Arizona Form 140ES Individual Estimated Tax Payment

What is the Arizona Form 140ES Individual Estimated Tax Payment

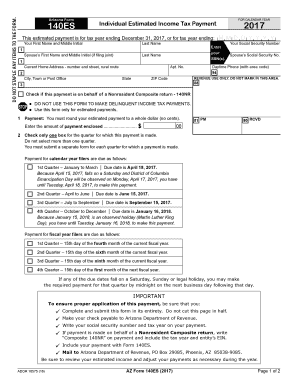

The Arizona Form 140ES is utilized for making individual estimated tax payments to the state of Arizona. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It allows individuals to pay their estimated tax liabilities in four installments throughout the year, ensuring they meet their tax obligations and avoid penalties. The form is specifically designed for residents and part-year residents of Arizona who have income that is not subject to withholding, such as self-employment income, rental income, or investment income.

How to use the Arizona Form 140ES Individual Estimated Tax Payment

Using the Arizona Form 140ES involves calculating your estimated tax liability and submitting payments accordingly. Taxpayers should first estimate their annual income and applicable deductions to determine the expected tax owed. Once the estimated amount is calculated, individuals can fill out the form to report their payments. It's important to keep track of the due dates for each installment to ensure timely submissions, as failure to do so may result in penalties. The form can be submitted online or via mail, depending on the taxpayer's preference.

Steps to complete the Arizona Form 140ES Individual Estimated Tax Payment

Completing the Arizona Form 140ES involves several key steps:

- Estimate your income: Calculate your expected income for the year, including any self-employment, rental, or investment income.

- Determine your tax liability: Use the Arizona tax tables or tax rate schedules to estimate your tax owed based on your income.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number, along with your estimated tax payment amounts.

- Submit your payment: Choose to pay online or mail your payment along with the completed form. Ensure you adhere to the payment deadlines to avoid penalties.

Key elements of the Arizona Form 140ES Individual Estimated Tax Payment

Several key elements are crucial when dealing with the Arizona Form 140ES. These include:

- Payment schedule: The form outlines four payment deadlines, typically due on April 15, June 15, September 15, and January 15 of the following year.

- Estimated tax calculation: Taxpayers must accurately calculate their estimated tax based on their projected income and deductions.

- Submission methods: The form can be submitted electronically or via postal mail, providing flexibility for taxpayers.

- Penalties for underpayment: If the estimated payments do not meet the required thresholds, taxpayers may incur penalties when filing their annual tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 140ES are critical for compliance. The estimated tax payments are generally due on the following dates:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

Taxpayers should mark these dates on their calendars to ensure timely payments and avoid any penalties associated with late submissions.

Penalties for Non-Compliance

Failure to comply with the Arizona Form 140ES requirements can result in penalties. If taxpayers do not make the required estimated tax payments, they may face a penalty for underpayment. This penalty is typically calculated based on the amount of tax owed and the duration of the underpayment. Additionally, interest may accrue on any unpaid amounts. It is essential for taxpayers to understand these penalties to avoid unexpected financial burdens when filing their annual tax returns.

Quick guide on how to complete arizona form 140es individual estimated tax payment

Access Arizona Form 140ES Individual Estimated Tax Payment effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without any holdups. Handle Arizona Form 140ES Individual Estimated Tax Payment on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest method to alter and electronically sign Arizona Form 140ES Individual Estimated Tax Payment easily

- Find Arizona Form 140ES Individual Estimated Tax Payment and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Verify all the details and click on the Done button to store your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to mislaid or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Arizona Form 140ES Individual Estimated Tax Payment and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140es individual estimated tax payment

How to make an eSignature for your Arizona Form 140es Individual Estimated Tax Payment in the online mode

How to generate an eSignature for the Arizona Form 140es Individual Estimated Tax Payment in Google Chrome

How to make an eSignature for signing the Arizona Form 140es Individual Estimated Tax Payment in Gmail

How to create an eSignature for the Arizona Form 140es Individual Estimated Tax Payment straight from your mobile device

How to generate an electronic signature for the Arizona Form 140es Individual Estimated Tax Payment on iOS

How to make an eSignature for the Arizona Form 140es Individual Estimated Tax Payment on Android

People also ask

-

What is the Arizona Form 140ES Individual Estimated Tax Payment?

The Arizona Form 140ES Individual Estimated Tax Payment is a tax form used by residents of Arizona to report and pay their estimated state income taxes. This form helps taxpayers avoid penalties by ensuring they pay enough tax throughout the year. Utilizing this form can simplify your tax planning and compliance.

-

How can airSlate SignNow help with the Arizona Form 140ES Individual Estimated Tax Payment?

airSlate SignNow provides a seamless solution for electronically signing and sending the Arizona Form 140ES Individual Estimated Tax Payment and other tax documents. With our platform, you can easily prepare, sign, and share your forms securely, making tax time less stressful.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses alike. The pricing includes access to essential features such as document eSigning, templates, and cloud storage, making it a valuable investment for anyone dealing with the Arizona Form 140ES Individual Estimated Tax Payment.

-

What features does airSlate SignNow offer for managing the Arizona Form 140ES Individual Estimated Tax Payment?

airSlate SignNow offers a range of features to streamline the management of the Arizona Form 140ES Individual Estimated Tax Payment, including customizable templates, automated reminders, and secure cloud storage. These tools enhance your productivity and ensure you can handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for handling the Arizona Form 140ES Individual Estimated Tax Payment?

Absolutely! airSlate SignNow can be easily integrated with various accounting and tax software to enhance your workflow when handling the Arizona Form 140ES Individual Estimated Tax Payment. This means you can manage your tax documents alongside your other financial tools seamlessly.

-

How does airSlate SignNow ensure the security of the Arizona Form 140ES Individual Estimated Tax Payment?

Security is a top priority for airSlate SignNow. We use advanced encryption methods and secure servers to protect your documents, including the Arizona Form 140ES Individual Estimated Tax Payment, from unauthorized access. This ensures that your sensitive tax information remains confidential.

-

What are the benefits of using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment?

Using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment offers numerous benefits, such as time savings, reduced paper usage, and enhanced organization. Our platform allows you to track the status of your documents and ensures that you meet all filing deadlines easily.

Get more for Arizona Form 140ES Individual Estimated Tax Payment

Find out other Arizona Form 140ES Individual Estimated Tax Payment

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip