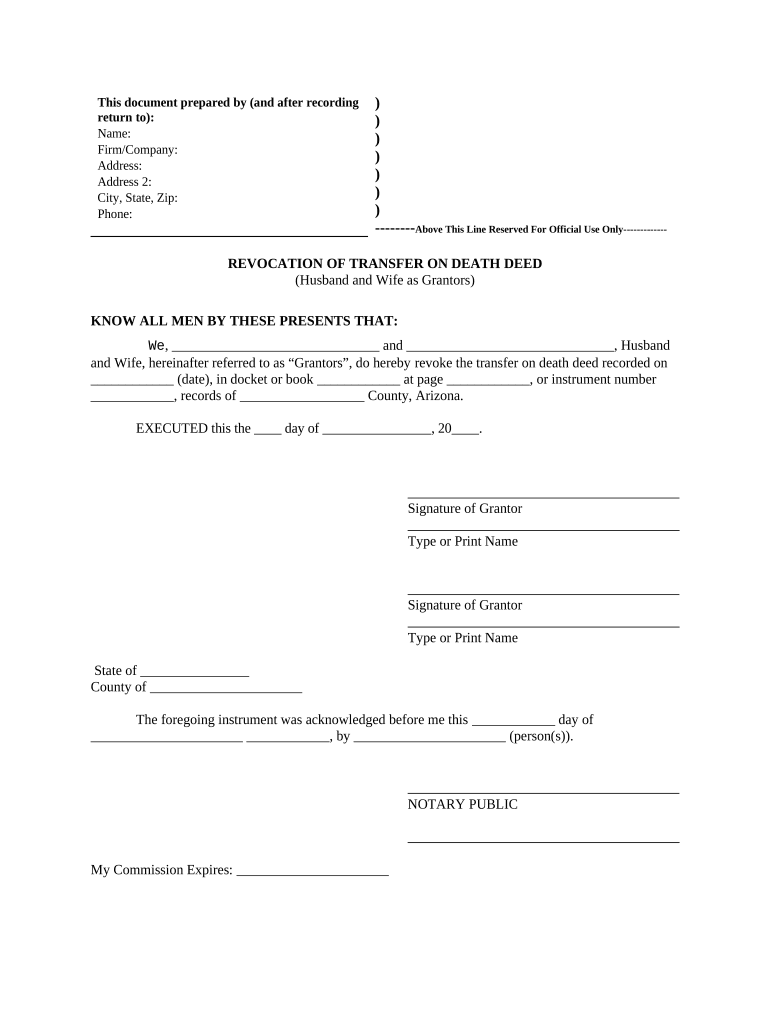

Revocation of Transfer on Death Deed or TOD Beneficiary Deed for Husband and Wife Grantors Arizona Form

Understanding the Wisconsin Transfer on Death Deed

The Wisconsin transfer on death deed is a legal instrument that allows an individual to transfer real estate to a beneficiary upon their death without the need for probate. This deed is particularly useful for estate planning, as it simplifies the transfer process and can help avoid lengthy legal procedures. It is essential for property owners in Wisconsin to understand how this deed works and its implications for their estate.

Key Elements of the Wisconsin Transfer on Death Deed

Several key elements define the Wisconsin transfer on death deed. First, it must clearly identify the property being transferred, including a legal description. Second, the grantor must designate one or more beneficiaries who will receive the property upon their death. Additionally, the deed must be signed by the grantor in the presence of a notary public. Finally, the deed must be recorded with the appropriate county register of deeds to be effective.

Steps to Complete the Wisconsin Transfer on Death Deed

Completing a Wisconsin transfer on death deed involves several straightforward steps:

- Obtain a blank transfer on death deed form, which can typically be found online or through legal resources.

- Fill out the form, ensuring all required information is accurate, including the property description and beneficiary details.

- Sign the deed in the presence of a notary public to validate the document.

- Record the completed deed with the county register of deeds where the property is located.

Legal Use of the Wisconsin Transfer on Death Deed

The legal use of the Wisconsin transfer on death deed is governed by specific state laws. This deed allows property owners to retain full control over their property during their lifetime, with the transfer occurring automatically upon death. It is crucial to ensure that the deed complies with Wisconsin statutes to avoid challenges or disputes among heirs. Consulting with a legal professional can provide guidance on proper execution and compliance.

State-Specific Rules for the Wisconsin Transfer on Death Deed

Wisconsin has specific rules regarding the transfer on death deed that must be followed. For instance, the deed must be executed by the property owner and witnessed by a notary public. Additionally, the deed must be recorded within a certain timeframe to be valid. Understanding these state-specific rules is vital for ensuring that the transfer on death deed is legally binding and effective.

Examples of Using the Wisconsin Transfer on Death Deed

Using a Wisconsin transfer on death deed can be beneficial in various scenarios. For example, a property owner may wish to transfer their home to their children upon their passing without the complications of probate. Another example includes transferring investment properties to a spouse or partner. These examples illustrate how the transfer on death deed can facilitate a smooth transition of property ownership while minimizing legal hurdles.

Quick guide on how to complete revocation of transfer on death deed or tod beneficiary deed for husband and wife grantors arizona

Effortlessly Prepare Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the proper template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without complications. Manage Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

Steps to Modify and eSign Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona with Ease

- Obtain Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona and select Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed of revocation sample?

A deed of revocation sample is a template document used to formally revoke a previous agreement or action. This sample ensures that all necessary legal language is present, making it easier to communicate your intent to revoke. Using a deed of revocation sample can streamline the process and minimize potential disputes.

-

How can I use airSlate SignNow to create my deed of revocation sample?

With airSlate SignNow, you can easily create a deed of revocation sample by using our intuitive document editor. Simply choose the template, customize it to fit your requirements, and add eSignatures for all parties involved. This hassle-free process makes it simple to manage important documents securely and efficiently.

-

Is there a cost associated with using a deed of revocation sample on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to customizable templates like the deed of revocation sample. Our plans are designed to be cost-effective while providing all the necessary features for document management and electronic signatures. Start with a free trial to explore our offerings.

-

What features does airSlate SignNow provide for managing a deed of revocation sample?

AirSlate SignNow provides features like document templates, customizable fields, eSignature capabilities, and real-time tracking for your deed of revocation sample. These features simplify the process of sending, signing, and managing important documents securely. You can also collaborate with team members to ensure accuracy.

-

Can I integrate airSlate SignNow with other software while using a deed of revocation sample?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for documents like the deed of revocation sample. Integrations with platforms such as Google Drive and Salesforce allow for streamlined processes and improved efficiency. This flexibility ensures you can manage documents within your existing system.

-

What are the benefits of using airSlate SignNow for my deed of revocation sample?

Using airSlate SignNow for your deed of revocation sample offers convenience, legal compliance, and improved turnaround times for document execution. The platform allows you to create, send, and track documents easily, ensuring that revocations are processed quickly and accurately. Additionally, eSigning saves time and costs compared to traditional methods.

-

Is my information secure when using a deed of revocation sample with airSlate SignNow?

Yes, airSlate SignNow prioritizes user security and employs high-level encryption protocols to protect your information when using a deed of revocation sample. The platform complies with industry standards and regulations, ensuring that your documents are kept safe and confidential. You can trust our solution for your document management needs.

Get more for Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona

- Commercial lot land form

- Earnest money form contract

- Counterproposal to contract for the sale and purchase of real estate form

- Exchange addendum to contract tax free exchange section 1031 form

- Amend real estate form

- Commercial real estate form

- Bill sale tractor 497328450 form

- Can i respond to a request for domestic violence d form

Find out other Revocation Of Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife Grantors Arizona

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile