Release of Lien Corporation or LLC Arkansas Form

What is the Release Of Lien Corporation Or LLC Arkansas

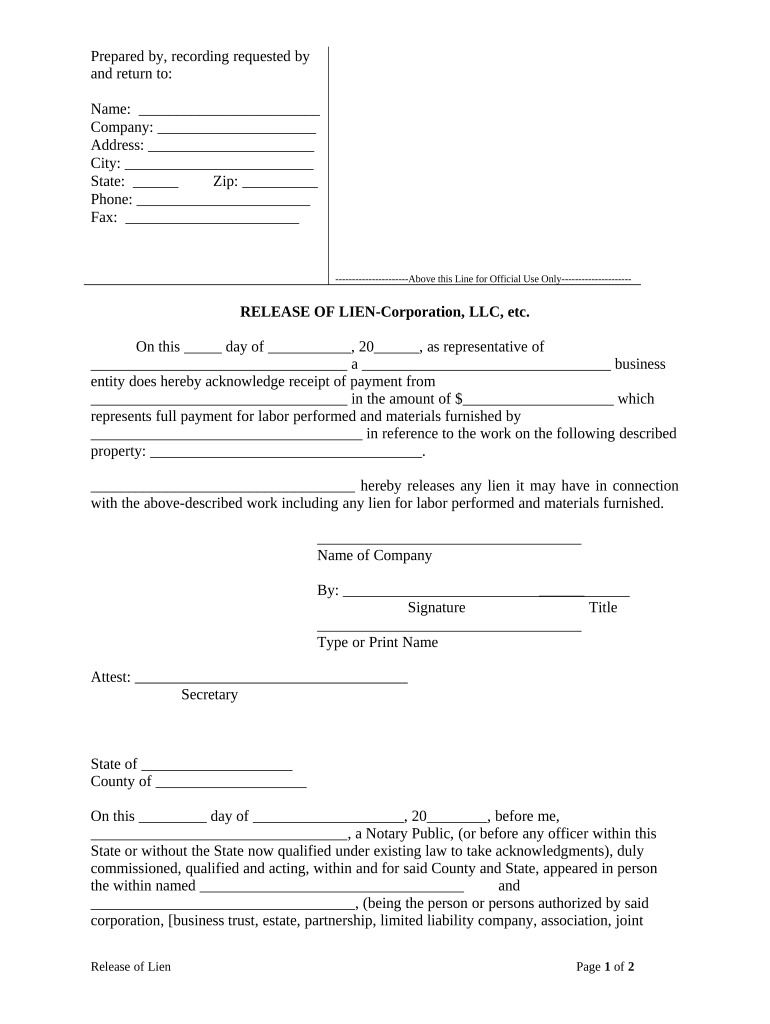

The Release Of Lien Corporation Or LLC Arkansas is a legal document that formally removes a lien placed on a corporation or limited liability company (LLC) in the state of Arkansas. A lien is a legal claim against an asset, often used as security for a debt. When the debt is satisfied, the lien must be released to clear the title of the property or asset. This document is essential for businesses looking to maintain a clear financial standing and ensure that their assets are free from encumbrances.

Steps to Complete the Release Of Lien Corporation Or LLC Arkansas

Completing the Release Of Lien Corporation Or LLC Arkansas involves several key steps:

- Gather necessary information about the lien, including the original lien document, the debtor's details, and the creditor's information.

- Obtain the appropriate form for the release of lien from the Arkansas Secretary of State or relevant authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the document in accordance with Arkansas law, which may require notarization.

- Submit the completed form to the appropriate office, either online or by mail, along with any required fees.

Legal Use of the Release Of Lien Corporation Or LLC Arkansas

The legal use of the Release Of Lien Corporation Or LLC Arkansas is crucial for ensuring compliance with state laws. This document serves as proof that a lien has been officially removed, which is important for both the debtor and creditor. It protects the rights of the debtor by clearing their title, allowing them to sell or refinance their property without complications. Additionally, it provides legal protection for creditors by formally documenting the satisfaction of the debt.

State-Specific Rules for the Release Of Lien Corporation Or LLC Arkansas

In Arkansas, specific rules govern the Release Of Lien for corporations and LLCs. These rules include the requirement for the form to be signed by the lienholder or their authorized representative. Notarization may be necessary to validate the document. Additionally, the release must be filed with the appropriate state office to be effective. Understanding these state-specific rules is essential for ensuring that the release is legally binding and recognized by all parties involved.

How to Obtain the Release Of Lien Corporation Or LLC Arkansas

To obtain the Release Of Lien Corporation Or LLC Arkansas, individuals can visit the Arkansas Secretary of State's website or office. The form is typically available for download or can be requested directly from the office. It is important to ensure that the correct version of the form is used, as there may be variations based on the type of lien or entity involved.

Required Documents

When preparing to file the Release Of Lien Corporation Or LLC Arkansas, several documents may be required:

- The original lien document, which details the terms of the lien.

- Identification of the lienholder and the debtor, including names and addresses.

- Proof of satisfaction of the debt, such as payment receipts or a settlement agreement.

- The completed release form itself, filled out accurately.

Quick guide on how to complete release of lien corporation or llc arkansas

Effortlessly prepare Release Of Lien Corporation Or LLC Arkansas on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without any delays. Handle Release Of Lien Corporation Or LLC Arkansas on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Release Of Lien Corporation Or LLC Arkansas with ease

- Find Release Of Lien Corporation Or LLC Arkansas and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Release Of Lien Corporation Or LLC Arkansas while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Release Of Lien Corporation Or LLC in Arkansas?

A Release Of Lien Corporation Or LLC in Arkansas is a legal document that signifies the removal of a lien against property owned by a corporation or LLC. This process typically involves obtaining a release from the creditor and filing the necessary paperwork with the state. Ensuring this document is properly filed is crucial for protecting your business's financial standing.

-

How can airSlate SignNow help in preparing a Release Of Lien Corporation Or LLC in Arkansas?

airSlate SignNow offers an easy-to-use platform for preparing and signing vital documents like the Release Of Lien Corporation Or LLC in Arkansas. Our features allow you to create, edit, and send documents quickly, ensuring compliance and accuracy every step of the way. With airSlate SignNow, you can streamline this process and avoid potential legal issues.

-

What are the costs associated with using airSlate SignNow for a Release Of Lien Corporation Or LLC in Arkansas?

airSlate SignNow provides cost-effective solutions tailored for businesses, including options for managing the Release Of Lien Corporation Or LLC in Arkansas. Our pricing plans are competitive, allowing companies to choose based on their needs without breaking the bank. Additionally, you can take advantage of our free trial to see how our services meet your requirements before committing.

-

What features does airSlate SignNow offer for managing the Release Of Lien Corporation Or LLC in Arkansas?

Our platform includes advanced features like document templates, e-signatures, and audit trails specifically for the Release Of Lien Corporation Or LLC in Arkansas. These tools help ensure that your documents are secure and compliant with state regulations. Furthermore, you can manage all your documents in one organized space, saving time and enhancing productivity.

-

How secure is airSlate SignNow when handling documents like a Release Of Lien Corporation Or LLC in Arkansas?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption protocols to protect your documents, including the Release Of Lien Corporation Or LLC in Arkansas. Our platform also provides secure sharing options and stringent access controls to safeguard sensitive business information.

-

Can I integrate airSlate SignNow with other tools for processing a Release Of Lien Corporation Or LLC in Arkansas?

Yes, airSlate SignNow supports integration with various third-party applications to enhance your workflow. Whether you're using project management tools or CRM systems, our platform can seamlessly connect with them to facilitate the processing of the Release Of Lien Corporation Or LLC in Arkansas. This integration streamlines your business operations and enhances efficiency.

-

What are the benefits of using airSlate SignNow for my business regarding the Release Of Lien Corporation Or LLC in Arkansas?

Using airSlate SignNow for the Release Of Lien Corporation Or LLC in Arkansas provides numerous benefits, such as increased efficiency and reduced paperwork. Our platform simplifies the signing process, enabling faster turnaround times. In addition, you’re able to track document status in real-time, ensuring that your corporation or LLC remains compliant with legal obligations.

Get more for Release Of Lien Corporation Or LLC Arkansas

- Letter from tenant to landlord about sexual harassment oregon form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children oregon form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure oregon form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497323675 form

- Oregon return form

- Oregon letter 497323677 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497323678 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497323679 form

Find out other Release Of Lien Corporation Or LLC Arkansas

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure