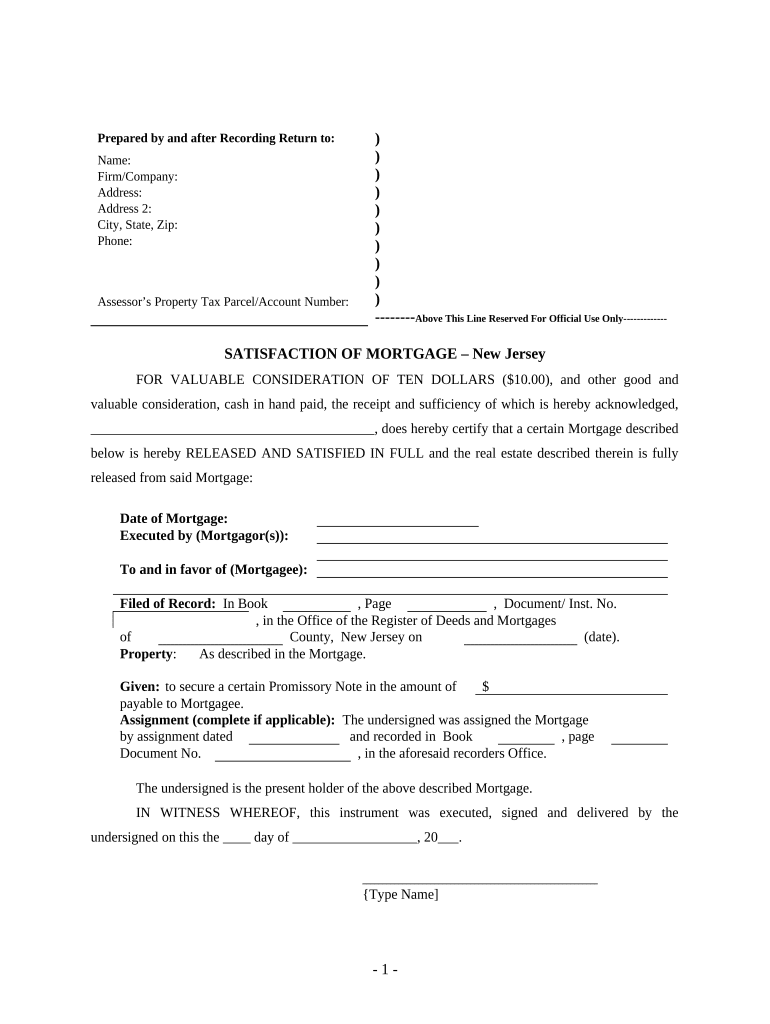

Mortgage Holder Form

What is the mortgage holder?

The mortgage holder is the individual or entity that owns the mortgage loan on a property. This can include banks, credit unions, or private lenders. The mortgage holder has the right to collect payments from the borrower and, in the event of default, can initiate foreclosure proceedings. Understanding the role of the mortgage holder is crucial for homeowners, as it affects their financial obligations and rights regarding the property.

Key elements of the mortgage holder

Several key elements define the mortgage holder's role:

- Ownership of the Loan: The mortgage holder owns the loan and has the legal right to enforce the terms of the mortgage agreement.

- Payment Collection: The mortgage holder is responsible for collecting monthly payments from the borrower, which typically include principal and interest.

- Foreclosure Rights: If the borrower fails to make payments, the mortgage holder has the right to foreclose on the property to recover the outstanding debt.

- Loan Servicing: The mortgage holder may also service the loan, managing payment processing and customer service for the borrower.

Steps to complete the mortgage holder form

Completing the mortgage holder form involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary information, including personal details, property address, and loan information.

- Fill Out the Form: Carefully fill in the mortgage holder form, ensuring all fields are completed accurately.

- Review for Accuracy: Double-check the information provided to avoid errors that could delay processing.

- Sign the Form: Use a reliable eSignature tool to sign the form digitally, ensuring it meets legal requirements.

- Submit the Form: Follow the submission guidelines, whether online, by mail, or in person, as specified by the mortgage holder.

Legal use of the mortgage holder

The legal use of the mortgage holder form is governed by various regulations that ensure its validity. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, which establish that eSignatures hold the same legal weight as traditional handwritten signatures. For the mortgage holder form to be legally binding, it must comply with these regulations, ensuring that both the signer and the process meet the necessary legal standards.

State-specific rules for the mortgage holder

Each state in the U.S. may have specific rules and regulations regarding mortgage holders. These can include variations in foreclosure processes, required disclosures, and consumer protections. It is essential for borrowers to understand their state's laws to ensure compliance and protect their rights. Consulting with a legal professional or a real estate expert can provide valuable insights into state-specific requirements.

Examples of using the mortgage holder

Practical examples of using the mortgage holder form include:

- Refinancing: Homeowners may need to complete the mortgage holder form when refinancing their existing mortgage to secure better terms.

- Transfer of Ownership: When a property is sold, the mortgage holder form may be required to transfer the mortgage obligations to the new owner.

- Loan Modification: Borrowers seeking to modify their loan terms may need to submit this form to their mortgage holder for approval.

Quick guide on how to complete mortgage holder

Effortlessly Prepare Mortgage Holder on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Mortgage Holder on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Mortgage Holder with Ease

- Obtain Mortgage Holder and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign Mortgage Holder while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit a mortgage holder?

airSlate SignNow is an electronic signature solution that enables mortgage holders to send, sign, and manage documents easily. With its user-friendly interface, a mortgage holder can streamline the signing process, ensuring faster transactions and improved client satisfaction. This can ultimately lead to quicker loan approvals and enhanced efficiency.

-

What pricing plans does airSlate SignNow offer for mortgage holders?

airSlate SignNow provides several pricing plans tailored to fit the needs of mortgage holders, including individual and business options. Each plan offers various features, making it easy for mortgage holders to choose one that suits their budget and document management requirements. Users can also benefit from a free trial to evaluate the service before committing.

-

Can airSlate SignNow integrate with other software commonly used by mortgage holders?

Yes, airSlate SignNow integrates seamlessly with several platforms frequently utilized by mortgage holders, such as CRM systems, document management software, and financial services applications. This integration allows mortgage holders to streamline their workflow, reducing the need for manual data entry and enhancing overall productivity. By connecting various tools, mortgage holders can maintain better oversight of their document processes.

-

Is airSlate SignNow secure for mortgage holders' sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and access controls, ensuring that all documents handled by mortgage holders are secure. This commitment to security helps protect sensitive client information, making it a reliable choice for professionals in the mortgage industry who prioritize confidentiality and compliance.

-

How does airSlate SignNow improve the efficiency of mortgage holders?

airSlate SignNow enhances efficiency for mortgage holders by streamlining the document signing process. With features like templates, bulk sending, and automatic notifications, mortgage holders can reduce turnaround times and eliminate bottlenecks. This efficiency leads to quicker closings and a more satisfying experience for both agents and clients.

-

What features make airSlate SignNow ideal for mortgage holders?

Key features of airSlate SignNow that appeal to mortgage holders include customizable templates, real-time tracking, and powerful mobile functionality. These tools allow mortgage holders to manage and execute documents seamlessly, regardless of their location. Such features can signNowly improve collaboration and expedite the signing process.

-

Can airSlate SignNow help mortgage holders manage their documents after signing?

Yes, airSlate SignNow offers robust document management capabilities that assist mortgage holders in organizing and storing signed documents securely. This functionality allows users to easily retrieve important documents when needed, ensuring compliance and reducing the risk of lost paperwork. Effective document management is crucial for any mortgage holder looking to maintain order in their operations.

Get more for Mortgage Holder

- Imnovid pomalidomide prescription authorisation form paf

- Nhti registrar form

- Equipment demonstration and test agreement form

- Tempus unlimited application form

- Pea river electric application form

- Notice of intention to impose claim on security deposit the florida bar form

- Independent caregiver caregiver contract template form

- Independent consultants contract template form

Find out other Mortgage Holder

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later