Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller California Form

What is the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

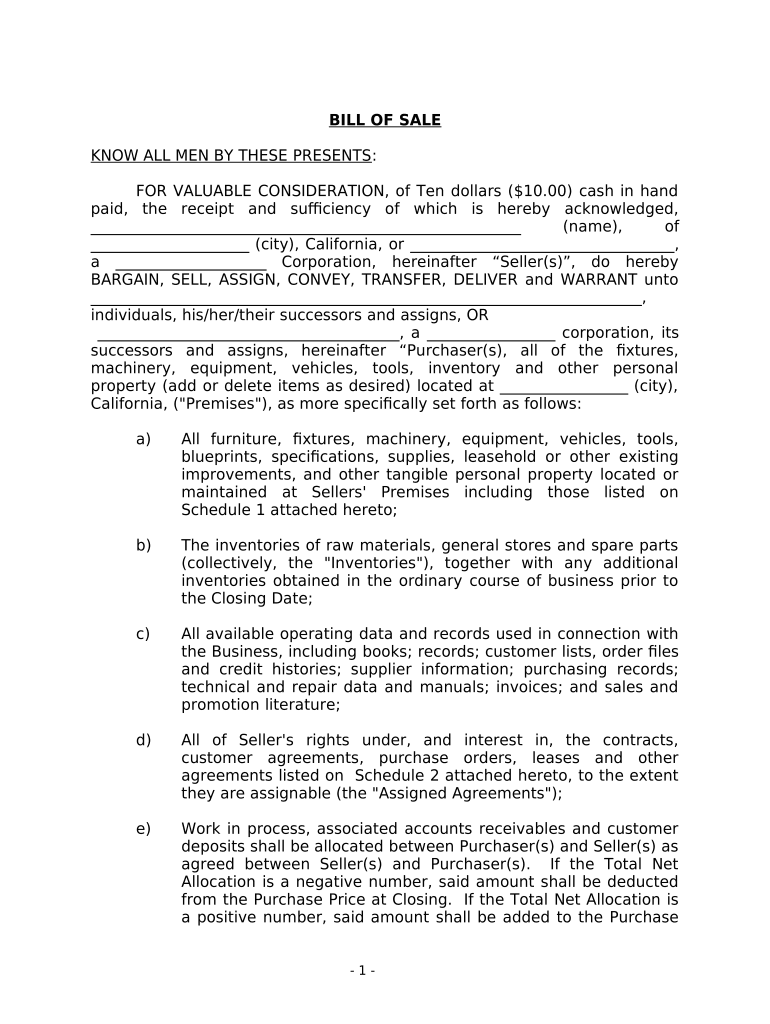

The Bill of Sale in connection with the sale of a business by an individual or corporate seller in California is a legal document that facilitates the transfer of ownership of a business. This document outlines the terms of the sale, including the purchase price, the assets being transferred, and any liabilities that may be assumed by the buyer. It serves as proof of the transaction and is essential for both parties to ensure clarity and legal protection. This form is particularly important in California, where specific laws govern business transactions, making it crucial for sellers and buyers to adhere to these regulations.

Key elements of the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

Several key elements must be included in the Bill of Sale to ensure its validity and effectiveness. These elements typically include:

- Identification of the parties: Full names and addresses of both the seller and buyer.

- Description of the business: A detailed description of the business being sold, including assets, inventory, and any included licenses.

- Purchase price: The total amount agreed upon for the sale, along with payment terms.

- Transfer of ownership: A clear statement that ownership is being transferred from the seller to the buyer.

- Signatures: Signatures of both parties, along with the date of signing, to validate the document.

Steps to complete the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

Completing the Bill of Sale involves several important steps to ensure that the document is legally binding and comprehensive. The steps include:

- Gather necessary information: Collect all relevant details about the business, including assets and liabilities.

- Draft the document: Use a template or create a customized Bill of Sale that includes all required elements.

- Review the document: Both parties should review the details to ensure accuracy and completeness.

- Sign the document: Both the seller and buyer must sign the Bill of Sale, ideally in the presence of a witness or notary.

- Distribute copies: Provide copies of the signed document to all parties involved for their records.

Legal use of the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

The legal use of the Bill of Sale in California is governed by state laws that dictate how business transactions should be conducted. To be legally binding, the document must meet specific requirements, including the inclusion of all necessary details and signatures. Additionally, it is advisable for both parties to retain copies of the Bill of Sale for their records, as it may be required for tax purposes or in the event of future disputes. Understanding and adhering to California’s legal framework is essential for ensuring that the transaction is valid and enforceable.

How to use the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

Using the Bill of Sale effectively involves understanding its purpose and the context in which it is utilized. Once the document is completed and signed, it serves as a formal record of the transaction and should be treated as a legal instrument. It is important for both the seller and buyer to understand their rights and obligations as outlined in the Bill of Sale. Additionally, the form may need to be filed with local government agencies or used in conjunction with other legal documents, such as transfer agreements or financial disclosures, to ensure a smooth transition of ownership.

State-specific rules for the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

California has specific rules and regulations that govern the use of a Bill of Sale in business transactions. These rules may include requirements for notarization, specific disclosures that must be made to the buyer, and compliance with local business laws. It is essential for both parties to familiarize themselves with these regulations to avoid potential legal issues. Consulting with a legal professional who specializes in business transactions can provide valuable guidance and ensure compliance with all state-specific requirements.

Quick guide on how to complete bill of sale in connection with sale of business by individual or corporate seller california

Easily set up Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California on any platform using airSlate SignNow's Android or iOS applications and simplify any document-focused task today.

How to change and electronically sign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California effortlessly

- Find Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to record your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California?

A Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California is a legal document that outlines the transfer of ownership for a business from one party to another. It details the sale terms, payment information, and descriptions of the assets involved, protecting both the buyer and seller during the transaction.

-

How can airSlate SignNow help with creating a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California?

airSlate SignNow provides an intuitive platform for generating and eSigning your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California. With customizable templates and integration features, you can quickly create documents that meet your specific business needs.

-

Is there a cost associated with generating a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California using airSlate SignNow?

Yes, using airSlate SignNow involves a subscription fee, which provides access to multiple features, including document creation and electronic signatures. The pricing plans are designed to be cost-effective for both individuals and businesses, ensuring you get great value while managing your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California.

-

What features does airSlate SignNow offer for Business Bill Of Sale documents?

airSlate SignNow offers features such as customizable templates, secure storage, eSignature capabilities, and audit trails to track changes. These features are essential for creating a solid Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California that is both legally compliant and efficient.

-

Can I integrate airSlate SignNow with other platforms for managing my Bills Of Sale?

Absolutely! airSlate SignNow integrates seamlessly with a range of platforms like Google Drive, Dropbox, and CRM systems. This allows for streamlined document management and easy access to your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California across various applications.

-

What are the benefits of using airSlate SignNow for my Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California?

Using airSlate SignNow streamlines the process of creating and signing your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California. It saves time, ensures compliance, and strengthens the security of your documents, providing peace of mind throughout the transaction process.

-

Is airSlate SignNow legally compliant for a Bill Of Sale In Connection With Sale Of Business?

Yes, airSlate SignNow is designed to comply with relevant eSignature laws, ensuring that your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California follows legal standards. This compliance helps protect your transaction's integrity and ensures enforceability in court if necessary.

Get more for Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

- Self employed technician contract form

- Professional services contract form

- Towing contract template form

- Self employed travel form

- Self employed tree surgeon services contract short form

- Self employed wait staff services contract form

- Services contract company form

- Self employed groundskeeper services contract form

Find out other Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller California

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online