Massachusetts Information Form

What is the Massachusetts Information Form

The Massachusetts Information Form is a crucial document used primarily for tax purposes in the state of Massachusetts. It serves as a means for individuals and businesses to provide necessary information to the Massachusetts Department of Revenue. This form helps ensure compliance with state tax laws and regulations, facilitating accurate reporting and assessment of taxes owed. The information collected may include personal identification details, income data, and other relevant financial information.

How to use the Massachusetts Information Form

Using the Massachusetts Information Form involves several key steps. First, gather all necessary documents, including identification and financial records. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check the information for accuracy to avoid potential issues with processing. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred submission method.

Steps to complete the Massachusetts Information Form

Completing the Massachusetts Information Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents, such as W-2s, 1099s, and any other relevant financial statements.

- Access the form online or obtain a physical copy from the Massachusetts Department of Revenue.

- Fill out the form, ensuring that all personal and financial information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or mail it to the appropriate address.

Legal use of the Massachusetts Information Form

The Massachusetts Information Form is legally binding when completed correctly and submitted in accordance with state laws. It must adhere to the guidelines set forth by the Massachusetts Department of Revenue to ensure its validity. Proper use of the form includes providing accurate information and meeting all filing deadlines. Non-compliance with these legal requirements can result in penalties or delays in processing.

Key elements of the Massachusetts Information Form

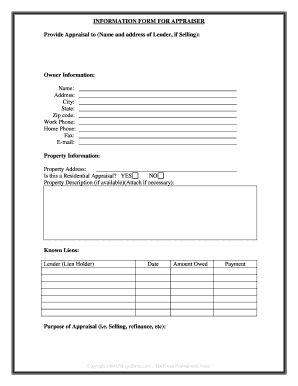

Several key elements are essential to the Massachusetts Information Form. These include:

- Personal Information: Name, address, and Social Security number of the individual or business.

- Income Details: Information regarding various sources of income, including wages, dividends, and interest.

- Tax Identification: Any relevant tax identification numbers required for accurate processing.

- Signature: A signature is required to validate the information provided and confirm its accuracy.

Who Issues the Form

The Massachusetts Information Form is issued by the Massachusetts Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among residents and businesses. The Department provides resources and guidance on how to properly fill out and submit the form, ensuring that users have access to the necessary support for their tax-related needs.

Quick guide on how to complete massachusetts information form

Complete Massachusetts Information Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly, eliminating delays. Manage Massachusetts Information Form on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Massachusetts Information Form seamlessly

- Find Massachusetts Information Form and click Get Form to begin.

- Make use of the tools available to complete your document.

- Mark important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Massachusetts Information Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Massachusetts information form and how can airSlate SignNow help?

The Massachusetts information form is a document that collects essential data for various legal and business uses in Massachusetts. airSlate SignNow simplifies the process of completing and eSigning this form, allowing users to manage their documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts information form?

Yes, airSlate SignNow offers a range of pricing plans to accommodate businesses of all sizes. The subscription fees are competitive, and you can efficiently manage the Massachusetts information form without breaking your budget.

-

What features does airSlate SignNow offer for the completion of the Massachusetts information form?

airSlate SignNow provides key features such as customizable templates, automated workflows, and secure eSignature capabilities for the Massachusetts information form. These tools streamline the document management process and enhance collaboration among users.

-

Are there any benefits to using airSlate SignNow for my Massachusetts information form needs?

Using airSlate SignNow for the Massachusetts information form offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface makes it easy for anyone to create, send, and sign documents quickly.

-

Can I integrate airSlate SignNow with other applications to manage the Massachusetts information form?

Yes, airSlate SignNow offers seamless integration with various applications, allowing you to manage your Massachusetts information form alongside tools like Google Drive, Dropbox, and Salesforce. These integrations facilitate smooth document workflows and enhance productivity.

-

How secure is the airSlate SignNow platform when handling the Massachusetts information form?

Security is a top priority at airSlate SignNow. When managing the Massachusetts information form, you can trust that your data is protected with advanced encryption and strict access controls, ensuring confidentiality and compliance with legal standards.

-

Can I access my Massachusetts information form on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to complete and eSign the Massachusetts information form on smartphones or tablets. This flexibility makes it easy to manage your documents on the go.

Get more for Massachusetts Information Form

- Letter from tenant to landlord about sexual harassment maine form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children maine form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure maine form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497310792 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497310793 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497310794 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497310795 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497310796 form

Find out other Massachusetts Information Form

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later