Accounting of Amount Due and Unpaid Corporation or LLC Alaska Form

Understanding the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

The Accounting of Amount Due and Unpaid Corporation or LLC Alaska form is a crucial document for businesses operating in Alaska. It serves to detail any outstanding debts owed by the corporation or limited liability company (LLC). This form is essential for maintaining accurate financial records and ensuring compliance with state regulations. By documenting amounts due and unpaid, businesses can manage their cash flow effectively and prepare for potential tax implications.

Steps to Complete the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

Completing the Accounting of Amount Due and Unpaid Corporation or LLC Alaska form involves several key steps:

- Gather relevant financial information, including invoices, statements, and payment records.

- Clearly list all amounts due, specifying the nature of each debt and the due dates.

- Ensure that all entries are accurate and reflect the most current financial status of the business.

- Review the completed form for any discrepancies before submission.

Legal Use of the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

This form is legally binding when completed correctly and can be used in various legal contexts, such as during audits or disputes. It is important to ensure compliance with local laws regarding financial documentation. Proper use of this form can protect the business's interests and provide a clear record of financial obligations.

Key Elements of the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

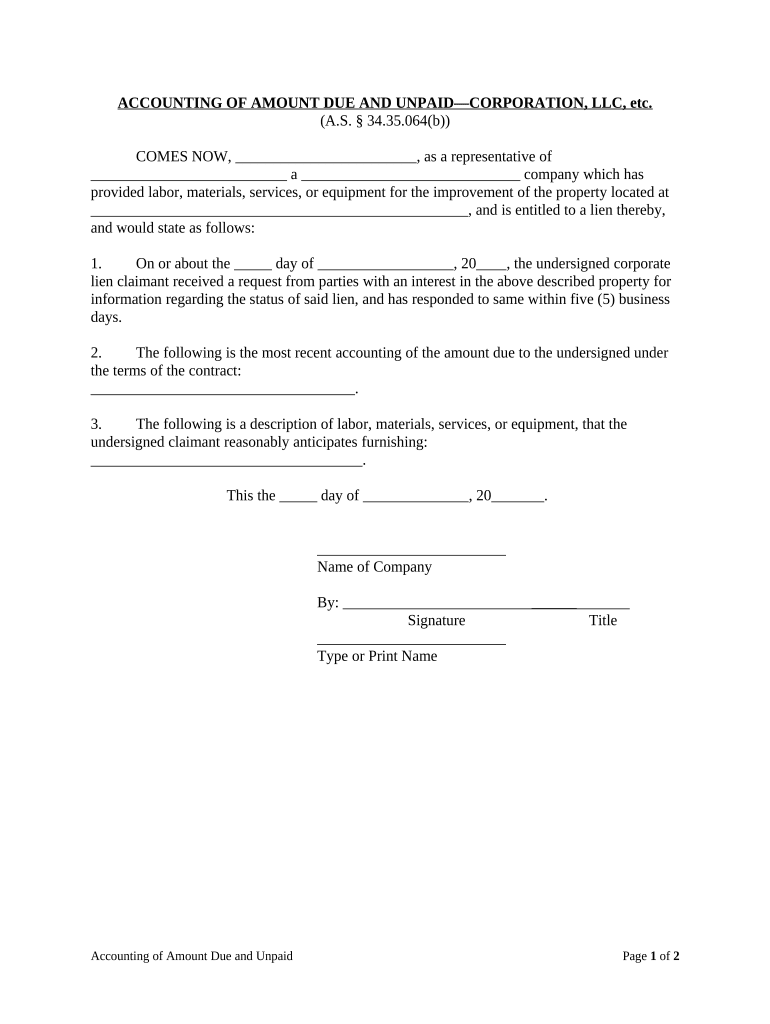

Several key elements must be included in the Accounting of Amount Due and Unpaid Corporation or LLC Alaska form:

- The name and address of the corporation or LLC.

- A detailed list of all amounts due, including the creditor's information.

- Payment terms and conditions associated with each debt.

- The date of the report and the signature of an authorized representative.

State-Specific Rules for the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

Alaska has specific regulations governing the accounting practices of corporations and LLCs. These rules dictate how businesses must report their financial obligations and maintain transparency with stakeholders. Familiarity with these regulations is essential for compliance and to avoid potential penalties.

Obtaining the Accounting of Amount Due and Unpaid Corporation or LLC Alaska

The Accounting of Amount Due and Unpaid Corporation or LLC Alaska form can typically be obtained through the Alaska Division of Corporations, Business and Professional Licensing. It may also be available through various business resource websites. Ensure that you are using the most current version of the form to comply with state requirements.

Quick guide on how to complete accounting of amount due and unpaid corporation or llc alaska

Effortlessly Prepare Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska with Ease

- Obtain Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska and click Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska?

Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska is crucial for maintaining accurate financial records and ensuring timely payments. It helps businesses stay compliant with state regulations and avoid penalties. Proper accounting practices also enhance cash flow management.

-

How can airSlate SignNow assist with the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska?

airSlate SignNow provides a seamless eSignature solution that ensures documents related to the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska are signed and approved quickly. This accelerates the invoicing process and enhances accountability in financial transactions.

-

What features does airSlate SignNow offer for managing unpaid amounts in Alaska?

airSlate SignNow offers features like document tracking, reminders, and automated workflows to effectively manage unpaid amounts. These tools simplify the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska, ensuring you can follow up effortlessly with clients.

-

Is airSlate SignNow cost-effective for handling accounting tasks in Alaska?

Yes, airSlate SignNow is designed as a cost-effective solution for businesses. Its pricing model allows companies in Alaska to efficiently manage the Accounting Of Amount Due And Unpaid Corporation Or LLC without incurring high overhead costs.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates with various accounting software, making it easier to maintain consistency in your financial records. This integration supports the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska by ensuring all information is synchronized.

-

What benefits can I expect from using airSlate SignNow for accounting in Alaska?

Using airSlate SignNow streamlines the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska, improving efficiency and reducing errors. The platform enhances document management and provides an intuitive user experience, leading to better customer satisfaction.

-

How do I ensure compliance while handling unpaid amounts for my LLC in Alaska?

airSlate SignNow helps ensure compliance by providing legally binding eSignatures and thorough audit trails. This feature is vital for the Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska, as it keeps your documentation above board and up to date.

Get more for Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska

- Mo notice 497313136 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497313137 form

- Missouri letter notice form

- Mo tenant notice form

- Letter from tenant to landlord with demand that landlord repair broken windows missouri form

- Letter tenant with form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497313142 form

- Tenant landlord repair agreement form

Find out other Accounting Of Amount Due And Unpaid Corporation Or LLC Alaska

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed