Ca Deed Trust Form

What is the CA Deed Trust

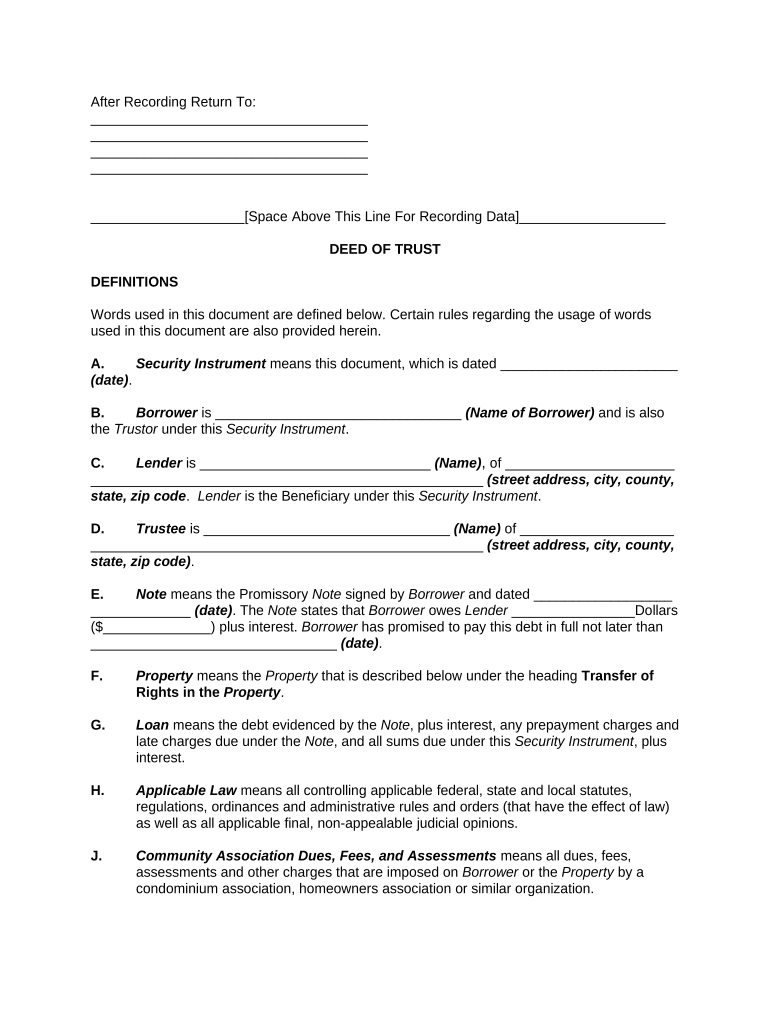

The CA deed trust is a legal document used in California to establish a trust for real estate properties. This form outlines the relationship between the trustor, trustee, and beneficiaries. The trustor is the individual who creates the trust, while the trustee manages the trust's assets on behalf of the beneficiaries. This type of deed trust is often utilized for estate planning, allowing individuals to transfer property ownership without going through probate, thus simplifying the process of asset distribution after death.

How to Use the CA Deed Trust

Using the CA deed trust involves several steps to ensure that the trust is set up correctly and legally binding. First, the trustor must clearly define the terms of the trust, including the property involved and the beneficiaries. Next, the trustor should complete the CA deed trust form, ensuring that all required information is accurate. Once completed, the trustor must sign the document in front of a notary public to validate it. Finally, the deed trust should be recorded with the county recorder's office to make it official and enforceable.

Steps to Complete the CA Deed Trust

Completing the CA deed trust form requires careful attention to detail. Follow these steps:

- Identify the property to be placed in the trust.

- Gather necessary information about the trustor, trustee, and beneficiaries.

- Fill out the CA deed trust form, ensuring all sections are completed.

- Sign the form in the presence of a notary public.

- Submit the signed form to the county recorder's office for official recording.

Key Elements of the CA Deed Trust

Several key elements must be included in the CA deed trust to ensure its validity:

- The names and addresses of the trustor, trustee, and beneficiaries.

- A detailed description of the property being transferred into the trust.

- The terms of the trust, including how the property will be managed and distributed.

- Signatures of the trustor and trustee, along with a notary's acknowledgment.

Legal Use of the CA Deed Trust

The CA deed trust is legally recognized in California, provided it complies with state laws regarding trusts and property transfers. It serves as a tool for estate planning, allowing individuals to manage their assets during their lifetime and dictate how those assets will be handled after their death. Proper execution and recording of the deed trust are essential to ensure that it is enforceable in a court of law.

Examples of Using the CA Deed Trust

Common scenarios for utilizing the CA deed trust include:

- Transferring a family home into a trust to avoid probate.

- Establishing a trust for minor children to manage their inheritance.

- Creating a revocable living trust to maintain control over assets while providing for beneficiaries.

Required Documents

To complete the CA deed trust, certain documents are necessary:

- Proof of ownership of the property, such as a title deed.

- Identification for the trustor and trustee, typically a driver's license or passport.

- Any existing estate planning documents that may affect the trust.

Quick guide on how to complete ca deed trust

Complete Ca Deed Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Ca Deed Trust on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ca Deed Trust effortlessly

- Obtain Ca Deed Trust and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Ca Deed Trust and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA Deed Trust?

A CA deed trust is a legal document that facilitates the transfer of real estate while providing security for a loan. It involves three parties: the borrower, the lender, and the trustee. Understanding this structure is essential for smooth transactions and ensuring legal compliance.

-

How does airSlate SignNow simplify the process of managing CA Deed Trust documents?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign CA deed trust documents efficiently. By utilizing customizable templates, you can streamline the entire signing process. This reduces turnaround time and enhances compliance with legal standards.

-

What features does airSlate SignNow provide for CA Deed Trust documentation?

With airSlate SignNow, you get features such as customizable templates, automated workflows, and secure document storage specifically for CA deed trust documents. Additionally, real-time tracking and analytics help you monitor the signing process, ensuring everything is recorded accurately.

-

Is pricing for using airSlate SignNow competitive for CA Deed Trust forms?

Yes, airSlate SignNow offers competitive pricing tailored to the needs of businesses handling CA deed trust forms. Various subscription plans are available, enabling you to choose what best fits your usage and budget. Cost-effectiveness combined with functionality makes it an excellent choice.

-

What are the benefits of using airSlate SignNow for CA Deed Trust transactions?

Using airSlate SignNow for CA deed trust transactions enhances efficiency and reliability. The platform ensures documents are securely handled and provides multiple eSignature options to suit user preferences. This not only speeds up transactions but also improves client satisfaction.

-

Can airSlate SignNow integrate with other software for managing CA Deed Trusts?

Absolutely, airSlate SignNow can seamlessly integrate with various third-party applications, allowing for a holistic approach to managing CA deed trust documents. By connecting tools like CRM systems or document management software, you can enhance efficiency in your workflow.

-

What security measures are in place for CA Deed Trust documents on airSlate SignNow?

Security is a priority with airSlate SignNow, especially for sensitive documents like CA deed trusts. The platform employs encryption, secure cloud storage, and compliance with industry standards to protect your data. This ensures that your CA deed trust documents are safe from unauthorized access.

Get more for Ca Deed Trust

Find out other Ca Deed Trust

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free