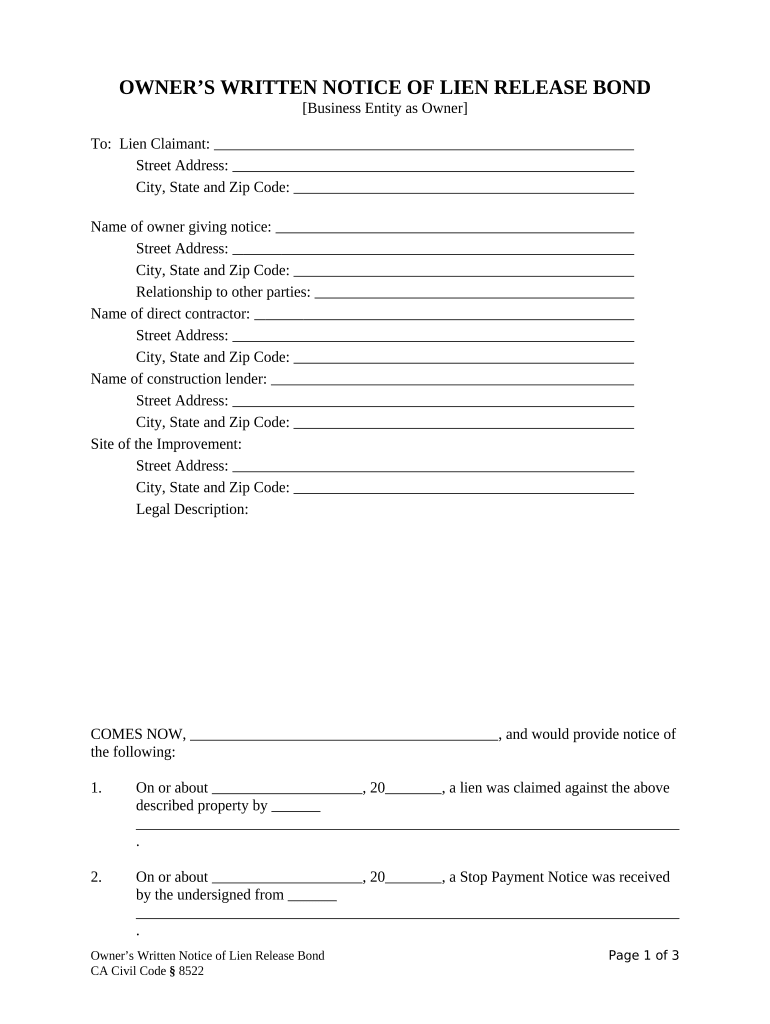

Ca Owner Llc Form

What is the Ca Owner LLC

The Ca Owner LLC is a specific legal structure that allows individuals to establish a limited liability company in California. This form provides owners with personal liability protection while allowing for flexible management and tax options. By forming a Ca Owner LLC, individuals can separate their personal assets from their business liabilities, which is crucial for risk management. This structure is particularly popular among small business owners and entrepreneurs seeking to operate in a more secure legal environment.

Steps to complete the Ca Owner LLC

Completing the Ca Owner LLC involves several key steps to ensure compliance with state regulations. Here’s a structured approach:

- Choose a name: The name must be unique and comply with California naming requirements for LLCs.

- Designate a registered agent: This individual or business entity will receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit this form to the California Secretary of State, along with the required filing fee.

- Create an Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on the business type, additional permits may be required at the local, state, or federal level.

Legal use of the Ca Owner LLC

The legal use of the Ca Owner LLC is primarily to protect owners from personal liability for business debts and obligations. This means that if the LLC faces legal issues or financial troubles, the personal assets of the owners are generally safeguarded. Additionally, the LLC structure allows for pass-through taxation, meaning profits and losses can be reported on the owners' personal tax returns, avoiding double taxation. Compliance with state regulations is essential to maintain the legal protections offered by this structure.

How to obtain the Ca Owner LLC

Obtaining a Ca Owner LLC requires following a series of steps that align with California state laws. First, you need to decide on a unique name for your LLC that adheres to state guidelines. Next, you will need to file the Articles of Organization with the California Secretary of State. This document officially registers your LLC and includes essential information such as the business name, address, and registered agent details. After filing, you may need to obtain an Employer Identification Number (EIN) from the IRS for tax purposes. Finally, consider drafting an Operating Agreement to clarify the management structure and ownership rights within the LLC.

Key elements of the Ca Owner LLC

Several key elements define the Ca Owner LLC structure, which include:

- Limited liability protection: Owners are not personally liable for business debts.

- Flexible management: Owners can manage the LLC directly or appoint managers.

- Pass-through taxation: Income is taxed at the individual level, avoiding corporate taxes.

- Compliance requirements: Annual filings and fees must be maintained to keep the LLC in good standing.

State-specific rules for the Ca Owner LLC

California has specific rules governing the formation and operation of LLCs. These include the requirement to file Articles of Organization with the Secretary of State, pay an initial filing fee, and comply with ongoing obligations such as submitting biennial Statements of Information. Additionally, California imposes an annual minimum franchise tax on LLCs, regardless of income. Understanding these state-specific rules is crucial for maintaining compliance and ensuring the LLC operates smoothly.

Quick guide on how to complete ca owner llc

Complete Ca Owner Llc effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Ca Owner Llc on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to modify and electronically sign Ca Owner Llc effortlessly

- Obtain Ca Owner Llc and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or the need to print new document copies due to errors. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Ca Owner Llc for enhanced communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA owner LLC and why should I consider one?

A CA owner LLC is a limited liability company formed in California where the owner protects personal assets from business liabilities. This structure is ideal for entrepreneurs seeking flexibility and protection in their business operations. By choosing a CA owner LLC, you can enjoy tax benefits and enhanced credibility.

-

How much does it cost to create a CA owner LLC?

The cost to create a CA owner LLC varies depending on filing fees, service fees, and potential legal costs. Typically, you can expect initial fees around $70 to $100 for filing with the state of California. Additional costs may include annual franchise taxes and ongoing compliance fees which vary based on revenue.

-

What key features does airSlate SignNow offer for managing a CA owner LLC?

airSlate SignNow provides essential features for managing a CA owner LLC, including secure eSigning, document templates, and audit trails. These tools streamline the signing process, ensuring that all documents are signed legally and securely. Moreover, our platform simplifies compliance, which is crucial for maintaining your LLC status.

-

Can I integrate airSlate SignNow with other tools for my CA owner LLC?

Yes, airSlate SignNow offers robust integrations with various business tools such as CRMs, Google Workspace, and Microsoft Office. These integrations allow you to enhance workflow efficiency, making it easy to manage documents related to your CA owner LLC. Connecting your favorite apps means you can automate processes, saving time and reducing manual tasks.

-

What advantages does using airSlate SignNow provide for a CA owner LLC?

Using airSlate SignNow for your CA owner LLC provides numerous advantages, including time-saving eSigning processes and increased document security. Our platform is user-friendly, ensuring that even those unfamiliar with technology can navigate it with ease. Furthermore, electronically signed documents hold up in court, protecting your business interests.

-

How does airSlate SignNow ensure the security of documents for my CA owner LLC?

airSlate SignNow is committed to document security by employing advanced encryption and secure storage protocols. Our platform adheres to industry standards to protect sensitive information for your CA owner LLC, ensuring that only authorized parties can access the documents. This level of security fosters trust and confidence in your business transactions.

-

Is airSlate SignNow suitable for all types of businesses operating as CA owner LLCs?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including startups and established enterprises operating as CA owner LLCs. The platform's flexibility and scalability make it an ideal choice for varied business needs, accommodating everything from individual entrepreneurs to larger team collaborations.

Get more for Ca Owner Llc

Find out other Ca Owner Llc

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement