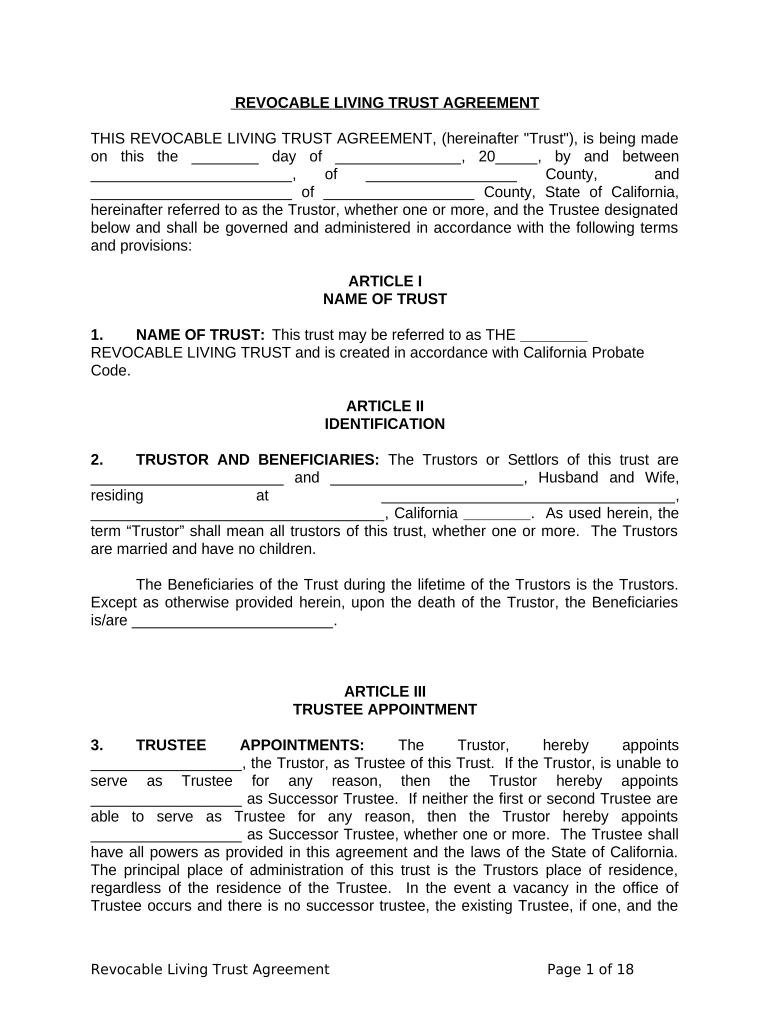

Living Trust California Form

What is the Living Trust California

A living trust in California is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. Unlike a will, a living trust can help avoid probate, making the transfer of assets more efficient and private. The trust creator, known as the grantor, retains control over the assets placed in the trust while they are alive. Upon the grantor's death, the designated trustee administers the trust according to the terms set forth in the document.

Key Elements of the Living Trust California

Several key elements define a living trust in California. These include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets. The grantor often serves as the initial trustee.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Trust Document: The legal document outlining the terms, conditions, and instructions for managing and distributing the trust assets.

Steps to Complete the Living Trust California

Completing a living trust in California involves several important steps:

- Identify Assets: Determine which assets you want to include in the trust, such as real estate, bank accounts, and investments.

- Choose a Trustee: Select a reliable person or institution to manage the trust.

- Draft the Trust Document: Create the trust document, ensuring it meets California legal requirements.

- Transfer Assets: Legally transfer ownership of the chosen assets into the trust.

- Review and Update: Regularly review the trust and update it as necessary to reflect changes in your circumstances or wishes.

Legal Use of the Living Trust California

The legal use of a living trust in California is governed by state laws that outline the requirements for creating and managing such trusts. It is crucial to ensure that the trust document complies with California law to be considered valid. This includes proper execution, witnessing, and notarization, if required. A well-structured living trust can provide significant benefits, including asset protection and privacy, while also ensuring that your wishes are honored after your passing.

State-Specific Rules for the Living Trust California

California has specific rules regarding living trusts that differ from other states. These include:

- Revocability: Most living trusts in California are revocable, allowing the grantor to modify or dissolve the trust at any time.

- Probate Avoidance: Living trusts help bypass the probate process, which can be lengthy and costly.

- Tax Implications: Trusts are generally not subject to state income tax during the grantor's lifetime, but tax implications may arise upon the grantor's death.

How to Obtain the Living Trust California

Obtaining a living trust in California can be accomplished through various methods. Individuals may choose to work with an attorney specializing in estate planning to ensure that the trust is legally sound and tailored to their specific needs. Alternatively, there are online resources and templates available that can help individuals create a living trust without legal assistance. Regardless of the method chosen, it is essential to ensure compliance with California laws to avoid potential legal issues.

Quick guide on how to complete living trust california

Effortlessly Prepare Living Trust California on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Living Trust California on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Living Trust California with Ease

- Find Living Trust California and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious search for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust California to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust in California?

A living trust in California is a legal document that allows individuals to manage their assets during their lifetime and dictate the distribution of those assets upon their death. It helps avoid probate, making the transfer process easier for beneficiaries. Establishing a living trust can ensure your wishes are honored and your estate is managed efficiently.

-

How much does it cost to create a living trust in California?

The cost of creating a living trust in California can vary widely, typically ranging from a few hundred to several thousand dollars depending on the complexity of your estate. Many individuals choose to utilize online services or estate planning attorneys, which may affect the pricing. It's essential to consider the long-term benefits and potential savings from avoiding probate when evaluating costs.

-

What are the benefits of setting up a living trust in California?

Setting up a living trust in California offers numerous benefits, including bypassing the probate process, maintaining privacy regarding your estate, and providing flexibility in managing your assets. A living trust can also facilitate the management of your assets if you become incapacitated, ensuring your affairs are handled according to your wishes. Overall, it simplifies the transfer of your estate to heirs.

-

Can I change or revoke my living trust in California?

Yes, a living trust in California is revocable, meaning you can modify or revoke it at any time while you are alive and competent. This flexibility allows you to adjust the trust as your financial situation or family circumstances change. Always consult with a legal expert when making changes to ensure compliance with state laws.

-

Who can be a trustee of my living trust in California?

In California, you can designate yourself as the trustee of your living trust, allowing you to manage your assets while you are alive. You may also appoint a trusted family member, friend, or professional fiduciary to serve as a successor trustee to take over management after your passing. Choosing the right trustee is crucial to ensuring your assets are handled according to your wishes.

-

Does a living trust in California cover all types of assets?

A living trust in California can encompass various types of assets, including real estate, bank accounts, investments, and personal property. However, certain assets like retirement accounts and life insurance policies may require specific beneficiary designations outside the trust. Properly funding your living trust with all relevant assets is essential to fully realize its benefits.

-

How does a living trust differ from a will in California?

A living trust in California differs from a will primarily in terms of the probate process. A living trust avoids probate, allowing for immediate asset distribution, whereas a will typically goes through probate, which can be lengthy and public. Additionally, a trust offers more privacy and flexibility in asset management during your lifetime.

Get more for Living Trust California

Find out other Living Trust California

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online