California Sheet Instructions Form

What is the California Sheet Instructions

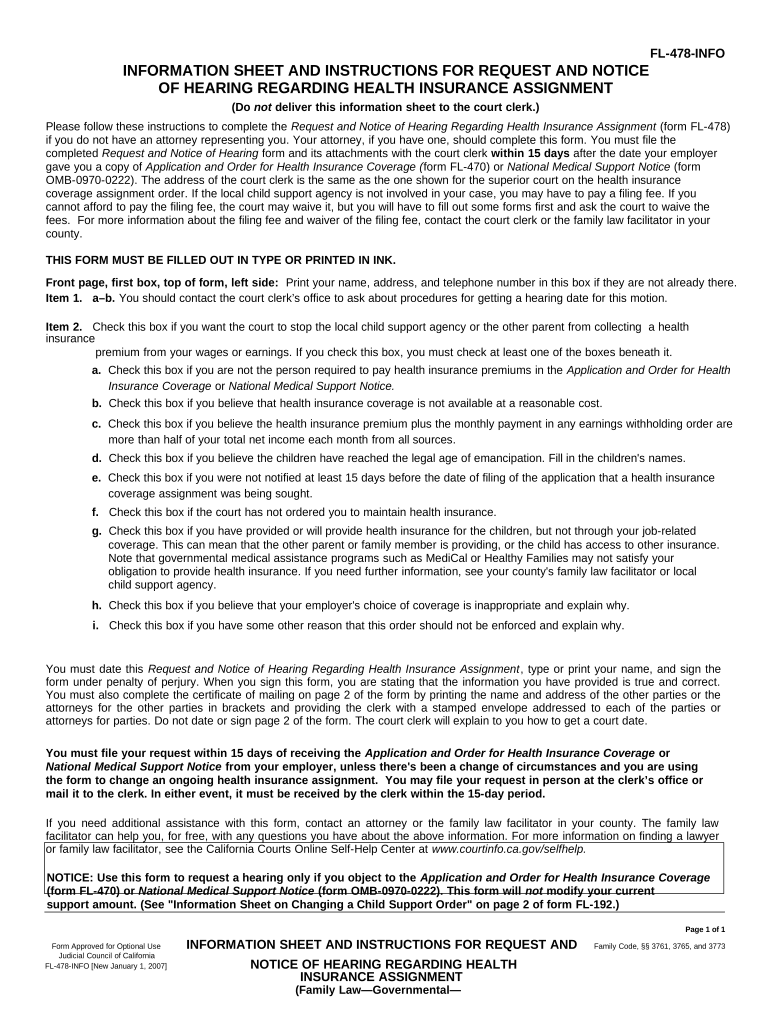

The California Sheet Instructions provide essential guidelines for individuals and businesses in California to complete specific forms related to health documentation. These instructions outline the necessary steps and requirements to ensure that the forms are filled out accurately and comply with state regulations. Understanding these instructions is crucial for maintaining compliance and ensuring that all health-related documentation is processed correctly.

How to use the California Sheet Instructions

Using the California Sheet Instructions involves a clear understanding of the form's requirements and the information needed. Users should first read through the instructions thoroughly to familiarize themselves with the necessary sections. Each part of the form must be completed with accurate information, and users should refer to the instructions for specific details on what is required in each section. This careful approach helps prevent errors that could lead to delays or compliance issues.

Steps to complete the California Sheet Instructions

Completing the California Sheet Instructions requires a systematic approach:

- Gather all required information, including personal details and any relevant health information.

- Carefully read through the instructions to understand each section's requirements.

- Fill out the form accurately, ensuring all fields are completed as specified.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal use of the California Sheet Instructions

The legal use of the California Sheet Instructions is paramount for ensuring that all health-related documentation is valid and enforceable. These instructions are designed to comply with state laws and regulations, which means that following them closely is essential. Any deviations from the instructions could result in the form being deemed invalid, which may lead to legal complications or penalties.

Key elements of the California Sheet Instructions

Key elements of the California Sheet Instructions include:

- Detailed descriptions of required information for each section of the form.

- Guidelines for signature requirements, ensuring legal validity.

- Information on submission methods and deadlines to ensure timely processing.

- Clarification of any state-specific regulations that must be adhered to.

Examples of using the California Sheet Instructions

Examples of using the California Sheet Instructions can provide clarity on how to apply the guidelines in real situations. For instance, a healthcare provider may need to complete a health-related form for a patient. By following the California Sheet Instructions, they can ensure that all necessary information is included, signatures are obtained, and the form is submitted correctly. This practical application helps reinforce the importance of adhering to the instructions.

Quick guide on how to complete california sheet instructions

Complete California Sheet Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage California Sheet Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to alter and eSign California Sheet Instructions with ease

- Find California Sheet Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to confirm your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management demands in just a few clicks from any device you choose. Modify and eSign California Sheet Instructions while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the main features of airSlate SignNow for instructions health?

airSlate SignNow offers a variety of features tailored for instructions health, including electronic signatures, document templates, and real-time tracking. These features streamline the signing process and enhance document management for healthcare professionals. With airSlate SignNow, you can efficiently handle patient documents while ensuring compliance with health regulations.

-

How does airSlate SignNow enhance the efficiency of instructions health workflows?

By implementing airSlate SignNow in your instructions health workflows, you can reduce the time spent on paperwork and manual processes. The platform automates document routing and notifications, allowing healthcare providers to focus more on patient care. This efficiency ultimately leads to improved patient satisfaction and outcomes.

-

What pricing plans does airSlate SignNow offer for instructions health users?

airSlate SignNow provides flexible pricing plans to cater to various needs, including those for instructions health. Plans range from free options for individual users to comprehensive enterprise solutions. Choosing the right plan ensures that healthcare organizations can access essential features while managing their budgets effectively.

-

Are there integrations available for airSlate SignNow in the instructions health sector?

Yes, airSlate SignNow offers numerous integrations that enhance its functionality for instructions health. You can connect the platform with popular healthcare management systems, CRM tools, and cloud storage services. These integrations facilitate seamless data exchange and improve collaboration among healthcare teams.

-

What benefits does airSlate SignNow provide for patient document management in instructions health?

The benefits of using airSlate SignNow for patient document management in instructions health include increased security, improved accessibility, and faster completion of forms. The platform's encrypted storage ensures that sensitive health information remains secure. By simplifying the process, healthcare providers can deliver quicker services to their patients.

-

How can I ensure compliance with regulations using airSlate SignNow in instructions health?

airSlate SignNow helps ensure compliance with regulations in instructions health by providing audit trails, secure encryption, and customizable workflows. By using these features, healthcare professionals can easily track document access and modifications. This transparency helps maintain compliance with HIPAA and other health regulations.

-

Is airSlate SignNow user-friendly for healthcare professionals dealing with instructions health?

Absolutely, airSlate SignNow is designed with user-friendliness in mind, making it accessible for healthcare professionals managing instructions health. The intuitive interface allows users to quickly learn how to send, sign, and manage documents without extensive training. This ease of use enhances productivity and reduces the learning curve for new users.

Get more for California Sheet Instructions

- Transfer superior court form

- Wpf uh 080200 order transferring case and setting hearing ortr washington form

- Deferred prosecution agreement form

- Notice to real property lender corporation or llc washington form

- Washington disclaimer form

- Washington conditional form

- Quitclaim deed wife form

- Warranty deed from husband and wife to corporation washington form

Find out other California Sheet Instructions

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast