California Widower Form

What is the California Widower

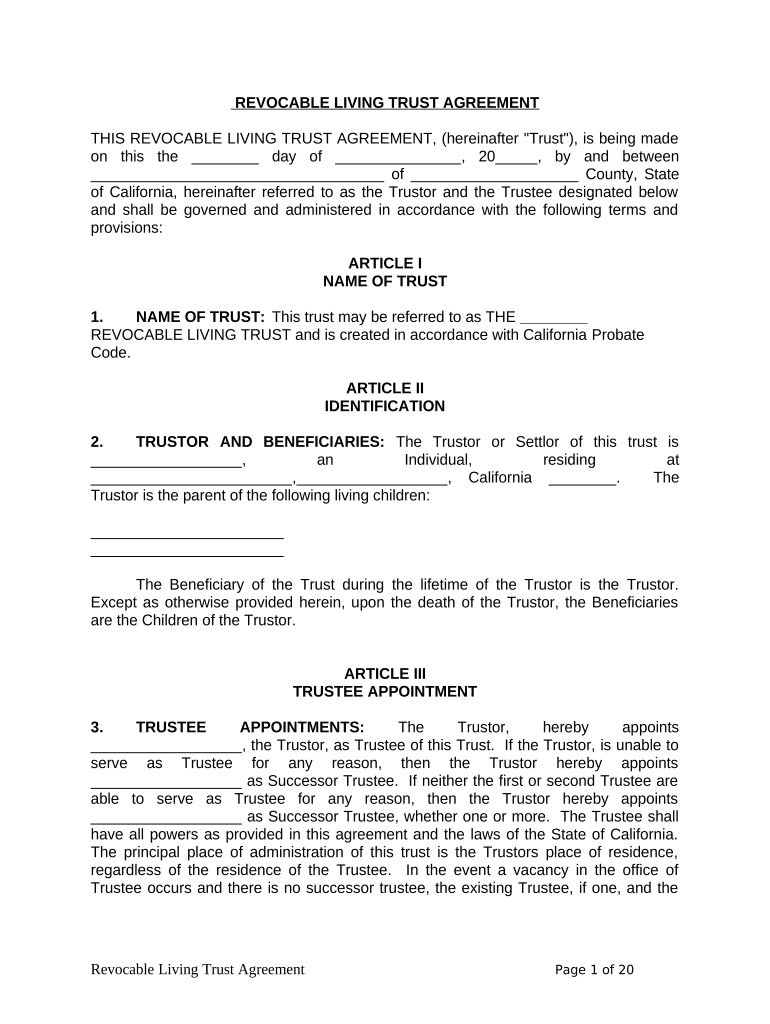

The California widower form is a legal document designed for individuals who have lost their spouse and need to address various legal and financial matters. This form is essential for managing the deceased spouse's estate, including settling debts, distributing assets, and claiming benefits. Understanding the specific requirements and implications of this form is crucial for ensuring compliance with California laws.

Steps to complete the California Widower

Completing the California widower form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the deceased spouse, including personal details and any relevant financial documents. Next, fill out the form with precise details, ensuring that all sections are completed. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the completed form to the appropriate authority, which may include a court or a financial institution, depending on the context of its use.

Legal use of the California Widower

The California widower form serves a vital legal purpose. It is used to establish the rights of the surviving spouse in matters such as inheritance, property rights, and claims against the estate. Proper execution of this form ensures that the widower's interests are protected under California law, allowing for a smoother transition during a difficult time. It is important to be aware of any specific legal requirements or stipulations that may apply when using this form.

Required Documents

When preparing to complete the California widower form, several documents are typically required. These may include the death certificate of the deceased spouse, proof of marriage, and any relevant financial documents such as bank statements or property deeds. Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately represented in the form.

Form Submission Methods

The California widower form can be submitted through various methods, depending on the specific requirements of the authority receiving the form. Common submission methods include online submission, mailing the completed form, or delivering it in person. Each method may have different processing times and requirements, so it is advisable to check with the relevant authority for specific instructions.

Eligibility Criteria

To use the California widower form, certain eligibility criteria must be met. Typically, the individual must be a legal spouse of the deceased at the time of death. Additionally, the individual must be able to provide necessary documentation, such as a marriage certificate and a death certificate. Understanding these criteria is essential to ensure that the form is completed correctly and that the rights of the surviving spouse are upheld.

Quick guide on how to complete california widower

Effortlessly prepare California Widower on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage California Widower on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign California Widower without hassle

- Obtain California Widower and click Get Form to proceed.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools available specifically from airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign California Widower and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit a California widower?

airSlate SignNow is a digital solution that allows California widowers to send and eSign important documents quickly and securely. With its user-friendly interface, you can manage legal paperwork such as wills or estate documents without hassle. Our platform simplifies the signing process, ensuring that vital tasks can be completed efficiently and with minimal stress.

-

How much does airSlate SignNow cost for a California widower?

The pricing for airSlate SignNow varies depending on the selected plan, making it accessible for California widowers. We offer tiered pricing that includes options for individual users and businesses, starting at a low monthly fee. This makes it easier for widowers to choose a plan that fits their budget while still receiving full access to our features.

-

What features does airSlate SignNow offer that would be useful for a California widower?

airSlate SignNow provides features such as document templates, advanced signing options, and real-time tracking, all tailored for California widowers handling sensitive documents. These features help simplify the process of finalizing important agreements and managing paperwork during difficult times. Additionally, you can easily store and retrieve documents as needed.

-

Can a California widower integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with various applications that a California widower might use, such as Google Drive, Dropbox, and Microsoft Office. These integrations allow for seamless document management and storage options, ensuring that you can work efficiently without needing to switch between different platforms. This added functionality can save time and reduce stress.

-

Is airSlate SignNow legally binding for a California widower's documents?

Absolutely! airSlate SignNow ensures that all electronic signatures comply with California laws, making them legally binding for the documents signed by a California widower. Our platform employs strong security measures to guarantee that your documents are protected throughout the signing process. This gives you peace of mind that your important agreements hold up in court.

-

How does airSlate SignNow ensure security for a California widower's sensitive documents?

airSlate SignNow prioritizes the security of sensitive documents for California widowers through advanced encryption and compliance with industry standards. Our platform employs multiple security layers to protect your data, ensuring that only authorized users can access your documents. This commitment to security allows you to focus on what matters most during challenging times.

-

What customer support options does airSlate SignNow provide for a California widower?

For California widowers, airSlate SignNow offers robust customer support that includes a comprehensive help center, live chat, and email support. Our knowledgeable support team is available to assist you with any questions or issues you may encounter while using the platform. This ensures that you receive timely assistance, making your experience smooth and efficient.

Get more for California Widower

Find out other California Widower

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors