Largo Local Business Tax Polk County Form

What is the Largo Local Business Tax?

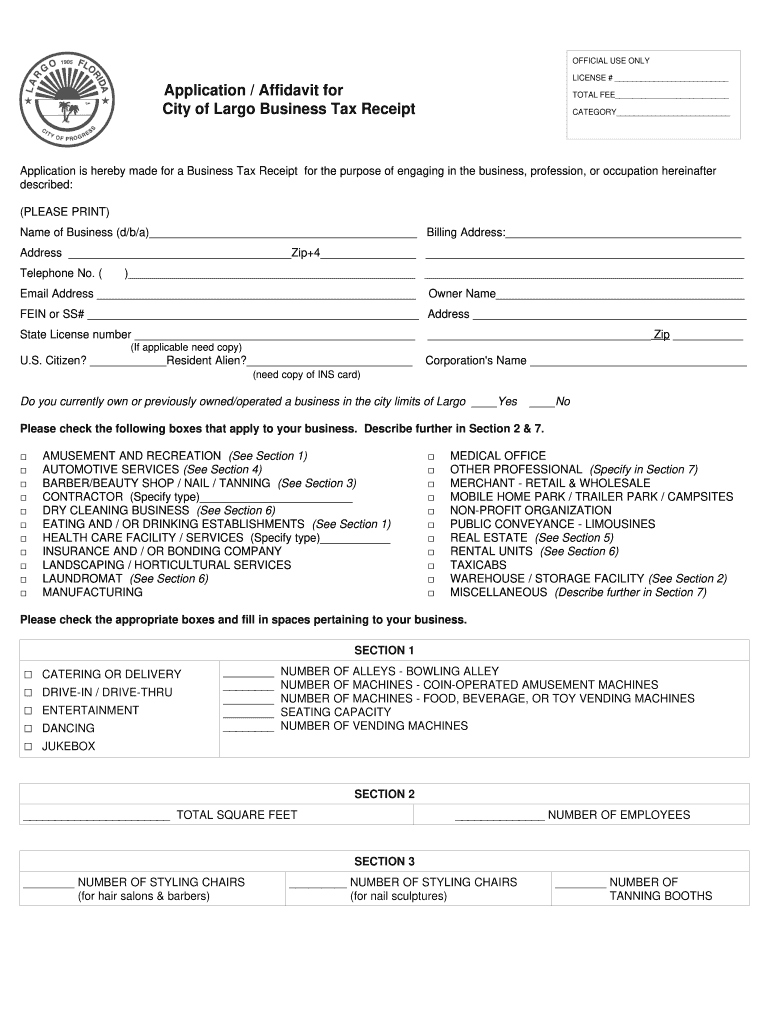

The Largo Local Business Tax is a requirement for businesses operating within the city of Largo, Florida. This tax is designed to generate revenue for local government services and infrastructure. Businesses must obtain a Largo business tax receipt to operate legally within the city limits. The tax applies to various business types, including retail, services, and home-based businesses. Understanding this tax is essential for compliance and to avoid potential penalties.

How to Obtain the Largo Local Business Tax

To obtain the Largo Local Business Tax, businesses must complete an application process. This typically involves submitting a detailed application form along with any required documentation, such as proof of business registration and identification. Applications can be submitted online, by mail, or in person at the Largo city offices. It is important to ensure that all information is accurate and complete to expedite the approval process.

Steps to Complete the Largo Local Business Tax Receipt

Completing the Largo business tax receipt involves several key steps:

- Gather necessary documentation, including your business registration and identification.

- Access the Largo business tax receipt application form, available online or at city offices.

- Fill out the application form accurately, providing all requested information.

- Submit the completed application along with any required fees.

- Await confirmation of approval from the city of Largo.

Legal Use of the Largo Local Business Tax Receipt

The Largo business tax receipt serves as legal documentation that a business is authorized to operate within the city. It is important for businesses to display this receipt prominently at their place of operation. This not only demonstrates compliance with local laws but also builds trust with customers and clients. Failure to possess a valid business tax receipt can result in fines and other legal consequences.

Required Documents for the Largo Local Business Tax Receipt

When applying for the Largo business tax receipt, businesses must provide specific documents, which may include:

- Business registration certificate.

- Identification documents for the business owner.

- Proof of location, such as a lease agreement or property deed.

- Any additional permits required for specific business activities.

Filing Deadlines for the Largo Local Business Tax Receipt

Filing deadlines for the Largo business tax receipt can vary based on the type of business and the time of year. Typically, businesses should apply for their tax receipt before commencing operations. It is advisable to check with the Largo city office for specific deadlines to ensure compliance and avoid late fees.

Quick guide on how to complete application affidavit for business tax receiptpdf city of largo

Your instructional manual on preparing your Largo Local Business Tax Polk County

If you’re interested in understanding how to finalize and submit your Largo Local Business Tax Polk County, here are some brief instructions to simplify the process of tax filing.

Initially, you only need to sign up for your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a user-friendly and robust document solution that enables you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and return to modify responses as necessary. Streamline your tax processes with advanced PDF editing, eSigning, and intuitive sharing options.

Follow the steps below to complete your Largo Local Business Tax Polk County in no time:

- Create your account and start working on PDFs quickly.

- Utilize our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Get form to launch your Largo Local Business Tax Polk County in our editor.

- Populate the required fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting physically can lead to increased mistakes and delayed refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

If I am the owner of my business, do I need to fill out the column that asks for my annual income if employed in the visa forms for B2 visa application?

Well I thought that I shouldn't fill that and when I applied, I didn't. However an immigration attorney later told me that it was a mistake to not fill that up. I didn't agreed with him though.I don't have any arguments in favour or against it, but definitely it says if you are an employee so I strongly believe it should be skipped.But on other hand, how do Visa officer knows that how much you are earning ?Tough situation so maybe more consultants need to share their opinion.

-

How do I fill the portion of a Schengen visa application form that has to do with the purpose of stay for a conference and scholarship induction programme? Is it business, tourist or others?

The correct Schengen visa type for attending a scientific/academic meeting is technically "Business."Annex II of the Schengen Visa Code (EU regulation 810/2009)Ask the conference to provide the supporting documents.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the application affidavit for business tax receiptpdf city of largo

How to make an electronic signature for your Application Affidavit For Business Tax Receiptpdf City Of Largo in the online mode

How to create an electronic signature for the Application Affidavit For Business Tax Receiptpdf City Of Largo in Chrome

How to make an eSignature for putting it on the Application Affidavit For Business Tax Receiptpdf City Of Largo in Gmail

How to generate an electronic signature for the Application Affidavit For Business Tax Receiptpdf City Of Largo from your mobile device

How to generate an electronic signature for the Application Affidavit For Business Tax Receiptpdf City Of Largo on iOS

How to generate an eSignature for the Application Affidavit For Business Tax Receiptpdf City Of Largo on Android OS

People also ask

-

What is a Largo business tax receipt?

A Largo business tax receipt is a document that verifies your business is registered and compliant with local tax regulations in Largo, Florida. It is essential for operating legally and can be obtained through the city’s Finance Department.

-

How can airSlate SignNow help with obtaining a Largo business tax receipt?

AirSlate SignNow can streamline the process of signing and sending the necessary documents required for your Largo business tax receipt. This eSignature solution makes it easy to manage, sign, and submit all paperwork efficiently and securely.

-

What are the pricing options for using airSlate SignNow for my Largo business tax receipt needs?

AirSlate SignNow offers cost-effective pricing plans tailored for small to large businesses. Depending on your requirements for features and document volume, you can choose a plan that suits your needs while ensuring compliance for your Largo business tax receipt.

-

What features does airSlate SignNow offer for handling business tax receipts?

AirSlate SignNow presents several features like customizable templates, automated workflows, and secure cloud storage that make managing your Largo business tax receipt more efficient. The platform also provides reminders and tracking tools to follow up on document status.

-

How does airSlate SignNow ensure the security of my documents for a Largo business tax receipt?

Your data is safeguarded with industry-standard encryption, ensuring that documents related to your Largo business tax receipt remain confidential. AirSlate SignNow complies with security regulations, making it a trusted choice for sensitive business documentation.

-

Can I integrate airSlate SignNow with other tools for my Largo business tax receipt?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for handling a Largo business tax receipt. Tools like CRM and document management software can be connected to streamline processes.

-

What benefits does using airSlate SignNow provide for small businesses needing a Largo business tax receipt?

Using airSlate SignNow benefits small businesses by simplifying the document signing process necessary for obtaining a Largo business tax receipt. It saves time, reduces the need for paper documents, and enhances operational efficiency with easy access to completed paperwork.

Get more for Largo Local Business Tax Polk County

- Sample web site development agreement form

- Free and open source software wikipedia form

- Glyphs fonts free download onlinewebfontscom form

- Form original equipment manufacture

- Form publisher oriented multimedia

- Form sales representative agreement

- Form large quantity sales distribution agreement

- End user license agreement read carefully before using form

Find out other Largo Local Business Tax Polk County

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement