Colorado Garnishment Form

What is the Colorado Garnishment

The Colorado garnishment is a legal process that allows a creditor to collect a debt by seizing a portion of a debtor's wages or bank account. This process is initiated through a court order, which mandates that a third party, such as an employer or bank, withhold funds from the debtor's earnings or account to satisfy the outstanding debt. The Colorado writ garnishment is specifically designed to ensure that creditors can recover debts while also providing protections for debtors under state law.

Steps to Complete the Colorado Garnishment

Completing the Colorado garnishment involves several key steps to ensure compliance with legal requirements. First, the creditor must obtain a judgment against the debtor in court. Once the judgment is secured, the creditor can file a writ of garnishment with the court. This document must include specific information, such as the debtor's details and the amount owed. After filing, the creditor serves the writ to the garnishee, which is the entity responsible for withholding the funds. The garnishee must then respond within a designated timeframe, confirming the amount that can be withheld.

Legal Use of the Colorado Garnishment

The legal use of the Colorado garnishment is governed by specific statutes that outline the rights and responsibilities of both creditors and debtors. Creditors must follow proper procedures to initiate garnishment, including obtaining a court judgment. Debtors have rights that protect them from excessive garnishment, including exemptions for certain types of income and assets. Understanding these legal parameters is crucial for both parties to ensure compliance and avoid potential disputes.

Eligibility Criteria

To initiate a Colorado garnishment, certain eligibility criteria must be met. Creditors must have a valid court judgment against the debtor, indicating that a debt is owed. Additionally, the debtor's income or assets must be subject to garnishment under Colorado law. This includes wages, bank accounts, and other financial resources. However, specific exemptions exist that protect certain income types, such as Social Security benefits and retirement funds, from garnishment.

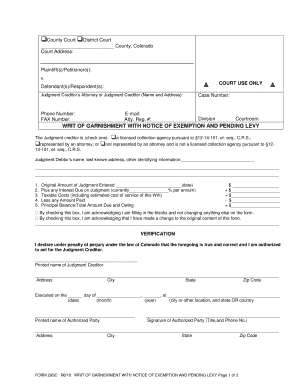

Required Documents

Filing for a Colorado garnishment requires specific documents to be submitted to the court. These typically include the completed writ of garnishment, a copy of the judgment against the debtor, and any necessary affidavits or declarations. It is important to ensure that all documents are accurately filled out and submitted in accordance with court requirements to avoid delays in the garnishment process.

Form Submission Methods

The Colorado writ garnishment can be submitted through various methods, including online, by mail, or in person at the appropriate court. Each method has its own set of guidelines and timelines that must be followed. For online submissions, it is essential to use the designated court portal, while mail submissions should be sent to the correct court address. In-person submissions allow for immediate confirmation of receipt, which can be beneficial for tracking the progress of the garnishment.

Penalties for Non-Compliance

Failure to comply with Colorado garnishment laws can result in significant penalties for both creditors and garnishees. Creditors who do not follow proper procedures may face sanctions from the court, including dismissal of the garnishment request. Garnishees who fail to withhold the appropriate funds or do not respond to the writ may also incur legal repercussions. Understanding these penalties is crucial for all parties involved to ensure adherence to the law.

Quick guide on how to complete colorado garnishment

Complete Colorado Garnishment effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Colorado Garnishment on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

The easiest way to edit and eSign Colorado Garnishment seamlessly

- Obtain Colorado Garnishment and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that intention.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Colorado Garnishment and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado writ garnishment?

A Colorado writ garnishment is a legal order that allows a creditor to collect a debt by seizing a debtor's money or property held by a third party, typically an employer or bank. It is an essential tool for creditors looking to recover outstanding obligations in the state of Colorado.

-

How can airSlate SignNow assist with Colorado writ garnishment?

airSlate SignNow streamlines the process of preparing and signing the necessary documents for a Colorado writ garnishment. With its user-friendly interface, you can quickly create, send, and eSign garnishment forms, ensuring that all documents are compliant and legally binding.

-

Are there any costs associated with using airSlate SignNow for Colorado writ garnishment?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options specifically designed for managing legal documents like a Colorado writ garnishment. These plans are cost-effective, providing great value for businesses looking to manage their legal documentation efficiently.

-

What features does airSlate SignNow offer for Colorado writ garnishment?

airSlate SignNow provides features such as document templates, real-time tracking of signed documents, and secure electronic signatures, all of which are essential for handling Colorado writ garnishment processes effectively. These features allow users to manage the garnishment workflow seamlessly.

-

Is airSlate SignNow compliant with Colorado laws regarding writ garnishment?

Yes, airSlate SignNow ensures that all its document services comply with Colorado laws concerning writ garnishment. This compliance helps users to feel confident that their documents will meet legal standards and withstand judicial scrutiny.

-

Can airSlate SignNow integrate with other software for managing Colorado writ garnishment?

Absolutely! airSlate SignNow integrates with various software tools commonly used in legal and financial services, enhancing your ability to manage Colorado writ garnishment processes alongside your existing systems. This integration saves time and improves the efficiency of document management.

-

How does electronic signature work for Colorado writ garnishment with airSlate SignNow?

With airSlate SignNow, electronic signatures for Colorado writ garnishment are legally binding, ensuring that your signed documents are recognized in a court of law. This feature allows parties involved in the garnishment process to sign documents from anywhere, speeding up the entire workflow.

Get more for Colorado Garnishment

- Arizona dissolution package to dissolve limited liability company llc arizona form

- Living trust for husband and wife with no children arizona form

- Arizona living trust form

- Living trust for individual who is single divorced or widow or widower with children arizona form

- Living trust for husband and wife with one child arizona form

- Trust minor children 497297523 form

- Amendment trust form 497297524

- Living trust property record arizona form

Find out other Colorado Garnishment

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document