Living Trust for Husband and Wife with No Children Arkansas Form

What is the Living Trust For Husband And Wife With No Children Arkansas

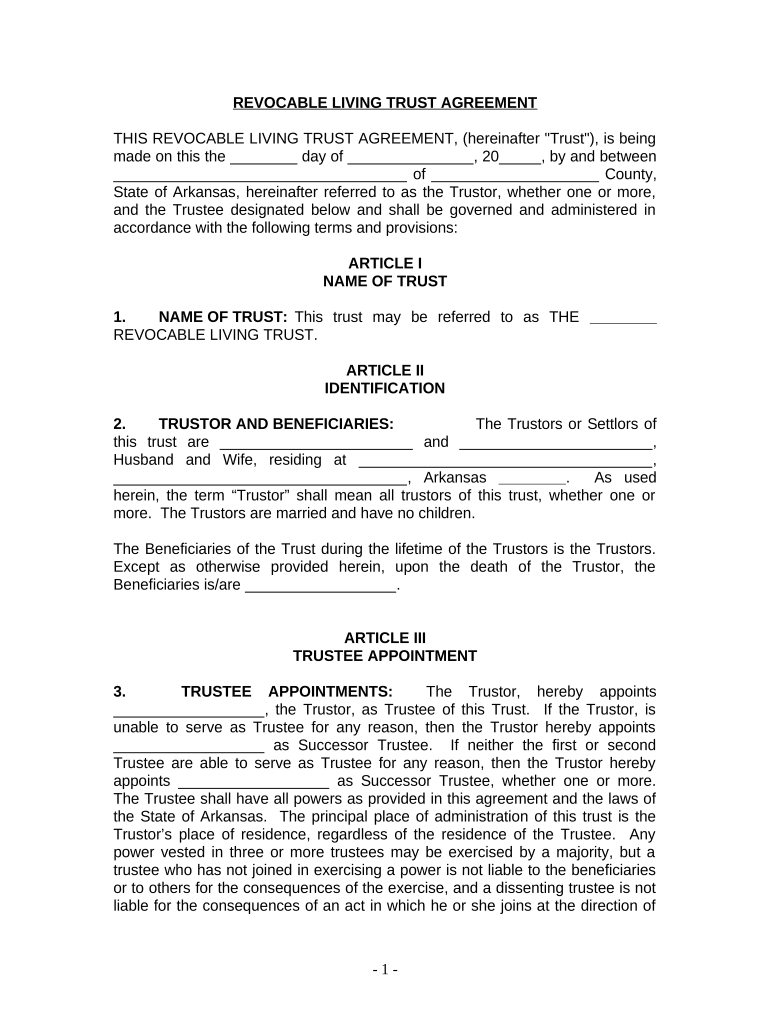

A living trust for husband and wife with no children in Arkansas is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after death. This type of trust can simplify the estate planning process, avoiding probate and ensuring that the couple's wishes are honored. It serves as a flexible tool for asset management, allowing the couple to retain control while providing for the future distribution of their estate.

Key Elements of the Living Trust For Husband And Wife With No Children Arkansas

Several key elements characterize a living trust for husband and wife with no children in Arkansas:

- Grantors: The couple creating the trust is known as the grantors. They retain control over the assets placed in the trust.

- Trustee: The couple can serve as trustees, managing the trust assets, or appoint a third party.

- Beneficiaries: Typically, the surviving spouse is the primary beneficiary, receiving all assets upon the death of the other spouse.

- Revocability: This trust can be altered or revoked by the grantors at any time during their lifetime.

Steps to Complete the Living Trust For Husband And Wife With No Children Arkansas

Completing a living trust for husband and wife with no children in Arkansas involves several steps:

- Consult an attorney: It is advisable to seek legal guidance to ensure compliance with state laws.

- Draft the trust document: Outline the terms of the trust, including asset management and distribution plans.

- Fund the trust: Transfer ownership of assets into the trust, which may include real estate, bank accounts, and investments.

- Sign the document: Both spouses must sign the trust document in the presence of a notary public to validate it.

Legal Use of the Living Trust For Husband And Wife With No Children Arkansas

The legal use of a living trust for husband and wife with no children in Arkansas allows couples to manage their estate efficiently. This trust can help avoid probate, which can be a lengthy and costly process. Additionally, it provides privacy since the trust does not become part of the public record upon the death of the grantors. The trust can also specify conditions for asset distribution, ensuring that the couple's wishes are followed precisely.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Arkansas

In Arkansas, specific rules govern the establishment and execution of living trusts. These include:

- Notarization: The trust document must be signed in front of a notary public to be legally binding.

- Asset Transfer: Properly transferring assets into the trust is crucial for its effectiveness.

- Tax Implications: Couples should understand any tax implications associated with their trust and consult a tax professional if necessary.

How to Obtain the Living Trust For Husband And Wife With No Children Arkansas

Obtaining a living trust for husband and wife with no children in Arkansas typically involves working with an estate planning attorney. They can provide customized documents that meet the couple's specific needs. Alternatively, couples may use reputable online legal services that offer templates for living trusts, ensuring compliance with Arkansas laws. It's important to ensure that any chosen method adheres to state regulations to avoid complications in the future.

Quick guide on how to complete living trust for husband and wife with no children arkansas

Prepare Living Trust For Husband And Wife With No Children Arkansas effortlessly on any gadget

Online document administration has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With No Children Arkansas on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Living Trust For Husband And Wife With No Children Arkansas without hassle

- Find Living Trust For Husband And Wife With No Children Arkansas and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Modify and eSign Living Trust For Husband And Wife With No Children Arkansas and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Arkansas?

A Living Trust For Husband And Wife With No Children in Arkansas is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be handled after their passing. This type of trust can help in avoiding probate and offers privacy for couples without children. It's designed to make the estate planning process smoother and more efficient.

-

What are the benefits of setting up a Living Trust For Husband And Wife With No Children in Arkansas?

Setting up a Living Trust For Husband And Wife With No Children in Arkansas allows couples to maintain control over their assets while ensuring a streamlined transfer of those assets after their death. Benefits include avoiding probate, protecting privacy, and potentially reducing estate taxes. It provides peace of mind that assets will be distributed according to their wishes.

-

How much does it cost to create a Living Trust For Husband And Wife With No Children in Arkansas?

The cost of creating a Living Trust For Husband And Wife With No Children in Arkansas can vary signNowly depending on the complexity of the estate and whether legal assistance is utilized. On average, legal fees may range from several hundred to a few thousand dollars. It’s advisable to compare services to find a solution that meets your budget.

-

Are there any specific requirements for creating a Living Trust For Husband And Wife With No Children in Arkansas?

To create a Living Trust For Husband And Wife With No Children in Arkansas, both spouses must be of legal age and have the mental capacity to engage in this legal agreement. The trust must be properly funded with assets and comply with Arkansas state laws. Consulting with an attorney can ensure that all legal requirements are met.

-

Can I modify a Living Trust For Husband And Wife With No Children in Arkansas?

Yes, a Living Trust For Husband And Wife With No Children in Arkansas is revocable, meaning you can modify the terms as needed during your lifetime. Changes can be made to adjust beneficiaries, trustees, and any other components of the trust. It's important to document any amendments properly to keep the trust valid.

-

How does a Living Trust For Husband And Wife With No Children in Arkansas affect taxes?

A Living Trust For Husband And Wife With No Children in Arkansas typically does not affect personal income taxes during the couple's lifetime, as it is treated as a revocable trust. However, upon the death of the surviving spouse, certain estate taxes may apply. Consulting with a tax advisor can provide clarity based on individual circumstances and estate value.

-

What happens to a Living Trust For Husband And Wife With No Children in Arkansas after the death of one spouse?

After the death of one spouse, the Living Trust For Husband And Wife With No Children in Arkansas continues to operate, with the surviving spouse retaining control of the assets. The trust remains unaffected, as it is revocable and can manage the distribution of assets according to the couple's wishes. Importantly, it helps avoid probate for the deceased spouse's share.

Get more for Living Trust For Husband And Wife With No Children Arkansas

- Letter from landlord to tenant returning security deposit less deductions rhode island form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return rhode island form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return rhode island form

- Letter from tenant to landlord containing request for permission to sublease rhode island form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages rhode form

- Rhode island tenant 497325139 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable rhode island form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration rhode form

Find out other Living Trust For Husband And Wife With No Children Arkansas

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation