Kentucky Satisfaction Mortgage Form

What is the Kentucky Satisfaction Mortgage

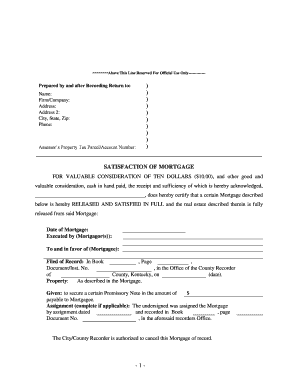

The Kentucky Satisfaction Mortgage is a legal document that serves to confirm the full repayment of a mortgage loan in the state of Kentucky. This form is essential for borrowers who have completed their mortgage obligations, as it releases the lender's claim on the property. By filing this document, homeowners can ensure that their property title is clear, allowing them to sell or refinance their home without any encumbrances. The satisfaction mortgage is a critical step in the mortgage lifecycle, signifying the conclusion of the loan agreement.

Steps to complete the Kentucky Satisfaction Mortgage

Completing the Kentucky Satisfaction Mortgage involves several key steps to ensure that the process is executed correctly and legally. Here are the steps to follow:

- Gather necessary information, including the original mortgage documents and borrower details.

- Complete the satisfaction mortgage form, ensuring all fields are filled accurately.

- Obtain the signature of the lender or their authorized representative to validate the document.

- File the completed form with the appropriate county clerk's office in Kentucky to officially record the satisfaction.

- Keep a copy of the filed document for personal records, as it serves as proof of mortgage satisfaction.

Legal use of the Kentucky Satisfaction Mortgage

The legal use of the Kentucky Satisfaction Mortgage is governed by state laws that outline the requirements for a valid release of mortgage. This document must be executed in accordance with the Kentucky Revised Statutes, ensuring that it meets all legal standards. It is crucial for homeowners to understand that the satisfaction mortgage must be filed within a specific timeframe after the mortgage has been paid off to avoid any potential legal complications. Failure to properly execute and file this document may result in continued claims on the property by the lender.

Required Documents

To complete the Kentucky Satisfaction Mortgage, several documents are required to ensure the process is legally binding and accurate. These include:

- The original mortgage agreement.

- Proof of payment in full, such as a final payment receipt.

- Identification documents of the borrower.

- Any additional documentation required by the county clerk's office.

Who Issues the Form

The Kentucky Satisfaction Mortgage form is typically issued by the lender or mortgage servicer once the loan has been paid in full. It is essential for borrowers to request this document from their lender, as it serves as the official release of the mortgage. In some cases, title companies may also assist in preparing and filing the satisfaction mortgage on behalf of the borrower.

State-specific rules for the Kentucky Satisfaction Mortgage

Each state has its own regulations regarding the satisfaction of mortgages, and Kentucky is no exception. In Kentucky, the satisfaction mortgage must be recorded with the county clerk where the property is located. Additionally, the state requires that the form be signed by the lender or their authorized representative to be considered valid. Understanding these state-specific rules is crucial for homeowners to ensure that their satisfaction mortgage is recognized legally and that their property title is clear.

Quick guide on how to complete kentucky satisfaction mortgage

Effortlessly Prepare Kentucky Satisfaction Mortgage on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly and without delays. Manage Kentucky Satisfaction Mortgage on any system with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Kentucky Satisfaction Mortgage with minimal effort

- Find Kentucky Satisfaction Mortgage and then select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure private information using the tools that airSlate SignNow specifically offers for that function.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form navigation, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Kentucky Satisfaction Mortgage and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage individual form?

A mortgage individual form is a specific document used in the mortgage application process that collects essential information about the borrower. This form is crucial for lenders to assess creditworthiness and determine loan eligibility. Understanding how to fill out this form accurately can signNowly impact your mortgage approval.

-

How does airSlate SignNow simplify the mortgage individual form process?

airSlate SignNow streamlines the mortgage individual form process by allowing users to fill out, sign, and send documents electronically. This saves time and reduces errors compared to traditional paper methods. With an intuitive interface, it helps borrowers navigate through the form efficiently.

-

Can I customize the mortgage individual form using airSlate SignNow?

Yes, airSlate SignNow enables users to customize the mortgage individual form according to their specific needs. You can add fields, include company branding, and even pre-fill certain information to make the completion process easier for your clients. Customization ensures that the form meets all necessary requirements for your unique situation.

-

Is airSlate SignNow a cost-effective solution for handling the mortgage individual form?

Absolutely! airSlate SignNow offers a cost-effective solution for handling the mortgage individual form, with flexible pricing plans to suit different budgets. By digitizing the process, businesses save on printing, mailing, and storage costs, ultimately enhancing their profitability while improving customer service.

-

What features does airSlate SignNow offer for the mortgage individual form?

airSlate SignNow provides several features specifically designed for the mortgage individual form, including electronic signatures, secure document storage, and automated workflows. These features enhance the efficiency of the mortgage application process, ensuring you can close deals faster and maintain compliance with regulations.

-

Can the mortgage individual form be integrated with other software?

Yes, airSlate SignNow allows seamless integration with various software applications, including CRM systems and loan processing software. This means that the mortgage individual form can be easily linked with your existing tools, streamlining your workflow and improving data accuracy throughout the mortgage process.

-

How secure is the information submitted through the mortgage individual form?

airSlate SignNow prioritizes security, ensuring that all information submitted through the mortgage individual form is encrypted and protected. It complies with industry standards to keep sensitive data safe, giving both you and your clients peace of mind when sharing personal information.

Get more for Kentucky Satisfaction Mortgage

Find out other Kentucky Satisfaction Mortgage

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form