Revocation Trust Form

What is the Revocation Trust Form

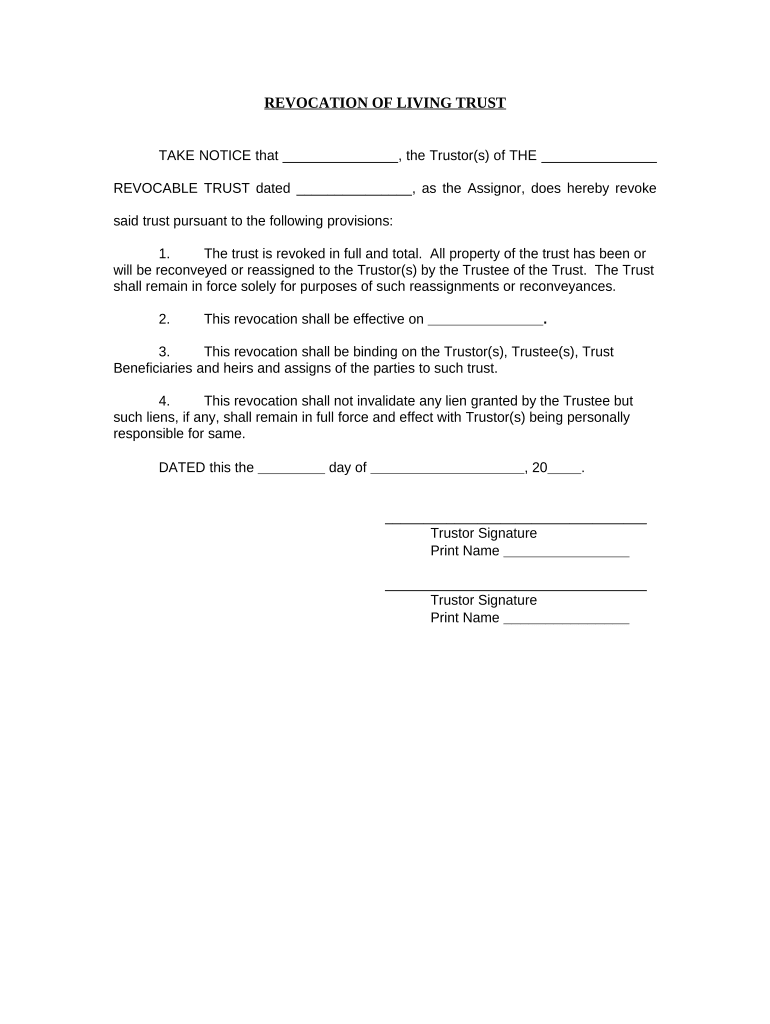

The revocation trust form is a legal document used to dissolve or revoke a trust that has been previously established. This form is essential for individuals who wish to change their estate planning strategies or manage their assets differently. By completing this form, the grantor can officially terminate the trust, ensuring that the assets held within it are redistributed according to their wishes. This form is particularly significant in the context of living trusts, where the grantor may want to make adjustments as their circumstances change.

How to use the Revocation Trust Form

Using the revocation trust form involves several key steps to ensure that the process is legally binding and effective. First, the grantor must gather all relevant information about the trust, including its name, date of creation, and details about the assets involved. Next, they should fill out the form accurately, providing all required information. After completing the form, the grantor must sign it in the presence of a notary public to validate the revocation. Once notarized, the form should be distributed to all relevant parties, including beneficiaries and financial institutions holding trust assets.

Steps to complete the Revocation Trust Form

Completing the revocation trust form requires careful attention to detail. Here are the steps to follow:

- Identify the trust you wish to revoke by its official name and date of creation.

- Fill out the form with accurate information, including your name, the trust's name, and any other required details.

- Sign the form in front of a notary public to ensure its legal validity.

- Distribute copies of the signed form to all relevant parties, such as beneficiaries and financial institutions.

Legal use of the Revocation Trust Form

The legal use of the revocation trust form is crucial for ensuring that the revocation is recognized by courts and financial institutions. To be legally binding, the form must comply with state laws governing trusts. This typically includes proper execution, which often involves notarization. Additionally, the grantor should keep a copy of the revoked trust and the revocation form for their records. This documentation can be essential if disputes arise regarding the trust or its assets in the future.

Key elements of the Revocation Trust Form

Several key elements must be included in the revocation trust form to ensure its effectiveness. These elements typically include:

- The name of the trust being revoked.

- The date the trust was originally created.

- The grantor's name and signature.

- A statement clearly indicating the intention to revoke the trust.

- Notarization details to verify the authenticity of the signature.

State-specific rules for the Revocation Trust Form

State-specific rules can significantly impact how the revocation trust form is completed and executed. Each state may have different requirements regarding notarization, witness signatures, and the specific language that must be included in the form. It is essential for the grantor to familiarize themselves with their state's laws to ensure compliance. Consulting with a legal professional can provide clarity on these regulations and help avoid potential issues during the revocation process.

Quick guide on how to complete revocation trust form

Accomplish Revocation Trust Form effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without hold-ups. Handle Revocation Trust Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Revocation Trust Form without hassle

- Find Revocation Trust Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your preference. Alter and eSign Revocation Trust Form and ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocation trust form?

A revocation trust form is a legal document that allows individuals to revoke or modify an existing trust. By filling out this form, you can ensure that your assets are redistributed according to your current wishes, providing flexibility in estate planning.

-

How do I create a revocation trust form with airSlate SignNow?

Creating a revocation trust form with airSlate SignNow is simple. You can start by choosing a template, filling in your specific details, and then using our intuitive interface to eSign it. Our platform makes it easy to manage your trust documents conveniently online.

-

Is there a cost associated with using the revocation trust form on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the revocation trust form. We provide a cost-effective solution suited for businesses of all sizes, enabling you to eSign and manage documents without breaking the bank.

-

What features does the airSlate SignNow platform offer for revocation trust forms?

The airSlate SignNow platform offers a user-friendly interface, templates for revocation trust forms, secure eSigning, and several collaboration tools. With these features, you can easily create, share, and manage your trust documents while ensuring compliance with legal standards.

-

Can I customize my revocation trust form with airSlate SignNow?

Yes, you can customize your revocation trust form using airSlate SignNow's editing tools. This allows you to add specific clauses, conditions, or additional requests based on your unique needs, ensuring that your document accurately reflects your intentions.

-

Are there any integrations available for the revocation trust form on airSlate SignNow?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to easily import, export, and manage your revocation trust form alongside other important documents in your workflow.

-

What are the benefits of using airSlate SignNow for a revocation trust form?

Using airSlate SignNow for your revocation trust form streamlines the document management process. You can eSign securely, track the document status, and store all your trust documents in one place, enhancing efficiency and reducing paperwork hassles.

Get more for Revocation Trust Form

- Public utility easement form

- Virginia deed easement 497428299 form

- Assumption agreement of deed of trust and release of original mortgagors virginia form

- Virginia small form

- Virginia unlawful form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497428305 form

- Virginia annual form

- Notices resolutions simple stock ledger and certificate virginia form

Find out other Revocation Trust Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online