Form Contractor Status 2006-2026

What is the Form Contractor Status

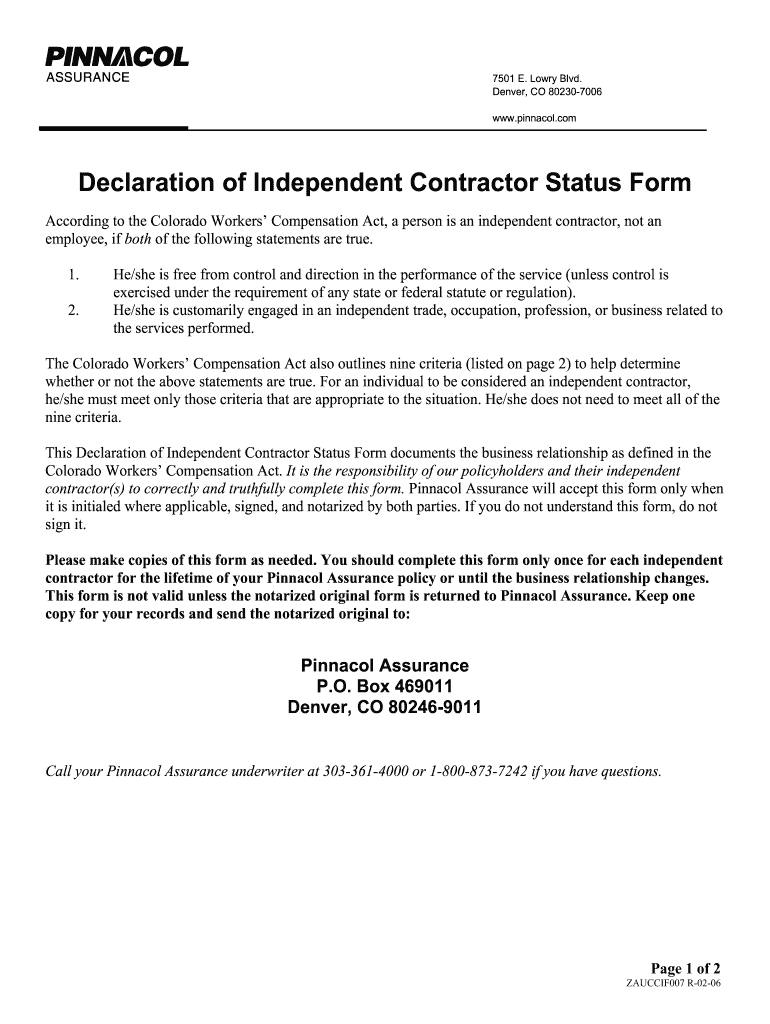

The Form Contractor Status is a critical document used to establish the classification of a worker as an independent contractor rather than an employee. This classification is essential for tax purposes and determines the obligations of both the contractor and the hiring entity. In the United States, correctly identifying a worker's status can influence tax liabilities, eligibility for benefits, and compliance with labor laws. The form typically requires information about the nature of the work, payment terms, and the relationship between the contractor and the client.

How to use the Form Contractor Status

Using the Form Contractor Status involves several steps to ensure accurate completion and compliance with legal requirements. First, gather the necessary information about the contractor, including their name, address, and Social Security number or Employer Identification Number (EIN). Next, clearly outline the services to be provided, payment arrangements, and any specific terms related to the work. Once the form is filled out, both parties should review it for accuracy before signing. This ensures that both the contractor and the hiring entity understand their rights and responsibilities.

Steps to complete the Form Contractor Status

Completing the Form Contractor Status requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary information about the contractor and the services provided.

- Clearly define the scope of work and payment terms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form with the contractor to confirm all details are correct.

- Both parties should sign the document to validate the agreement.

- Keep a copy of the completed form for your records.

Legal use of the Form Contractor Status

The legal use of the Form Contractor Status is paramount for compliance with federal and state labor laws. Misclassification of workers can lead to significant penalties, including back taxes, fines, and legal disputes. It is essential to ensure that the form accurately reflects the nature of the working relationship. The form should be used in conjunction with other documentation, such as contracts and invoices, to provide a comprehensive understanding of the contractor's role and responsibilities.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the classification of independent contractors. According to IRS criteria, the degree of control the employer has over the work performed is a significant factor in determining status. The IRS uses a three-part test that examines behavioral control, financial control, and the type of relationship between the parties. Understanding these guidelines helps ensure that the Form Contractor Status is completed correctly and that all parties comply with tax obligations.

Eligibility Criteria

Eligibility for using the Form Contractor Status typically hinges on the nature of the work and the relationship between the contractor and the hiring entity. To qualify as an independent contractor, the worker must have control over how they perform their tasks, be responsible for their own expenses, and not be entitled to employee benefits. Meeting these criteria is essential for both parties to avoid potential legal complications and ensure proper tax treatment.

Quick guide on how to complete form contractor status

The simplest method to locate and endorse Form Contractor Status

Across the breadth of your organization, ineffective workflows related to paper approvals can eat up signNow hours of labor. Signing documents such as Form Contractor Status is an inherent aspect of operations in any sector, which is why the productivity of each contract’s lifespan critically impacts the organization’s overall efficiency. With airSlate SignNow, endorsing your Form Contractor Status can be as straightforward and swift as possible. This platform provides the latest version of virtually any document. Even better, you can sign it right away without needing to install external software on your computer or produce any physical copies.

Steps to obtain and sign your Form Contractor Status

- Explore our collection by category or use the search bar to find the document you require.

- View the document preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your document and include any essential information using the toolbar.

- Once finished, click the Sign tool to endorse your Form Contractor Status.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can search for, complete, modify, and even send your Form Contractor Status in a single tab without any complications. Enhance your processes with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do illegal immigrants live in the US successfully for 20 years, including getting a driving license, get a job, pay taxes, and buy a house?

I live in Arizona and have seen a lot of this go down over the last couple decades. It boils down to numerous businesses, both small and large who are willing to capitalize on a cheap, extremely hard working labor force (legal status be damned). There are very few white people in this state who work as laborers in landscaping, roofing, concrete, tree trimming, house painting, dish washing, car washing, house cleaning, and crop harvesting. The white people run the companies. Or are the foremen or managers. But almost every person busting thier ass at the physical work is from Mexico and many speak little if any English.They are getting paid under the table, or they are using stolen identites for tax purposes (a decade ago a friend of mine's brother was sent a letter from the IRS claiming he was several years and thousands of dollars behind on taxes, his brother was 13 at the time). These immigrant workers are also doing the job for less than a legal citizen would take, sometimes less than minimum wage. This saves the companies money, and law enforcement did little to crack down on the employers. And since the businesses were making money on the cheap labor, they didn't want the cops to end the gravy train either.A cottage industry of slum lords were more than willing to take rent money from these immigrants for houses and apartments, and if you sell a car in a private transaction there is no legal requirement to verify the legal status of the buyer. Sure they are supposed to register and insure it, but that only matters if they get pulled over, and the smart ones register it under a family memeber who is a citizen or has a green card.Now that you have an immigrant population with money to spend, entrepreneurial people who speak the same language will start local businesses to cater to the needs of these folks who might be shy to spend their money in a store where they have trouble communicating. And all this feeds back into and perpetuates the cycle.So the short answer is: money!

-

My employer made me fill out a w-9 he pays me by the hour and with holds taxes from me this isn't legal is it either he needs to have me fill out a w2 or not with hold taxes am I correct about this?

Think of the W-9 as a vehicle between a pay provider or a vendor and an independent contractor. When a W-9 is involved, we typically do not use the terms "employer" or "employee". Rather we use the terms vendor and independent contractor. If you have filled out a W-9, then the person paying for labor sees the worker as an independent contractor, not an employee. In this case you get a 1099-MISC and not a Form W-2 at the end of the year. (People and companies that pay for labor often prefer to pay workers as independent contractors, instead of as employees, because the payor does not have to pay employment taxes or provide other benefits.) If you fail to fill out and provide a completed W-9 when one is requested of you, then the person paying for labor is required to hold back part of the pay to the independent contractor (mandatory back up withholding). However, if you have provided a signed W-9 back to the person paying you, then you are correct, the payor should not be withholding anything (unless you have more than one single status as a worker for this company?) If you have filled out and returned only a W-9 to the person who pays you, and know for sure you have not also filled out a W-4 (to be treated as an employee and later receive a W-2), and you can also produce paycheck stubs that show withholding for Social Security and Medicare, state taxes (FICA, MED, etc.), then you should raise this issue with your tax preparer and ask if you should consider filing a Form SS-8 when you complete your tax return. Better yet, print out and bring a Form SS-8 into work now, and ask to speak with someone in human resources, personnel, or the accounting office at the company about that Form SS-8. An SS-8 form should sufficiently scare the bejesus out of the company. If some foul play is at work here, the concern over a Form SS-8 will make people sit up and pay attention. If it is something else (like some of your work is as an employee and other more independent projects are paid out to contractors instead of employees,) then an SS-8 will still be effective... the person paying for labor will go out of their way to then be as clear as possible in explaining their actions. Two final thoughts: 1) Remember, it does not matter what they are doing or not doing, or whether it is legal or questionable. It only matters what you can demonstrate or prove. If you don't get real, live paychecks or at least a stub or advice of deposit that shows withholding, then it will be difficult for you to demonstrate what has or is happening. 2) Sit with a professional tax preparer this coming tax season - and just pay for the service. If you've never seen or filled out a Form SS-8 before, now is not the time to venture it on your own. I can probably figure out how to change the oil in my car by myself. I go to a mechanic for an oil change for a reason.

-

Is it true that there are some people working as programmers and don't really know how to code?

Working with a very small team we hired a gentleman with a fairly impressive resume. He’d earned the title of “Senior Developer” at one of his jobs with relatively few years experience, and kept it forward through several jobs since then.We hired him with the same title, and while I wasn’t a part of his interviews I know we normally included a few code-proficiency screeners.Well, he worked under our front end lead for a few weeks with very little progress. Finally my colleague couldn’t handle working with him anymore and forced our manager to make a change.The change was apparently to transfer him to my purview.So I spent a week working directly with him one-on-one.It was apparent he wasn’t familiar with the language we were using on the back-end, which was Java, but I’m a firm believer that you need good developers not good Java developers. We can teach syntax.I figured I’d be clever. I asked him his best language - it was PHP. I have a few years of PHP under my belt, so no problem! Solve it in PHP, I’ll translate.The problem was simple. I wanted a function that took a list of objects and returned a new list containing one of the attributes (the ID) from each.After nearly an hour, the only meaningful thing he’d managed to say was “There are many ways to iterate a list in PHP”, but none were forthcoming.Not only was he working as a programmer, he was a “Senior Developer” who was probably only a couple jobs away from transitioning into management.What may blow your mind is he wasn’t even our worst hire. Because he wrote so little code, we caught it early and very little damage was done beyond a little lost time.

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

What do I fill out as the "current USCIS status" on form i-485?

The I-485 form was updated in June 2017!Here is a guide on how to fill out the latest I-485.

Create this form in 5 minutes!

How to create an eSignature for the form contractor status

How to create an eSignature for the Form Contractor Status in the online mode

How to generate an eSignature for your Form Contractor Status in Chrome

How to create an eSignature for putting it on the Form Contractor Status in Gmail

How to create an eSignature for the Form Contractor Status right from your smartphone

How to create an eSignature for the Form Contractor Status on iOS devices

How to generate an electronic signature for the Form Contractor Status on Android

People also ask

-

What is the direction to pay form contractor?

The direction to pay form contractor is a document that instructs how payments should be made to a contractor for services rendered. It simplifies the process by specifying payment details, allowing for a smooth transaction. Using airSlate SignNow, you can create, send, and eSign this form effortlessly.

-

How can I create a direction to pay form contractor using airSlate SignNow?

Creating a direction to pay form contractor with airSlate SignNow is easy. You can either use our templates or start from scratch, adding all necessary fields and details for the payment instructions. Once your document is ready, you can instantly send it for eSignature.

-

What features does airSlate SignNow offer for managing direction to pay form contractor?

airSlate SignNow offers various features to manage your direction to pay form contractor effectively. These include customizable templates, automated reminders, and tracking for document status. You can also integrate with other tools to streamline your workflow.

-

Is there a mobile app for airSlate SignNow to manage my contractor payments?

Yes, airSlate SignNow provides a mobile app that allows you to manage your direction to pay form contractor on the go. You can create documents, send them for signing, and track their status directly from your mobile device. This ensures you stay updated wherever you are.

-

How does airSlate SignNow ensure the security of direction to pay form contractor?

airSlate SignNow employs industry-standard security measures to protect your documents, including the direction to pay form contractor. All data is encrypted, and we provide secure storage solutions. Additionally, our platform is compliant with major security regulations, ensuring your information is safe.

-

Can airSlate SignNow integrate with other tools for processing contractor payments?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage payments through the direction to pay form contractor. You can connect with accounting software, CRMs, and more to optimize your payment process.

-

What are the pricing options for airSlate SignNow when using it for contractor documents?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs, including those for sending the direction to pay form contractor. You can choose between monthly or annual subscriptions with varying features. A free trial is also available for you to explore before committing.

Get more for Form Contractor Status

- Portrait photography agreement free sample contract form

- Reservation of tickets form

- Photography services contract template download free form

- Change of event time location etc form

- Cross license agreement secgov form

- Persuasion advocating legislation form

- Nonexclusive license agreement for the manufacture and sale of a product form

- Letter to editor of local newspaper form

Find out other Form Contractor Status

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online