South Dakota Trust Reconciliation Form

What is the South Dakota Trust Reconciliation Form

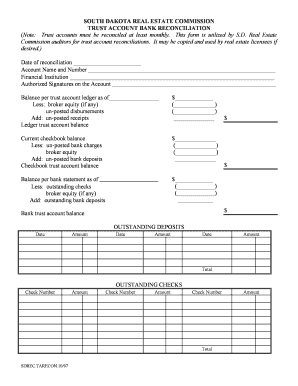

The South Dakota Trust Reconciliation Form is a legal document used to reconcile the financial activities of a trust. This form is essential for trustees to report income, expenses, and distributions accurately. It ensures compliance with state laws and provides transparency to beneficiaries regarding the trust's financial status. The form is particularly important for maintaining the trust's integrity and for fulfilling fiduciary duties.

How to use the South Dakota Trust Reconciliation Form

Using the South Dakota Trust Reconciliation Form involves several steps. First, gather all relevant financial documents related to the trust, including bank statements, income records, and expense receipts. Next, fill out the form by entering the necessary financial data, ensuring accuracy in reporting all income and distributions. Once completed, the form should be reviewed for any discrepancies before submission to the appropriate state authority. This process helps maintain compliance and ensures that all parties involved are informed about the trust's financial activities.

Steps to complete the South Dakota Trust Reconciliation Form

Completing the South Dakota Trust Reconciliation Form requires careful attention to detail. Follow these steps:

- Collect all financial records related to the trust.

- Fill in the trust's income sources, including interest, dividends, and other earnings.

- Document all expenses incurred by the trust, such as administrative costs and distributions to beneficiaries.

- Calculate the net income or loss for the reporting period.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated state office, ensuring it is filed by any applicable deadlines.

Legal use of the South Dakota Trust Reconciliation Form

The legal use of the South Dakota Trust Reconciliation Form is critical for trustees. It serves as an official record of the trust's financial activities and is often required by state law. Proper completion and submission of the form can help prevent legal disputes among beneficiaries and ensure that the trustee fulfills their fiduciary responsibilities. Additionally, maintaining accurate records through this form can protect trustees from potential legal liabilities.

Key elements of the South Dakota Trust Reconciliation Form

Several key elements are essential when filling out the South Dakota Trust Reconciliation Form. These include:

- Trust name and identification number.

- Reporting period for the financial activities.

- Detailed income sources, including amounts and types.

- Comprehensive list of expenses, including dates and purposes.

- Net income or loss calculation.

- Signature of the trustee or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the South Dakota Trust Reconciliation Form are crucial to ensure compliance. Typically, the form must be submitted annually, and the specific due date may vary based on the trust's reporting period. It is important for trustees to be aware of these deadlines to avoid penalties or legal issues. Keeping a calendar of important dates related to trust management can help ensure timely submissions.

Quick guide on how to complete south dakota trust reconciliation form

Effortlessly Prepare South Dakota Trust Reconciliation Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents a superb eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without holdups. Manage South Dakota Trust Reconciliation Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and Electronically Sign South Dakota Trust Reconciliation Form with Ease

- Find South Dakota Trust Reconciliation Form and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign South Dakota Trust Reconciliation Form to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south dakota trust reconciliation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Dakota Trust Reconciliation Form?

The South Dakota Trust Reconciliation Form is a document designed to help trustees reconcile trust accounts in compliance with state regulations. It ensures accurate record-keeping and transparency in trust management. Using this form can simplify the reconciliation process and help maintain trust integrity.

-

How can airSlate SignNow assist with the South Dakota Trust Reconciliation Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the South Dakota Trust Reconciliation Form. Our solution streamlines the document workflow, making it faster and more efficient to manage trust documents. With our platform, you can ensure that all parties can access and sign the form securely.

-

What are the pricing options for using airSlate SignNow for the South Dakota Trust Reconciliation Form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individual users and teams. You can choose a plan that best fits your requirements for managing the South Dakota Trust Reconciliation Form. Our cost-effective solutions ensure you get the best value for your document management needs.

-

Are there any features specifically for the South Dakota Trust Reconciliation Form?

Yes, airSlate SignNow includes features tailored for the South Dakota Trust Reconciliation Form, such as customizable templates and automated workflows. These features help streamline the process of filling out and signing the form, ensuring compliance and accuracy. Additionally, you can track the status of the document in real-time.

-

What benefits does airSlate SignNow provide for managing trust documents?

Using airSlate SignNow for the South Dakota Trust Reconciliation Form offers numerous benefits, including enhanced security, reduced processing time, and improved collaboration among stakeholders. Our platform ensures that your documents are stored securely and are easily accessible. This leads to better trust management and compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the South Dakota Trust Reconciliation Form?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to seamlessly manage the South Dakota Trust Reconciliation Form alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are synchronized across platforms.

-

Is it easy to use airSlate SignNow for the South Dakota Trust Reconciliation Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to use when handling the South Dakota Trust Reconciliation Form. Our intuitive interface allows users to navigate the platform effortlessly, ensuring a smooth experience from document creation to signing. You don’t need extensive technical skills to get started.

Get more for South Dakota Trust Reconciliation Form

Find out other South Dakota Trust Reconciliation Form

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast