In Trust Form

What is the In Trust

The term "in trust" refers to a legal arrangement where one party holds property or assets for the benefit of another. This can involve various types of trusts, including living trusts, which are established during an individual's lifetime. The creator of the trust, known as the grantor, transfers assets into the trust, and a trustee manages these assets according to the trust's terms. This arrangement can help avoid probate, provide tax benefits, and ensure that assets are distributed according to the grantor's wishes.

How to Use the In Trust

Using an "in trust" arrangement involves several steps. First, determine the type of trust that best suits your needs, such as a revocable or irrevocable trust. Next, select a trustee who will manage the trust assets. After that, draft the trust document, outlining the terms and conditions, including how assets should be managed and distributed. Finally, transfer the chosen assets into the trust. It's advisable to consult with a legal professional to ensure compliance with state laws and to address any specific requirements.

Steps to Complete the In Trust

Completing an "in trust" arrangement involves a systematic approach:

- Define your goals: Identify what you want to achieve with the trust, such as asset protection or tax savings.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

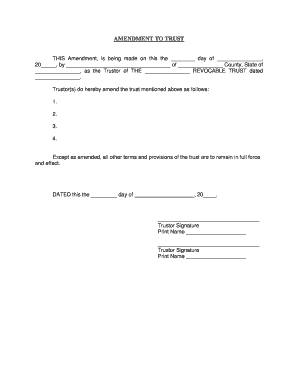

- Draft the trust document: Outline the terms, including beneficiaries and asset management instructions.

- Fund the trust: Transfer assets into the trust, ensuring proper documentation is completed.

- Review and update: Regularly assess the trust to ensure it meets your evolving needs and complies with legal requirements.

Legal Use of the In Trust

The legal use of an "in trust" arrangement is governed by state laws, which may vary significantly. Generally, trusts must be created in writing and signed by the grantor. It's essential to follow specific legal formalities, such as notarization or witnessing, to ensure the trust is enforceable. Additionally, understanding the tax implications and reporting requirements associated with trusts is crucial for compliance and effective management.

Key Elements of the In Trust

Several key elements define an "in trust" arrangement:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: The individuals or entities that will benefit from the trust.

- Trust document: A legal document that outlines the terms, conditions, and instructions for managing the trust.

- Assets: The property or financial resources placed into the trust.

- Purpose: The specific goals of establishing the trust, such as estate planning or asset protection.

Required Documents

Establishing an "in trust" arrangement typically requires several important documents:

- Trust agreement: The primary document that outlines the terms of the trust.

- Asset transfer documents: Documents necessary for transferring ownership of assets into the trust.

- Identification: Valid identification for the grantor and trustee, often required for notarization.

- Tax identification number: If applicable, a tax ID for the trust may be needed for tax reporting purposes.

Quick guide on how to complete in trust

Effortlessly Prepare In Trust on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle In Trust on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign In Trust Seamlessly

- Locate In Trust and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign In Trust and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the specific needs of businesses. These plans ensure that you can trust in the platform's affordability and flexibility, allowing you to choose the right option for scaling your document signing processes.

-

How does airSlate SignNow ensure document security?

Security is a top priority at airSlate SignNow. The platform employs robust encryption protocols and compliance with industry standards, so you can trust in the protection of your sensitive documents during the signing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a comprehensive set of features, including customizable templates, real-time collaboration, and audit trails. These features help you manage your documents efficiently and ensure that your agreements remain trustworthy throughout their lifecycle.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers seamless integrations with popular applications like Salesforce, Google Drive, and Zapier. This compatibility allows you to streamline your workflow, making sure that documents are handled efficiently and in trust.

-

What are the benefits of using airSlate SignNow for eSignatures?

Using airSlate SignNow for eSignatures enhances your business's efficiency and reduces turnaround time on contracts. Trust in the platform’s ability to facilitate smooth transactions while maintaining compliance with legal requirements across various industries.

-

How can I create a template in airSlate SignNow?

Creating a template in airSlate SignNow is straightforward. Simply upload your document and customize your fields, ensuring that you can trust in the process for repeated use, signNowly reducing manual entry for future signings.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to the needs of businesses of all sizes. Small businesses can trust in its cost-effective solutions, making it easy to manage document signing without breaking the bank.

Get more for In Trust

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497309829 form

- Marital joint debts form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497309831 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective form

- Massachusetts property form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective form

- Massachusetts dissolution form

Find out other In Trust

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer