Accounting for Personal Representative Arkansas Form

What is the Accounting For Personal Representative Arkansas

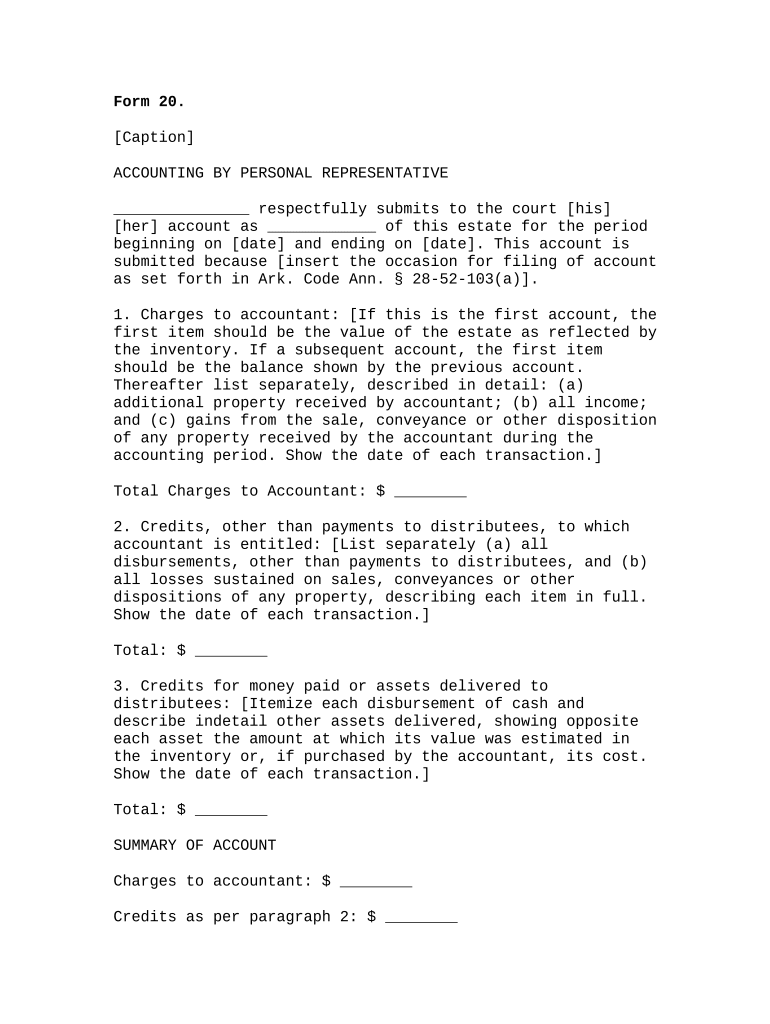

The Accounting For Personal Representative Arkansas is a legal document used by personal representatives to report the financial activities related to the estate of a deceased individual. This form outlines the income, expenses, and distributions made during the administration of the estate. It serves as a transparent record for beneficiaries and the court, ensuring that all financial dealings are properly documented and accounted for. Understanding this form is crucial for personal representatives, as it helps maintain compliance with state laws and protects the interests of all parties involved.

How to use the Accounting For Personal Representative Arkansas

Using the Accounting For Personal Representative Arkansas involves several key steps. First, the personal representative must gather all financial records related to the estate, including bank statements, receipts, and invoices. Next, they should accurately compile this information into the form, detailing all income received and expenses incurred during the estate administration. Once completed, the form must be submitted to the appropriate court and shared with beneficiaries to provide transparency regarding the estate's financial status.

Steps to complete the Accounting For Personal Representative Arkansas

Completing the Accounting For Personal Representative Arkansas requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including bank statements and receipts.

- List all income received by the estate, such as rental income or dividends.

- Document all expenses incurred, including funeral costs, taxes, and administrative fees.

- Calculate the total income and total expenses to determine the net balance.

- Prepare the form by entering all information in the designated sections.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the court and provide copies to all beneficiaries.

Legal use of the Accounting For Personal Representative Arkansas

The legal use of the Accounting For Personal Representative Arkansas is essential for ensuring compliance with state probate laws. This form must be filed with the court overseeing the estate to provide a clear account of the financial activities conducted by the personal representative. Failure to properly complete and submit this form can result in legal consequences, including potential penalties or challenges from beneficiaries. It is important for personal representatives to understand their responsibilities and ensure that the form is used correctly to uphold their fiduciary duties.

State-specific rules for the Accounting For Personal Representative Arkansas

Each state has specific rules governing the use of the Accounting For Personal Representative Arkansas. In Arkansas, personal representatives must adhere to the state's probate code, which outlines the requirements for reporting estate finances. This includes deadlines for submission, required documentation, and the format of the accounting. Personal representatives should familiarize themselves with these regulations to ensure compliance and avoid any legal issues during the estate administration process.

Required Documents

To complete the Accounting For Personal Representative Arkansas, several key documents are required. These include:

- Bank statements reflecting estate accounts.

- Receipts for all expenses incurred during the estate administration.

- Records of income received by the estate, such as rental agreements or investment statements.

- Any court orders or documents related to the probate process.

Gathering these documents beforehand will facilitate a smoother completion of the accounting form.

Quick guide on how to complete accounting for personal representative arkansas

Effortlessly Prepare Accounting For Personal Representative Arkansas on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Accounting For Personal Representative Arkansas on any device with the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

Edit and Electronically Sign Accounting For Personal Representative Arkansas with Ease

- Get Form to begin.

- Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Done button to save your changes.

Say goodbye to lost or misplaced files, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Accounting For Personal Representative Arkansas to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'Accounting For Personal Representative Arkansas'?

'Accounting For Personal Representative Arkansas' refers to the financial management practices specific to individuals serving as personal representatives in Arkansas. This includes handling estate funds, managing debts, and ensuring proper distribution of assets according to Arkansas laws. Understanding these practices is essential for compliance and effective estate management.

-

How does airSlate SignNow support 'Accounting For Personal Representative Arkansas'?

airSlate SignNow supports 'Accounting For Personal Representative Arkansas' by providing an easy-to-use platform for digital document signing and management. Personal representatives can quickly send, receive, and eSign essential financial documents, ensuring timely compliance with state regulations. This streamlines the accounting process and reduces the risk of errors.

-

What are the pricing plans for airSlate SignNow regarding personal representative accounting needs?

airSlate SignNow offers several pricing plans to accommodate various needs, including those of personal representatives engaged in 'Accounting For Personal Representative Arkansas.' These plans are designed to provide cost-effective solutions, and potential users can choose a plan that fits their budget and feature requirements for efficient document management.

-

What features does airSlate SignNow offer for estate accounting in Arkansas?

The features of airSlate SignNow that cater to 'Accounting For Personal Representative Arkansas' include customizable templates, secure document storage, and automated workflows. These tools help personal representatives simplify and expedite their document management processes, ensuring accurate record-keeping and compliance with Arkansas law.

-

Can airSlate SignNow integrate with accounting software used by personal representatives?

Yes, airSlate SignNow can integrate with various accounting software often used by personal representatives for 'Accounting For Personal Representative Arkansas.' This integration allows users to synchronize their documents seamlessly with their accounting tools, optimizing workflow efficiency and maintaining accurate financial records.

-

What benefits does using airSlate SignNow provide to personal representatives in Arkansas?

Using airSlate SignNow provides numerous benefits for personal representatives involved in 'Accounting For Personal Representative Arkansas,' such as enhanced document security, faster turnaround times, and reduced paperwork. These advantages enable personal representatives to focus more on managing estates efficiently rather than on cumbersome administrative tasks.

-

Is airSlate SignNow easy to use for first-time users handling estate accounts?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible even for first-time users handling 'Accounting For Personal Representative Arkansas.' Comprehensive tutorials and customer support are available to assist users in navigating the platform effectively.

Get more for Accounting For Personal Representative Arkansas

Find out other Accounting For Personal Representative Arkansas

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast