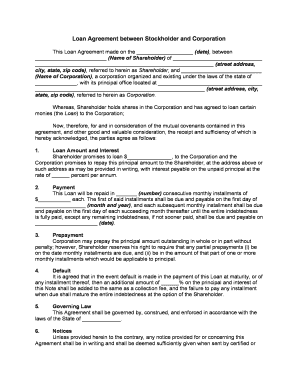

Loan Agreement Form

What is the loan agreement?

A loan agreement is a legally binding document between a lender and a borrower that outlines the terms and conditions of a loan. This agreement specifies the amount of money being borrowed, the interest rate, the repayment schedule, and any collateral involved. In the context of loan shareholders, this document may also detail the rights and obligations of both parties concerning the shares involved in the transaction. Understanding the structure and components of a loan agreement is essential for ensuring that all parties are aware of their responsibilities and rights.

Key elements of the loan agreement

When drafting a loan agreement, several key elements must be included to ensure clarity and legal compliance. These elements typically consist of:

- Loan amount: The total sum being borrowed.

- Interest rate: The percentage charged on the principal amount, which can be fixed or variable.

- Repayment terms: The schedule for payments, including frequency and duration.

- Collateral: Any assets pledged as security for the loan.

- Default conditions: Circumstances under which the borrower may be considered in default.

- Governing law: The state laws that will govern the agreement.

Including these elements helps protect both the lender and the borrower, ensuring that the loan transaction is transparent and enforceable.

Steps to complete the loan agreement

Completing a loan agreement involves several important steps to ensure that it is valid and legally binding. The following steps should be followed:

- Gather necessary information, including the loan amount, interest rate, and repayment terms.

- Draft the agreement, incorporating all key elements and ensuring clarity in language.

- Review the document with all parties involved to confirm mutual understanding and agreement.

- Make any necessary revisions based on feedback from the parties.

- Sign the agreement, ensuring that all parties provide their signatures in the designated areas.

- Store the signed document securely, whether in physical or digital format.

Following these steps will help ensure that the loan agreement is properly executed and enforceable in a legal setting.

Legal use of the loan agreement

The legal use of a loan agreement is crucial for establishing the rights and obligations of both the lender and the borrower. To be considered legally binding, the agreement must meet specific requirements, such as:

- Mutual consent: Both parties must agree to the terms and conditions outlined in the agreement.

- Consideration: There must be something of value exchanged, typically the loan amount.

- Capacity: Both parties must have the legal capacity to enter into a contract.

- Legality: The purpose of the loan must be legal and not violate any laws.

By adhering to these legal standards, the loan agreement can be enforced in a court of law, providing protection for both parties involved.

How to use the loan agreement

Using a loan agreement effectively requires understanding its purpose and how it functions in a transaction. Here are some practical uses:

- Documenting the terms of a loan between a corporation and its shareholders.

- Establishing clear repayment schedules to avoid misunderstandings.

- Providing a legal framework for resolving disputes should they arise.

- Ensuring compliance with tax regulations related to loans and interest income.

Utilizing a loan agreement in these ways can help facilitate smoother transactions and protect the interests of all parties involved.

Examples of using the loan agreement

Loan agreements can be applied in various scenarios, particularly in corporate settings. Some examples include:

- A corporation providing a loan to a shareholder to purchase additional shares.

- A shareholder lending money to the corporation for operational expenses.

- Documenting in-kind income accepted as part of a loan agreement.

These examples illustrate the versatility of loan agreements and their importance in maintaining clear financial relationships within corporate structures.

Quick guide on how to complete loan agreement

Effortlessly Complete Loan Agreement on Any Device

Managing documents online has become increasingly popular for both businesses and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Loan Agreement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Loan Agreement with Ease

- Locate Loan Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Edit and eSign Loan Agreement and ensure optimal communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement form blank?

A loan agreement form blank is a template that allows you to outline the terms of a loan between two parties. By using a loan agreement form blank, you can easily customize the necessary details such as loan amount, interest rate, and payment schedule, ensuring that all essential terms are documented.

-

How can airSlate SignNow help with loan agreement forms?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign loan agreement forms blank. With its intuitive interface, you can customize existing templates or create your own, making the process efficient and user-friendly.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using this platform for your loan agreement form blank needs, you can save time and costs associated with traditional paperwork, allowing you to focus on your core business functions.

-

What features are included in airSlate SignNow for managing loan agreements?

airSlate SignNow offers various features for managing loan agreement forms blank, including customizable templates, real-time tracking, and secure eSignature options. These features simplify the loan agreement process, making it easier to keep track of documents and ensure compliance.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This allows you to manage your loan agreement form blank along with other tools you already use, streamlining your workflow.

-

What are the benefits of using an electronic loan agreement form blank?

Using an electronic loan agreement form blank simplifies the signing process by providing instant access and reducing paperwork. It also enhances security through encrypted signatures, improves efficiency, and allows for easy storage and retrieval of documents.

-

How do I create a loan agreement form blank using airSlate SignNow?

To create a loan agreement form blank in airSlate SignNow, simply sign up for an account, choose a template, and customize it to fit your needs. The platform guides you through the process, enabling you to add relevant clauses and provisions quickly.

Get more for Loan Agreement

- Iowa prenuptial premarital agreement uniform premarital agreement act with financial statements iowa

- Iowa prenuptial form

- Amendment to prenuptial or premarital agreement iowa form

- Financial statements only in connection with prenuptial premarital agreement iowa form

- Revocation of premarital or prenuptial agreement iowa form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children iowa form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497304833 form

- Iowa corporation form

Find out other Loan Agreement

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online