predetermined time. This contrasts with charitable remainder trusts, where the donor receives income later. The charitable lead unitrust is particularly appealing for those wanting to provide immediate support to charities while planning their financial future.

Get more for Unitrust

- Petition restoration form

- Ga probate with form

- Declaring no administration form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497303967 form

- Annual minutes 497303968 form

- Notices resolutions simple stock ledger and certificate georgia form

- Minutes organizational form

- Ga secretary form

Find out other Unitrust

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document