Non Foreign Affidavit under IRC 1445 Arkansas Form

What is the Non Foreign Affidavit Under IRC 1445 Arkansas

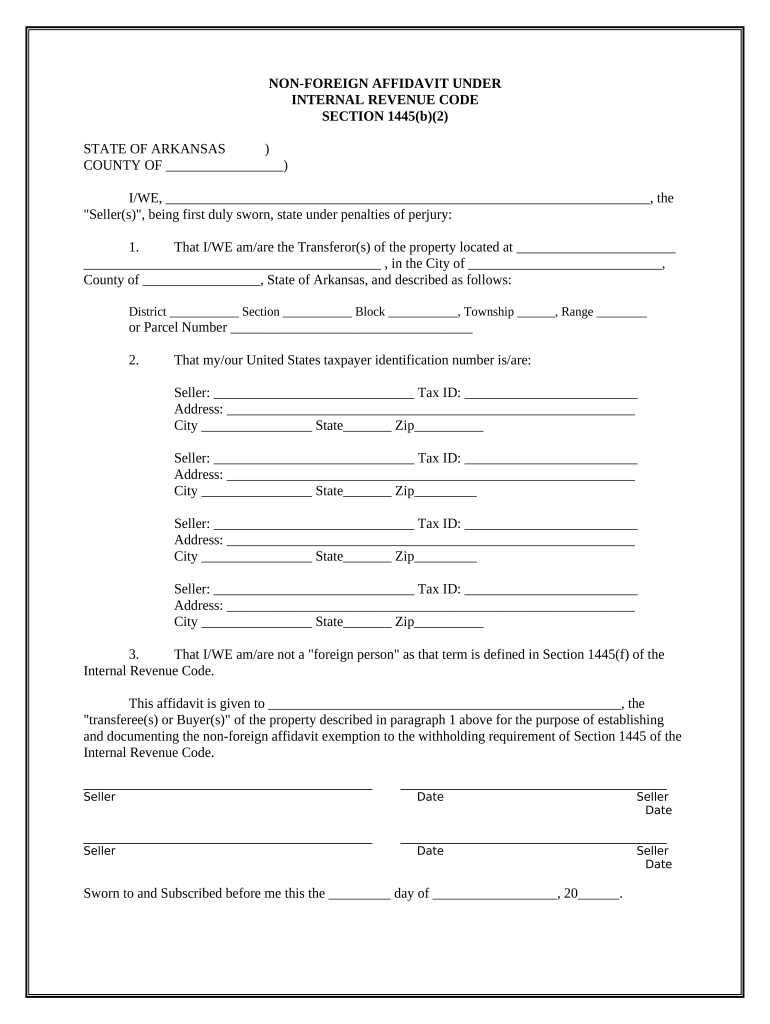

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Arkansas to certify that a seller of real property is not a foreign person. This affidavit is crucial for tax purposes, particularly in the context of the Foreign Investment in Real Property Tax Act (FIRPTA). By completing this affidavit, the seller ensures that the buyer is not required to withhold taxes on the sale of the property, as would be the case if the seller were a foreign entity. This form is essential for both parties involved in the transaction to comply with federal tax regulations.

How to Use the Non Foreign Affidavit Under IRC 1445 Arkansas

Using the Non Foreign Affidavit Under IRC 1445 involves several key steps. First, the seller must accurately fill out the form, providing necessary information such as their name, address, and tax identification number. Next, the seller must sign the affidavit in the presence of a notary public to validate the document. Once completed, the affidavit should be provided to the buyer, who will retain it for their records and may need to submit it to the IRS as part of their tax filings. Proper use of this affidavit helps facilitate a smooth real estate transaction and ensures compliance with tax laws.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Arkansas

Completing the Non Foreign Affidavit Under IRC 1445 requires careful attention to detail. Follow these steps:

- Obtain the affidavit form from a reliable source, such as a legal professional or real estate agent.

- Fill in your personal information, including your full name, address, and taxpayer identification number.

- Indicate that you are not a foreign person by checking the appropriate box or providing a statement.

- Sign the affidavit in front of a notary public to ensure its legality.

- Provide the completed affidavit to the buyer for their records.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Arkansas

The Non Foreign Affidavit Under IRC 1445 contains several key elements that must be included for it to be valid. These elements include:

- Seller's Information: Full name, address, and taxpayer identification number.

- Certification Statement: A declaration that the seller is not a foreign person.

- Signature: The seller's signature, which must be notarized.

- Date: The date on which the affidavit is signed.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Arkansas

The legal use of the Non Foreign Affidavit Under IRC 1445 is critical in real estate transactions. This affidavit serves as a protective measure for buyers, ensuring they are not held liable for withholding taxes on the sale of property. It also provides sellers with a clear declaration of their tax status, which can facilitate smoother transactions. When used correctly, the affidavit helps both parties comply with federal tax regulations and avoid potential penalties associated with non-compliance.

Required Documents for the Non Foreign Affidavit Under IRC 1445 Arkansas

To complete the Non Foreign Affidavit Under IRC 1445, certain documents may be required. These typically include:

- A valid form of identification, such as a driver's license or passport.

- Proof of residency, which may include utility bills or bank statements.

- Any prior tax documents that may be relevant to the transaction.

Quick guide on how to complete non foreign affidavit under irc 1445 arkansas

Prepare Non Foreign Affidavit Under IRC 1445 Arkansas seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Non Foreign Affidavit Under IRC 1445 Arkansas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Arkansas effortlessly

- Obtain Non Foreign Affidavit Under IRC 1445 Arkansas and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authenticity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few simple clicks from any device you prefer. Edit and eSign Non Foreign Affidavit Under IRC 1445 Arkansas and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in Arkansas?

A Non Foreign Affidavit Under IRC 1445 in Arkansas is a legal document that certifies a seller's foreign status for tax purposes during the sale of real estate. It ensures that the seller is not subject to withholding tax under U.S. tax regulations. This affidavit is crucial for buyers to avoid unnecessary tax complications.

-

How can airSlate SignNow help with Non Foreign Affidavit Under IRC 1445 in Arkansas?

airSlate SignNow provides an efficient platform for preparing, signing, and managing Non Foreign Affidavit Under IRC 1445 documents in Arkansas. With our easy-to-use interface, you can create and send these affidavits for eSignature quickly. This streamlines the entire process, making compliance easier for all parties involved.

-

What are the pricing options available for using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 in Arkansas?

airSlate SignNow offers competitive pricing plans tailored to meet varying business needs for handling Non Foreign Affidavit Under IRC 1445 in Arkansas. You can choose from monthly and annual subscription options, allowing flexibility based on your usage. Our pricing is transparent and costs-effective, making it accessible for businesses of all sizes.

-

Is airSlate SignNow secure for signing Non Foreign Affidavit Under IRC 1445 in Arkansas?

Yes, airSlate SignNow is committed to providing a secure platform for all document transactions, including Non Foreign Affidavit Under IRC 1445 in Arkansas. We utilize bank-grade encryption and follow strict data privacy regulations to protect your information. You can trust that your documents are safe with us.

-

Can I integrate airSlate SignNow with other tools for managing Non Foreign Affidavit Under IRC 1445 in Arkansas?

Absolutely! airSlate SignNow offers integrations with various popular tools and platforms that enhance the management of Non Foreign Affidavit Under IRC 1445 in Arkansas. Whether you use CRM systems, cloud storage, or project management tools, our API facilitates seamless connections that improve workflow efficiency.

-

What features does airSlate SignNow provide for Non Foreign Affidavit Under IRC 1445 in Arkansas?

airSlate SignNow offers features specifically designed to simplify the handling of Non Foreign Affidavit Under IRC 1445 in Arkansas. Some of these include customizable templates, advanced eSignature options, and real-time tracking of document status. These features ensure you have everything you need to manage your documents efficiently.

-

How fast can I get a Non Foreign Affidavit Under IRC 1445 in Arkansas signed using airSlate SignNow?

With airSlate SignNow, you can expect quick turnaround times for signing your Non Foreign Affidavit Under IRC 1445 in Arkansas. The online eSigning process is designed for speed, often enabling documents to be signed in a matter of minutes. This efficiency helps you meet deadlines without delay.

Get more for Non Foreign Affidavit Under IRC 1445 Arkansas

- Check bad form 497313914

- Ms trust form

- Mississippi certificate trust form

- Mutual wills containing last will and testaments for man and woman living together not married with no children mississippi form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children mississippi form

- Mutual wills or last will and testaments for man and woman living together not married with minor children mississippi form

- Non marital cohabitation living together agreement mississippi form

- Paternity case package establishment of paternity mississippi form

Find out other Non Foreign Affidavit Under IRC 1445 Arkansas

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU