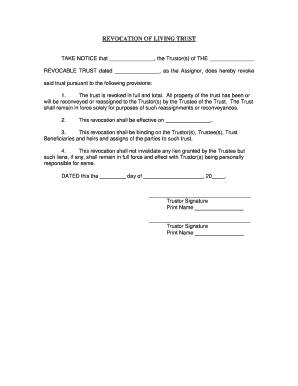

Co Trust Form

What is the Co Trust

The co trust is a legal document that establishes a trust agreement between two or more parties. This arrangement allows for the management and distribution of assets in accordance with the terms set forth in the trust document. Co trusts are often used for estate planning, where multiple individuals may wish to jointly manage a trust for the benefit of designated beneficiaries. This type of trust can help avoid probate, ensure privacy, and provide a clear plan for asset distribution.

How to Use the Co Trust

Using a co trust involves several key steps. First, the parties involved must agree on the terms and conditions of the trust, including the roles of each trustee and the beneficiaries. Once the agreement is established, the trust document must be drafted, ensuring that it complies with state laws. After signing, the trust assets should be transferred into the trust. It is crucial for all parties to understand their responsibilities and the implications of the trust to ensure smooth management.

Steps to Complete the Co Trust

Completing a co trust requires careful attention to detail. The following steps outline the process:

- Identify the parties involved and their roles as trustees and beneficiaries.

- Draft the trust document, clearly outlining the terms, conditions, and asset management strategies.

- Review the document with all parties to ensure mutual understanding and agreement.

- Sign the trust document in the presence of a notary public to validate it legally.

- Transfer the designated assets into the trust, ensuring proper title and ownership changes.

Legal Use of the Co Trust

The legal use of a co trust is governed by state trust laws, which dictate how trusts must be created, managed, and executed. For a co trust to be legally valid, it must meet specific criteria, including proper documentation and adherence to the terms outlined in the trust. Additionally, the trust must comply with relevant federal and state regulations, ensuring that it serves its intended purpose without legal complications.

Key Elements of the Co Trust

Understanding the key elements of a co trust is essential for effective management and compliance. Important components include:

- The names and roles of all trustees and beneficiaries.

- The specific assets that will be placed in the trust.

- The distribution plan for the assets upon the occurrence of certain events, such as the death of a trustee.

- Provisions for the management of the trust, including decision-making processes and conflict resolution.

Eligibility Criteria

Eligibility to establish a co trust typically requires that all parties involved are legally competent to enter into a contract. This means they must be of legal age and mentally capable of understanding the implications of the trust. Additionally, the trust must have identifiable assets that can be placed into the trust, and the purposes of the trust must be lawful under state law.

Quick guide on how to complete co trust

Complete Co Trust seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly, eliminating any delays. Handle Co Trust on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Co Trust with ease

- Find Co Trust and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Co Trust and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is co trust and how can it benefit my business?

Co trust is a comprehensive framework that fosters secure collaboration in document handling. By utilizing co trust features in airSlate SignNow, businesses can ensure that all parties maintain transparency and accountability during the eSigning process, ultimately enhancing trust and reducing the risk of disputes.

-

How does airSlate SignNow ensure the security of my documents under co trust?

airSlate SignNow employs top-notch encryption and security protocols to safeguard your documents within the co trust framework. This means that your sensitive information remains protected throughout the eSigning process, giving you peace of mind while conducting business transactions.

-

What pricing plans are available for airSlate SignNow that include co trust features?

airSlate SignNow offers various pricing plans tailored to meet your needs, all of which include essential co trust features. You can choose from different tiers based on the volume of documents you need to manage, ensuring that businesses of all sizes can leverage co trust without breaking the bank.

-

Can I integrate airSlate SignNow with other software while using co trust?

Yes, airSlate SignNow allows seamless integrations with various software solutions while utilizing co trust features. This flexibility means you can enhance your workflow and maintain a cohesive eSigning environment across different platforms, maximizing efficiency in your business operations.

-

What are the primary features of airSlate SignNow related to co trust?

Key co trust features in airSlate SignNow include user authentication, document tracking, and secure storage. These elements work together to enhance the eSigning experience, providing a reliable and efficient way to manage your document workflows while ensuring accountability and transparency.

-

How can co trust in airSlate SignNow improve my team's collaboration?

Co trust within airSlate SignNow enhances team collaboration by providing tools that ensure all parties are informed and accountable. With features such as real-time notifications and tracking, your team can work together more effectively, reducing the likelihood of errors and improving overall document turnaround times.

-

Is there a trial period for airSlate SignNow that allows me to explore co trust features?

Yes, airSlate SignNow offers a free trial period during which you can explore all co trust features without any commitments. This allows you to assess how co trust can benefit your business and enhance your document management processes before making a financial commitment.

Get more for Co Trust

- Ky pllc form

- Disclaimer form 497307843

- Notice furnishing form

- Quitclaim deed from individual to husband and wife kentucky form

- Warranty deed from individual to husband and wife kentucky form

- Quitclaim deed from corporation to husband and wife kentucky form

- Warranty deed from corporation to husband and wife kentucky form

- Quitclaim deed from corporation to individual kentucky form

Find out other Co Trust

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple