Alabama Installments Fixed Rate Promissory Note Secured by Residential Real Estate Alabama Form

What is the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

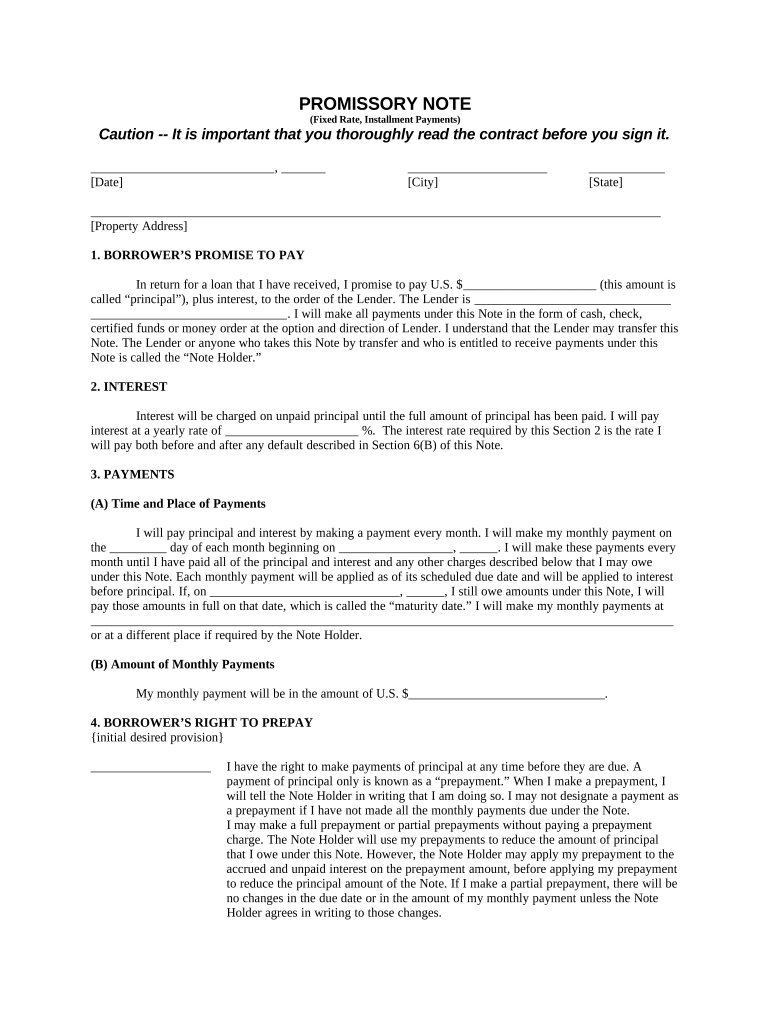

The Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by real estate in Alabama. This promissory note specifies the borrower's promise to repay the loan amount in fixed installments over a predetermined period. It is secured by the residential property, meaning that if the borrower defaults, the lender has the right to take possession of the property to recover the owed amount. This type of note is commonly used in real estate transactions, providing clarity and protection for both the lender and borrower.

Key Elements of the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

Several key elements are essential in the Alabama Installments Fixed Rate Promissory Note. These include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Payment Schedule: Details on how often payments are due, typically monthly.

- Term Length: The duration over which the loan will be repaid.

- Collateral Description: A detailed description of the residential real estate securing the loan.

- Default Terms: Conditions under which the borrower may be considered in default.

Steps to Complete the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

Completing the Alabama Installments Fixed Rate Promissory Note involves several important steps:

- Gather Information: Collect all necessary details, including borrower and lender information, property details, and loan terms.

- Fill Out the Form: Accurately complete the promissory note, ensuring all fields are filled in correctly.

- Review Terms: Both parties should review the terms of the note to ensure mutual understanding and agreement.

- Sign the Document: Both the borrower and lender must sign the document, which can be done digitally for convenience.

- Secure Copies: Each party should retain a copy of the signed promissory note for their records.

Legal Use of the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

The Alabama Installments Fixed Rate Promissory Note is legally binding when executed according to state laws. It must include all necessary elements to be enforceable in a court of law. Compliance with the Uniform Commercial Code (UCC) and local regulations is crucial for ensuring the document's validity. Additionally, both parties should ensure that the document is signed in the presence of a notary public if required, to further enhance its legal standing.

How to Obtain the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

Obtaining the Alabama Installments Fixed Rate Promissory Note can be done through various means. Many legal websites and document preparation services offer templates that can be customized to meet specific needs. Additionally, consulting with a real estate attorney can provide guidance and ensure that the document complies with all legal requirements. It is essential to ensure that any template used is up-to-date and reflective of current Alabama laws.

State-Specific Rules for the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

Alabama has specific rules governing promissory notes that must be adhered to. These include requirements for interest rates, which must comply with state usury laws, and stipulations regarding the execution and notarization of the document. Additionally, Alabama law may require certain disclosures to be made to the borrower, ensuring transparency in the lending process. Understanding these state-specific rules is crucial for both lenders and borrowers to avoid legal complications.

Quick guide on how to complete alabama installments fixed rate promissory note secured by residential real estate alabama

Manage Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama smoothly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama effortlessly

- Obtain Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details thoroughly and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama and maintain effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama?

An Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama is a legal document that outlines the repayment terms of a loan secured by residential real estate. This type of promissory note specifies a fixed interest rate and creates a clear repayment schedule, which is essential for both lenders and borrowers.

-

How does an Alabama Installments Fixed Rate Promissory Note benefit borrowers?

Borrowers benefit from an Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama as it provides predictable monthly payments. This clarity makes budgeting easier and ensures that borrowers understand their financial obligations over the repayment period.

-

What are the key features of the Alabama Installments Fixed Rate Promissory Note?

Key features include a fixed interest rate, a specified repayment schedule, and secure documentation of the loan transaction. These elements make the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama a reliable option for both parties involved.

-

What pricing options are available for using airSlate SignNow with Alabama Installments Fixed Rate Promissory Note?

airSlate SignNow offers a variety of pricing plans that cater to different business needs when creating and managing Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama. You can choose a plan that fits your budget and access the features required to streamline document signing and eSigning processes.

-

Is it possible to integrate airSlate SignNow with other applications for Alabama Installments Fixed Rate Promissory Note?

Yes, airSlate SignNow allows for various integrations with popular applications, enhancing the usability of the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama. This makes it easy for businesses to incorporate signing and management of documents within their existing workflows.

-

How does airSlate SignNow ensure the security of my Alabama Installments Fixed Rate Promissory Note?

airSlate SignNow prioritizes security through encryption and secure access controls for documents like the Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama. This ensures that sensitive information is protected throughout the document lifecycle.

-

What should I consider when drafting an Alabama Installments Fixed Rate Promissory Note?

When drafting an Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama, consider the loan amount, interest rate, repayment terms, and any relevant local laws. Consulting with a legal professional can also ensure that your document is compliant and protects your interests.

Get more for Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

- Durable power of attorney for health care and living will nevada form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497320861 form

- Nv annual form

- Notices resolutions simple stock ledger and certificate nevada form

- Minutes for organizational meeting nevada nevada form

- Nevada sample letter form

- Nevada civil file form

- Nevada case form

Find out other Alabama Installments Fixed Rate Promissory Note Secured By Residential Real Estate Alabama

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter