Partial Release of Property from Mortgage by Individual Holder Alabama Form

Understanding the Partial Release of Property from Mortgage

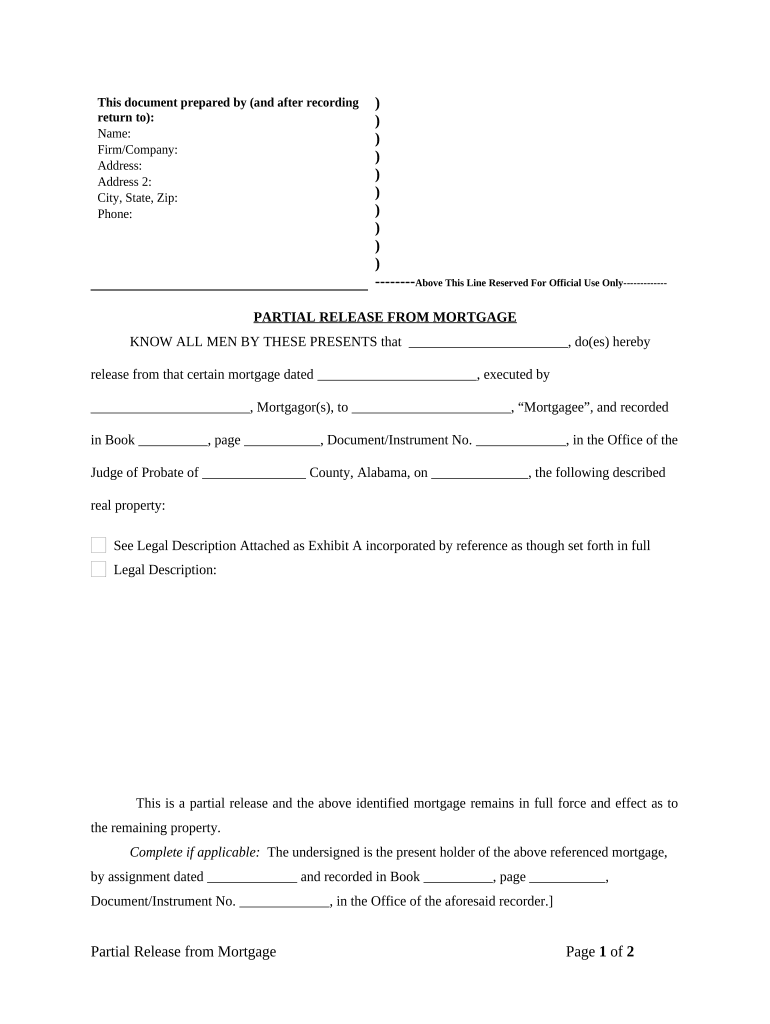

The partial release of property from mortgage allows a borrower to remove a portion of their property from the mortgage agreement. This process is often utilized when a borrower sells a part of their mortgaged property or wishes to release a specific parcel while retaining the remaining property under the original mortgage. In the context of Alabama, this legal document must meet specific requirements to be valid and enforceable.

Steps to Complete the Partial Release of Property from Mortgage

Completing the partial release of property from mortgage involves several important steps:

- Gather necessary information: Collect all relevant details regarding the mortgage, including the original loan agreement and property descriptions.

- Prepare the document: Draft the partial release form, ensuring it includes all required information such as the legal description of the property being released.

- Obtain signatures: Ensure that all necessary parties, including the mortgage holder, sign the document. Electronic signatures can be used if compliant with applicable laws.

- File the document: Submit the completed form to the appropriate county office for recording. This step is critical for the release to be legally recognized.

Key Elements of the Partial Release of Property from Mortgage

When creating a partial release of mortgage, certain key elements must be included to ensure its legality:

- Property description: A clear and accurate description of the property being released is essential.

- Borrower and lender information: Include the names and addresses of both the borrower and the lender.

- Signature lines: Ensure there are designated areas for all required signatures, including witnesses if necessary.

- Notarization: Depending on state laws, notarization may be required to validate the document.

Legal Use of the Partial Release of Property from Mortgage

The legal use of a partial release of mortgage is primarily to facilitate the sale or transfer of a portion of the property while maintaining the mortgage on the remaining property. This document must comply with state-specific laws to ensure it is enforceable in Alabama. Proper execution and recording of the document are crucial to protect the rights of all parties involved.

Obtaining the Partial Release of Property from Mortgage

To obtain a partial release of property from mortgage, borrowers typically need to request it from their lender. This request can often be initiated through a formal letter or by contacting the lender directly. It is advisable to provide all relevant information about the mortgage and the specific property to be released. Once the lender approves the request, they will provide the necessary documentation to be completed and recorded.

State-Specific Rules for the Partial Release of Property from Mortgage

In Alabama, specific rules govern the partial release of mortgage. These may include requirements regarding the format of the document, necessary signatures, and filing procedures. It is essential for borrowers to familiarize themselves with these regulations to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide clarity on state-specific requirements and help navigate the process effectively.

Quick guide on how to complete partial release of property from mortgage by individual holder alabama

Complete Partial Release Of Property From Mortgage By Individual Holder Alabama effortlessly on any device

Online document management has grown in popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly and without hindrances. Manage Partial Release Of Property From Mortgage By Individual Holder Alabama on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Partial Release Of Property From Mortgage By Individual Holder Alabama seamlessly

- Find Partial Release Of Property From Mortgage By Individual Holder Alabama and click Get Form to begin.

- Use the tools we offer to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Partial Release Of Property From Mortgage By Individual Holder Alabama while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a partial release of mortgage?

A partial release of mortgage is a legal document that allows homeowners to remove a portion of their property from the lien of a mortgage. This typically occurs when a homeowner has sold part of their property or wishes to refinance a specific section. Understanding the implications of a partial release of mortgage is essential for effective property management.

-

How does airSlate SignNow facilitate the process of a partial release of mortgage?

airSlate SignNow streamlines the process of a partial release of mortgage by enabling users to easily create, send, and sign necessary documents electronically. With our user-friendly interface, parties involved can simplify the paperwork and ensure timely execution. This helps avoid delays that can occur with traditional methods of handling documentation.

-

What are the benefits of using airSlate SignNow for managing a partial release of mortgage?

Using airSlate SignNow for a partial release of mortgage offers numerous benefits, including increased efficiency and reduced costs. Our platform provides secure document storage and tracking features, ensuring that all stakeholders have access to the most current versions of documents. Plus, our electronic signatures provide legal validity, making the process seamless.

-

Are there any costs associated with processing a partial release of mortgage using airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow, but they are designed to be cost-effective compared to traditional methods. Our pricing plans are flexible, and users can select the features they need for processing a partial release of mortgage. This allows businesses to manage their expenses while still benefiting from advanced document management solutions.

-

What features does airSlate SignNow offer for a partial release of mortgage?

airSlate SignNow offers a variety of features tailored for the partial release of mortgage, including document templates, secure cloud storage, and electronic signature capabilities. These features make it easier to generate and customize documents quickly, automatically send reminders, and track the status of signatures. This enhances the overall efficiency of the mortgage process.

-

Can airSlate SignNow integrate with other software for partial release of mortgage?

Yes, airSlate SignNow seamlessly integrates with various third-party software to enhance your workflow surrounding a partial release of mortgage. This includes customer relationship management (CRM) systems and cloud storage services, allowing for a more comprehensive document management approach. Integration reduces manual entry, improving accuracy and efficiency.

-

Is electronic signing valid for a partial release of mortgage?

Yes, electronic signing through airSlate SignNow is legally valid for a partial release of mortgage in accordance with the ESIGN Act and UETA. This means that parties can sign documents electronically without the need for physical paperwork, facilitating a faster and more convenient process. This legal validity provides confidence to all stakeholders involved.

Get more for Partial Release Of Property From Mortgage By Individual Holder Alabama

- Legal last will and testament form for married person with adult and minor children new york

- Mutual wills package with last wills and testaments for married couple with adult and minor children new york form

- New york widow form

- Legal last will and testament form for widow or widower with minor children new york

- Form widower 497322042

- Ny last will testament form

- Legal last will and testament form for divorced and remarried person with mine yours and ours children new york

- Last will testament 497322045 form

Find out other Partial Release Of Property From Mortgage By Individual Holder Alabama

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online