Self Employed Technician Contract Form

What is the Self Employed Technician Contract

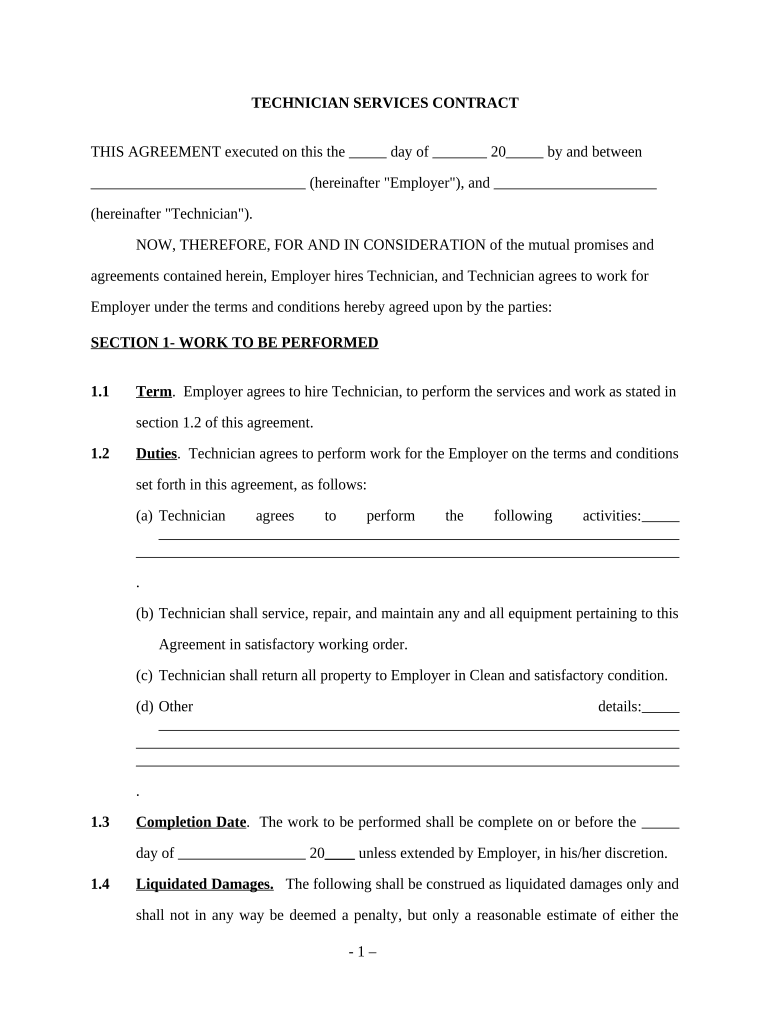

The self employed technician contract is a legal document that outlines the terms and conditions between a technician and a client or company. This contract is essential for defining the scope of work, payment terms, and responsibilities of both parties involved. It serves as a protective measure for technicians, ensuring they are compensated fairly for their services while also clarifying the expectations of the client. By establishing clear guidelines, the contract helps prevent misunderstandings and disputes, making it a vital tool for anyone working as a self-employed technician.

Key elements of the Self Employed Technician Contract

Several key elements are crucial for a self employed technician contract to be effective:

- Scope of Work: Clearly defines the services to be provided, including specific tasks and responsibilities.

- Payment Terms: Outlines how and when the technician will be compensated, including rates, invoicing procedures, and payment methods.

- Duration: Specifies the length of the contract, including start and end dates, and any conditions for renewal or termination.

- Confidentiality: Addresses the handling of sensitive information and trade secrets to protect both parties.

- Liability: Clarifies the responsibilities of each party regarding damages or losses incurred during the execution of work.

- Dispute Resolution: Provides a framework for resolving conflicts that may arise, including mediation or arbitration procedures.

Steps to complete the Self Employed Technician Contract

Completing a self employed technician contract involves several important steps:

- Identify the Parties: Clearly state the names and contact information of the technician and the client.

- Define the Scope of Work: Detail the services to be performed, including any specific tasks or deliverables.

- Set Payment Terms: Specify the payment structure, including rates and payment schedules.

- Include Legal Provisions: Add necessary clauses regarding confidentiality, liability, and dispute resolution.

- Review and Revise: Ensure both parties review the contract for clarity and completeness before finalizing.

- Sign the Contract: Both parties should sign and date the document, acknowledging their agreement to the terms.

Legal use of the Self Employed Technician Contract

To ensure the legal validity of the self employed technician contract, it must comply with relevant state and federal laws. This includes adhering to regulations regarding eSignatures, as electronic contracts can be legally binding if they meet specific criteria. It is important to use a reliable platform for signing and storing the contract to maintain its integrity and security. Additionally, both parties should retain copies of the signed contract for their records, as this can serve as evidence in case of disputes.

How to obtain the Self Employed Technician Contract

The self employed technician contract can be obtained through various means. Many online resources offer templates that can be customized to fit specific needs. Additionally, legal professionals can provide tailored contracts that address unique circumstances. When selecting a template or drafting a contract, it is important to ensure that it complies with local laws and includes all necessary elements to protect both parties involved.

Examples of using the Self Employed Technician Contract

There are numerous scenarios where a self employed technician contract is beneficial:

- A freelance IT technician providing services to a small business.

- A self-employed electrician contracted for residential repairs.

- A graphic designer working on a project basis for various clients.

- A consultant offering specialized services in a specific industry.

In each case, the contract serves to clarify expectations and protect the rights of both the technician and the client, ensuring a professional working relationship.

Quick guide on how to complete self employed technician contract

Effortlessly Prepare Self Employed Technician Contract on Any Device

Managing documents online has become a trend among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can access the necessary forms and securely store them online. airSlate SignNow supplies all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle Self Employed Technician Contract on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Self Employed Technician Contract with Ease

- Find Self Employed Technician Contract and click on Get Form to commence.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Self Employed Technician Contract and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employed technician contract?

A self employed technician contract is a legal document that outlines the terms of work between a self-employed technician and their client. This contract specifies the responsibilities, payment terms, and duration of the service, ensuring both parties understand their obligations. Using a self employed technician contract helps prevent misunderstandings and protects your rights as a technician.

-

How can airSlate SignNow help me with my self employed technician contract?

airSlate SignNow simplifies the process of preparing and signing a self employed technician contract. With our intuitive platform, you can easily create, customize, and send contracts to clients for electronic signatures. This streamlined workflow saves you time and ensures that your contracts are secure and legally binding.

-

What features does airSlate SignNow offer for managing self employed technician contracts?

airSlate SignNow offers various features tailored for managing self employed technician contracts, including customizable templates, secure eSigning, and document tracking. You can also integrate with other apps to streamline your workflow and manage multiple contracts seamlessly. Our user-friendly interface allows you to focus on your work rather than getting bogged down with paperwork.

-

Is there a cost associated with using airSlate SignNow for my self employed technician contract?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers, designed to accommodate different needs. The cost is competitive and offers great value for the features provided, including unlimited eSigning and document management for your self employed technician contract. Check our pricing page for detailed information and choose a plan that suits your requirements.

-

What are the benefits of using airSlate SignNow for a self employed technician contract?

The benefits include enhanced efficiency, improved organization, and time savings when managing your self employed technician contract. By using airSlate SignNow, you can reduce paperwork, avoid delays with electronic signatures, and keep all your contracts in one easily accessible place. Additionally, our secure platform provides peace of mind when handling sensitive information.

-

Can I integrate airSlate SignNow with other software for my self employed technician contract?

Absolutely! airSlate SignNow offers integration options with various software, such as CRMs, project management tools, and accounting applications. This feature allows you to incorporate your self employed technician contract workflow into your existing processes efficiently, enhancing productivity and ensuring a cohesive operational flow.

-

What types of technicians can benefit from a self employed technician contract?

Any self employed technician, whether in fields like plumbing, electrical work, or digital services, can benefit from a well-crafted self employed technician contract. This contract helps to clarify project scope, payment terms, and service expectations, minimizing confusion and disputes. By utilizing airSlate SignNow, technicians across various industries can create legally compliant contracts easily.

Get more for Self Employed Technician Contract

- 2021 i 030 wisconsin schedule cc request for a closing certificate for fiduciaries form

- 2021 live freshwater bait fish license application cagov form

- Wwwrevenuewigovdorformspa 003due date statement of personal property 2022

- Wwwrevenuestatemnushomeowners homesteadhomeowners homestead credit refundminnesota department of form

- 2021 i 050 form 1npr nonresident ampamp part year resident wisconsin income tax

- Wwwsignnowcomfill and sign pdf form91081 nhnh application bar examination fill out and sign printable

- Wwwdrecagovfilespdfexamlicense application checklist california department of form

- Fillable online nglsynod august september b2010b form

Find out other Self Employed Technician Contract

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online