The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass Form

Understanding the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

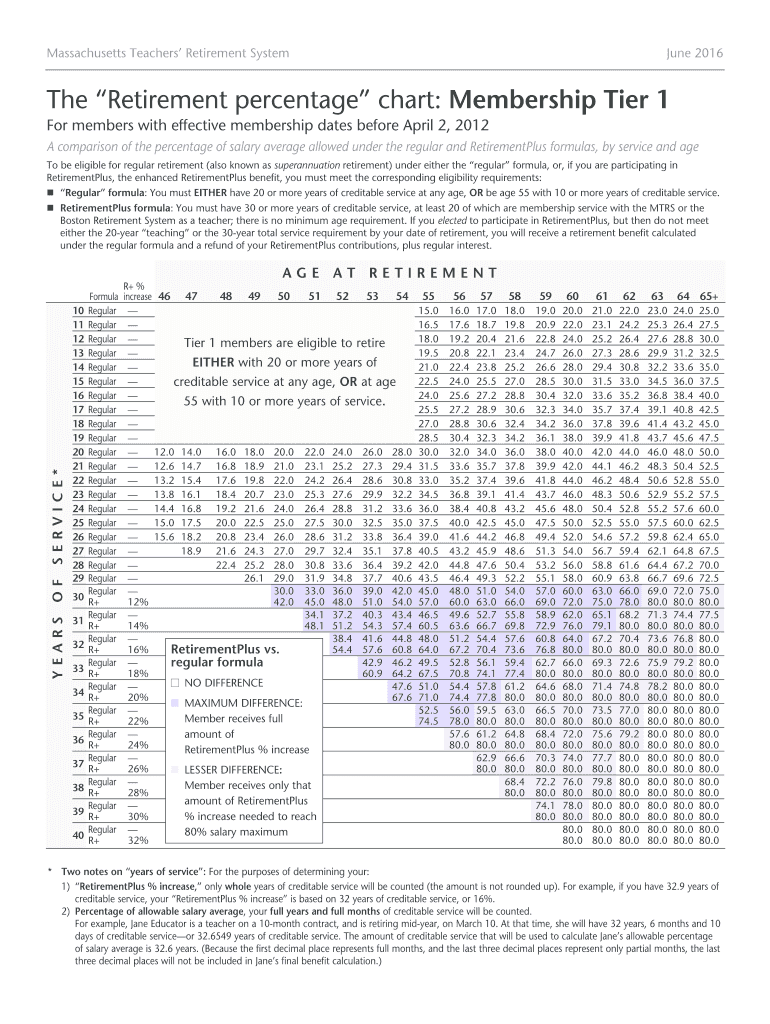

The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass is a structured guide designed to help individuals understand their retirement benefits. This chart outlines the percentage of income that retirees can expect to receive based on their years of service and contributions to the retirement system. It is particularly useful for employees of the Massachusetts government, providing clarity on how retirement benefits are calculated and distributed.

How to Utilize the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

To effectively use the Retirement Percentage Chart, individuals should first identify their years of service and the corresponding tier. By locating their service duration on the chart, users can determine the percentage of their salary that will be provided as a retirement benefit. This information is crucial for financial planning and understanding future income during retirement.

Obtaining the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

The Retirement Percentage Chart can be obtained through the official Massachusetts government website or by contacting the human resources department within state agencies. It is essential to ensure that you have the most current version of the chart, as updates may occur based on legislative changes or adjustments in retirement policies.

Steps to Complete the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

Completing the Retirement Percentage Chart involves several steps:

- Identify your employment start date and total years of service.

- Locate the appropriate tier on the chart based on your employment classification.

- Cross-reference your years of service with the chart to find your retirement percentage.

- Use this percentage to estimate your retirement income based on your final salary.

Legal Considerations for the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

Understanding the legal framework surrounding the Retirement Percentage Chart is vital. The chart is governed by state laws and regulations that dictate how retirement benefits are calculated and distributed. It is essential for employees to be aware of any legal changes that may impact their retirement planning, including eligibility criteria and benefit adjustments.

Key Elements of the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

Key elements of the Retirement Percentage Chart include:

- The tier classification, which determines the benefit structure.

- The years of service, which directly influence the retirement percentage.

- The final average salary, which is used to calculate the retirement benefit amount.

- Any applicable cost-of-living adjustments that may affect retirement income.

Examples of Using the Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

For instance, if an employee has twenty years of service and falls under Tier 1, they can refer to the chart to find that they are entitled to a retirement benefit of a specific percentage of their final salary. This example illustrates how the chart can be a practical tool for planning retirement finances.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the retirement percentage chart membership tier 1 mass gov mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass?

The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass is a specialized resource designed to help members understand retirement benefits and percentages applicable to their specific tier. This chart provides essential insights for planning retirement effectively, ensuring members are well-informed about their entitlements.

-

How can I access The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass?

To access The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass, you need to become a member of the Mass Gov Mass program. Once you register, you will receive exclusive access to the chart and other valuable resources tailored to your retirement planning needs.

-

What are the benefits of using The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass?

Using The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass allows members to gain a clear understanding of their retirement benefits. This resource helps in making informed decisions about retirement savings and planning, ultimately leading to a more secure financial future.

-

Is there a cost associated with The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass?

Yes, there is a membership fee associated with accessing The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass. This fee supports the maintenance of the chart and the continuous provision of updated information to ensure members receive the most accurate data.

-

Can The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass be integrated with other financial planning tools?

Yes, The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass can be integrated with various financial planning tools. This integration allows members to utilize the chart alongside other resources, enhancing their overall retirement planning strategy.

-

Who is eligible for The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass?

Eligibility for The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass typically includes employees of the Massachusetts government and their beneficiaries. It is designed to serve those who are looking to understand their retirement benefits more thoroughly.

-

How often is The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass updated?

The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass is updated regularly to reflect any changes in retirement policies or percentages. Members can expect to receive timely updates to ensure they have the most current information available for their retirement planning.

Get more for The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

- Maryland asthma action plan 16953751 form

- Integrated midwives association of the philippines form

- Kamasutra hindi pdf form

- Sample assistive technology evaluation report swaaac form

- Restitution payment form

- Renewal application for license for nursing home the tennessee health state tn form

- Form e24

- Foot and ankle clinic queensway carleton hospital form

Find out other The Retirement Percentage Chart Membership Tier 1 Mass Gov Mass

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter