Chapter 13 Plan Alabama Form

What is the Chapter 13 Plan Alabama

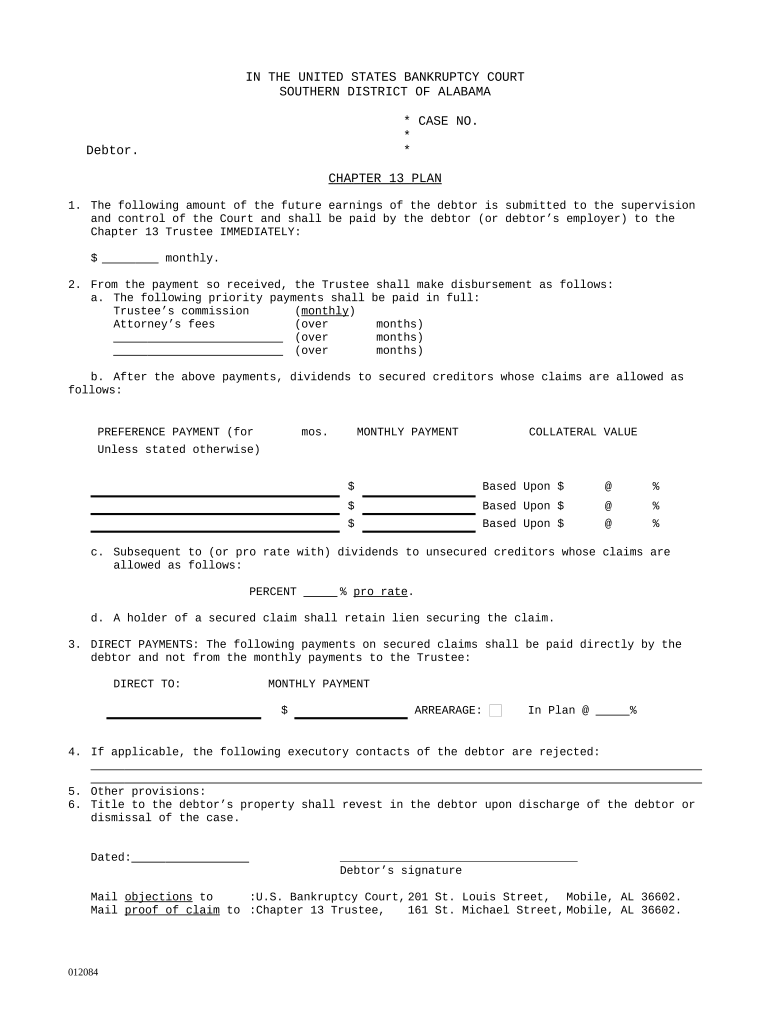

The Chapter 13 Plan in Alabama is a legal framework designed for individuals who are struggling with debt but wish to retain their assets while repaying creditors over a specified period. This plan allows debtors to propose a repayment plan to make installments to creditors over three to five years. Unlike Chapter 7 bankruptcy, which liquidates assets, Chapter 13 enables individuals to reorganize their debts and maintain ownership of their property, making it a viable option for many facing financial difficulties.

Steps to complete the Chapter 13 Plan Alabama

Completing the Chapter 13 Plan in Alabama involves several key steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, tax returns, and a list of debts.

- Consult a Bankruptcy Attorney: Seek legal advice to ensure compliance with state laws and to help draft the repayment plan.

- File the Petition: Submit the Chapter 13 petition to the bankruptcy court, along with the proposed repayment plan.

- Attend the Meeting of Creditors: Participate in a meeting where creditors can ask questions about your financial situation and repayment plan.

- Obtain Court Approval: After addressing any creditor concerns, the court will review and approve the repayment plan if it meets legal requirements.

Key elements of the Chapter 13 Plan Alabama

Several key elements define the Chapter 13 Plan in Alabama:

- Payment Amount: The plan must specify the monthly payment amount to be made to the bankruptcy trustee.

- Duration: The repayment period typically lasts three to five years, depending on the debtor's income.

- Debt Classification: The plan must categorize debts into secured and unsecured, determining how each type will be treated.

- Priority Debts: Certain debts, such as child support and taxes, are prioritized and must be paid in full during the plan.

Legal use of the Chapter 13 Plan Alabama

The legal use of the Chapter 13 Plan in Alabama is governed by federal and state bankruptcy laws. It provides a structured approach for individuals to manage their debts while adhering to legal requirements. Debtors must comply with all court orders and make timely payments to avoid dismissal of their case. The plan protects debtors from creditor actions, such as foreclosure or wage garnishment, while they work towards financial stability.

Eligibility Criteria

To qualify for the Chapter 13 Plan in Alabama, individuals must meet specific eligibility criteria:

- Regular Income: Debtors must have a reliable source of income to fund the repayment plan.

- Debt Limits: There are limits on the amount of secured and unsecured debt a debtor can have to qualify.

- Good Faith: The debtor must propose a plan in good faith, demonstrating a genuine effort to repay debts.

Form Submission Methods

Submitting the Chapter 13 Plan in Alabama can be done through various methods:

- Online Submission: Many courts allow electronic filing of bankruptcy petitions and plans through their online systems.

- Mail: Documents can be mailed directly to the bankruptcy court, ensuring all forms are included and correctly filled out.

- In-Person Filing: Debtors may also choose to file documents in person at the courthouse, which allows for immediate confirmation of receipt.

Quick guide on how to complete chapter 13 plan alabama 497295910

Generate Chapter 13 Plan Alabama effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly replacement for old-fashioned printed and signed papers, as you can locate the needed form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, amend, and electronically sign your documents quickly without delays. Handle Chapter 13 Plan Alabama on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest way to amend and electronically sign Chapter 13 Plan Alabama with ease

- Obtain Chapter 13 Plan Alabama and click on Get Form to begin.

- Use the tools we provide to fill in your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional hand-signed signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Amend and electronically sign Chapter 13 Plan Alabama and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 Plan in Alabama?

A Chapter 13 Plan in Alabama is a legal option that allows individuals to reorganize their debts and repay them over a specified period, typically three to five years. This plan helps protect your assets while you regain financial stability. Understanding the details of a Chapter 13 plan is essential for making informed decisions about your financial future.

-

How much does it cost to file a Chapter 13 Plan in Alabama?

The costs associated with filing a Chapter 13 Plan in Alabama can vary based on several factors, including attorney fees and court costs. Generally, there is a filing fee of around $310, and legal fees can range from $2,500 to $5,000 depending on the complexity of your case. It's important to discuss these costs upfront with your attorney for transparent budgeting.

-

What are the benefits of filing a Chapter 13 Plan in Alabama?

Filing a Chapter 13 Plan in Alabama allows individuals to keep their property while repaying debts through a structured payment plan. Additionally, it provides protection from creditors and stops wage garnishments. This plan is a valuable option for those looking to manage their debts effectively without liquidating assets.

-

How long does a Chapter 13 Plan last in Alabama?

In Alabama, a Chapter 13 Plan typically lasts between three to five years. The duration depends on the debtor’s income level and the amount of debt owed. Completing the plan successfully can lead to the discharge of remaining unsecured debts, providing a fresh financial start.

-

Can I modify my Chapter 13 Plan in Alabama?

Yes, you can modify your Chapter 13 Plan in Alabama if changes in your financial situation occur. Modifications can help adjust payment amounts or timelines, ensuring the plan remains manageable. It's advisable to consult your attorney to navigate this process effectively and ensure compliance with court requirements.

-

What types of debts can be included in a Chapter 13 Plan in Alabama?

A Chapter 13 Plan in Alabama can include various types of debts such as credit card bills, medical bills, and personal loans. However, certain debts like alimony and child support must be paid in full outside of the plan. Knowing what debts are eligible can help you streamline your repayment strategy.

-

Are there income requirements for a Chapter 13 Plan in Alabama?

Yes, to qualify for a Chapter 13 Plan in Alabama, you must have a regular income that is sufficient to cover your proposed payment plan. This requirement ensures that you can meet your obligations while undergoing the debt reorganization process. Discussing income levels with your attorney is crucial for determining eligibility.

Get more for Chapter 13 Plan Alabama

- Mortgage holder form

- Partial release of property from mortgage for corporation new jersey form

- Partial release of property from mortgage by individual holder new jersey form

- Nj discrimination form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy new jersey form

- Warranty deed for parents to child with reservation of life estate new jersey form

- Warranty deed for separate or joint property to joint tenancy new jersey form

- Warranty deed to separate property of one spouse to both spouses as joint tenants new jersey form

Find out other Chapter 13 Plan Alabama

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online