Exemption Certificate for Construction Projects with FormSend 2003-2026

What is the Exemption Certificate for Construction Projects?

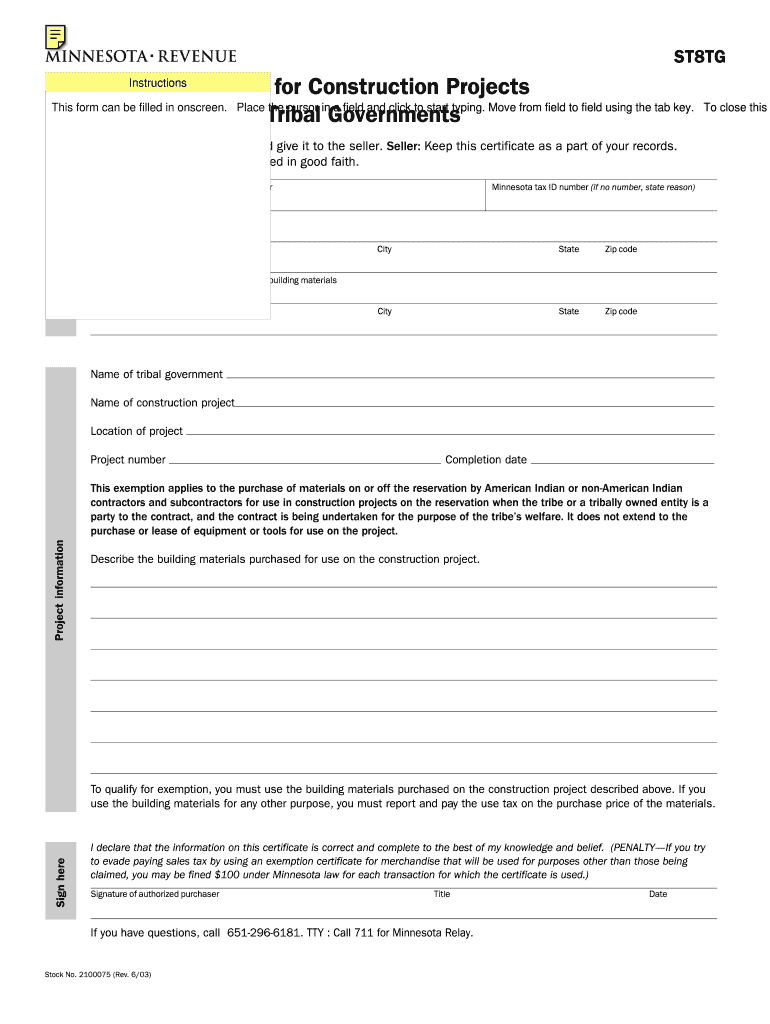

The Exemption Certificate for Construction Projects is a vital document that allows contractors to purchase materials without paying sales tax. This certificate is particularly important for construction projects where materials are a significant cost. By utilizing this exemption, contractors can reduce their overall project expenses, making it an essential tool for financial management in the construction industry.

Steps to Complete the Exemption Certificate for Construction Projects

Filling out the Exemption Certificate requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Obtain the form: Access the Exemption Certificate from your state's revenue department website or through a trusted source.

- Fill in your information: Provide your name, business name, address, and tax identification number. This identifies you as the contractor applying for the exemption.

- Detail the project: Clearly describe the construction project for which the exemption is being requested. Include the project address and any relevant information.

- List the materials: Specify the materials you intend to purchase tax-free. This helps to clarify the scope of the exemption.

- Sign and date: Ensure that you sign and date the certificate to validate it. An unsigned certificate may be deemed invalid.

Key Elements of the Exemption Certificate for Construction Projects

Understanding the essential components of the Exemption Certificate is crucial for its proper use. Key elements include:

- Contractor Information: This section includes the contractor's name, address, and tax identification number.

- Project Details: A description of the construction project, including its location and purpose.

- Material Description: A detailed list of materials that will be purchased under the exemption.

- Signature: The contractor's signature is necessary to authenticate the certificate.

Legal Use of the Exemption Certificate for Construction Projects

The legal use of the Exemption Certificate is governed by state laws. It is crucial to ensure that the certificate is used strictly for eligible purchases related to construction projects. Misuse of the certificate can lead to penalties, including fines and back taxes. Always refer to your state's regulations to ensure compliance.

Eligibility Criteria for the Exemption Certificate for Construction Projects

To qualify for the Exemption Certificate, contractors must meet specific eligibility criteria, which typically include:

- The contractor must be registered and in good standing with the state.

- The project must be a legitimate construction project that qualifies under state tax laws.

- Materials purchased must be directly related to the construction project.

Form Submission Methods for the Exemption Certificate

Submitting the Exemption Certificate can be done through various methods, depending on state requirements. Common submission methods include:

- Online Submission: Many states allow electronic submission through their revenue department websites.

- Mail: You can print the completed form and send it via postal mail to the appropriate state office.

- In-Person: Some states may allow you to submit the form in person at designated tax offices.

Quick guide on how to complete exemption certificate for construction projects with formsend

Your assistance manual on how to prepare your Exemption Certificate For Construction Projects With FormSend

If you’re interested in learning how to create and dispatch your Exemption Certificate For Construction Projects With FormSend, here are some brief directions to facilitate tax submission.

Initially, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your tax forms efficiently. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to modify answers as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to complete your Exemption Certificate For Construction Projects With FormSend in moments:

- Establish your account and begin working on PDFs in just a few minutes.

- Utilize our catalog to obtain any IRS tax form; explore through variations and schedules.

- Select Get form to access your Exemption Certificate For Construction Projects With FormSend in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Remember that paper filing may increase return mistakes and postpone refunds. It goes without saying, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Are there any tips for filling out PMP certificate when I have a ton of small projects (100) due to agile process?

The only ‘tips’ I can provide are:Document continuously - one of the biggest mistakes I made was that I left my documenting until my final year of experience. It was far (far!) easier to document-as-I-went on the last year. With 100’s of small projects it’s far easier to document each week. Block in a spot on your calendar and just do it(TM)Do not think for a moment that you won’t get audited(!) - I personally know two people who have been audited. Don’t half-bake your data otherwise you might find yourself doing far more when the audit team rolls around.Don’t forget to have fun - being a PM is a great career choice and while it seems like a lot of work now there are plenty of rewards at the end of the journey.Adamp.s - if you were expecting shortcuts i’m afraid there aren’t any.

-

How can I create an online certificate for membership? I want to send a link for members to just fill out and download.

ClassMarker will enable you to do exactly what you are wanting to achieve.With ClassMarker, you can create fully customized certificates.Options include:Portrait & Landscape CertificatesA4 & Letter sizesMultiple Font styles and sizesDrag and Drop Text and ImagesAdd extra Text fields and ImagesSelect different date display formatsAbility to create wallet sized certificatesYou can also now have Unique IDs, Serial Numbers, Course numbers and more included on your ClassMarker Certificates.If you choose for users to add their names, you can select for these to be automatically added to their certificates.Creating customized certificatesTo do as you have mentioned, you could create questionnaires/forms that you are wanting users to fill out (this can be done with a variety of different question types). You can ask for information such as name and/or email and additional ‘extra information’ questions that you can choose to make mandatory. If you like, you can choose to include these on the certificates as well.You will also be able to choose what your users see when they have finished completing their questionnaire. You can choose to not show any questions and answers but instead some customized feedback to thank your users for taking the time to fill out your questionnaire and any additional details you require, along with redirecting them elsewhere.Users will then click on the ‘certificate download’ button on their results page on-screen and/or have the results emailed to them which will also include the certificate download link so that they can download their certificate at a time that is convenient for them!You had mentioned you want to send a link to members - you can do this in ClassMarker by assigning your questionnaire to a link, in which you can then embed this directly into a page on your website or email them the link.You can check out ClassMarker’s video demo here:Online Testing Video Demonstrations

-

How can I get people to fill out my travel survey for a marketing research project?

(Disclaimer: I work for a market research company called Marketest)If you want to find out what your potential customers think of your business idea (and if they would be willing to pay for it) then you would use quantitative research.You can signNow out your audience with us within 10 days (or less, it depends on the specificity of your project). Prices depend on the no. of questions and no. of respondents, but we offer the cheapest prices because we primarily works with start-uppers, entrepreneurs, small business owners, PhD researchers and students.If it is of your interest, feel free to drop me an email at b.diflumeri@marketest.co.uk or take a free quote with us.Hope to be helpful :)

-

What is wrong with the hiring process and how could it be fixed? Endless forms have to be filled out, nothing is unified, and GitHub, StackOverflow (for developers) or Dribbble (for designers) are not taken into consideration.

Finding the right job candidates is one of the biggest recruiting challenges. Recruiters and other HR professionals that don’t use best recruiting strategies are often unable to find high-quality job applicants. With all the changes and advances in HR technologies, new recruiting and hiring solutions have emerged. Many recruiters are now implementing these new solutions to become more effective and productive in their jobs.According to Recruitment strategies report 2017 done by GetApp, the biggest recruiting challenge in 2017 was the shortage of skilled candidates.The process of finding job candidates has changed signNowly since few years ago. Back then, it was enough to post a job on job boards and wait for candidates to apply. Also called “post and pray” strategy.Today, it is more about building a strong Employer Branding strategy that attracts high quality applicants for hard-to-fill roles.Steps for finding the right job candidates1. Define your ideal candidate a.k.a candidate personaNot knowing who your ideal candidate is, will make finding one impossible. To be able to attract and hire them, you need to know their characteristics, motivations, skills and preferences.Defining a candidate persona requires planning and evaluation. The best way is to start from your current talent star employees. Learn more about their personalities, preferences, motivations and characteristics. Use these findings to find similar people for your current and future job openings.2. Engage your current employeesYou probably already know that your current employees are your best brand ambassadors. Same as current product users are best ambassadors for product brands. Their word of mouth means more than anyone else’s.Encourage their engagement and let them communicate their positive experiences to the outside. Remember, your employees are your best ambassadors, and people trust people more than brands, CEOs and other C-level executives.Involving your current employees can not only help you build a strong Employer Branding strategy, but it can also help your employees feel more engaged and satisfied with their jobs.3. Write a clear job descriptionsEven though many recruiters underestimate this step, it is extremely important to do it right! Writing a clear and detailed job description plays a huge role in finding and attracting candidates with a good fit. Don’t only list duties, responsibilities and requirements, but talk about your company’s culture and Employee Value Proposition.To save time, here are our free job description templates.4. Streamline your efforts with a Recruitment Marketing toolIf you have right tools, finding the right job candidates is much easier and faster than without them. Solutions offered by recruitment marketing software are various, and with them you can build innovative recruiting strategies such as Inbound Recruiting and Candidate Relationship Management to improve Candidate Experience and encourage Candidate Engagement.Sending useful, timely and relevant information to the candidates from your talent pool is a great way for strengthening your Employer Brand and communicating your Employee Value Proposition.5. Optimize your career site to invite visitors to applyWhen candidates want to learn about you, they go to your career site. Don-t loose this opportunity to impress them. Create content and look that reflects your company’s culture, mission and vision. Tell visitors about other employees success and career stories.You can start by adding employee testimonials, fun videos, introduce your team, and write about cool project that your company is working on.Don’t let visitors leave before hitting “Apply Now” button.6. Use a recruiting software with a powerful sourcing toolToday, there are powerful sourcing tools that find and extract candidates profiles. They also add them directly to your talent pool. Manual search takes a lot of time and effort, and is often very inefficient. With a powerful sourcing tool, you can make this process much faster, easier and more productive. These tools help you find candidates that match both the position and company culture.7. Use an Applicant Tracking SystemSolutions offered by applicant tracking systems are various, but their main purpose is to fasten and streamline the selections and hiring processes. By fastening the hiring and selection process, you can signNowly improve Candidate Experience. With this, you can increase your application and hire rate for hard-to-fill roles. Did you know that top talent stays available on the market for only 10 days?8. Implement and use employee referral programsReferrals are proven to be best employees! Referrals can improve your time, cost and quality of hire, and make your hiring strategy much more productive. Yet, many companies still don’t have developed strategies for employee referrals.This is another great way to use your current employee to help you find the best people. To start, use these referral email templates for recruiters, and start engaging your employees today!GetApp‘s survey has proven that employee referrals take shortest to hire, and bring the highest quality job applicants.If you don’t have ideas about how to reward good referrals, here’s our favorite list of ideas for employee referral rewards.

-

How can I get out of a contract with a company to do construction work for me?

You can't just "get out" of it, but there may be provisions that allow you to terminate the Contractor. If you go that route then you run the risk of facing a claim and having to prove to an arbitrator or judge that the provisions were satisfied. You may end up having to pay the Contractor without the work being completed. Read your Contract. Also, some more specifics as to the situation would be helpful.

Create this form in 5 minutes!

How to create an eSignature for the exemption certificate for construction projects with formsend

How to generate an eSignature for your Exemption Certificate For Construction Projects With Formsend in the online mode

How to create an electronic signature for your Exemption Certificate For Construction Projects With Formsend in Google Chrome

How to create an eSignature for signing the Exemption Certificate For Construction Projects With Formsend in Gmail

How to generate an electronic signature for the Exemption Certificate For Construction Projects With Formsend straight from your mobile device

How to make an electronic signature for the Exemption Certificate For Construction Projects With Formsend on iOS devices

How to generate an electronic signature for the Exemption Certificate For Construction Projects With Formsend on Android devices

People also ask

-

What is an Exemption Certificate For Construction Projects With FormSend?

An Exemption Certificate For Construction Projects With FormSend is a document that helps contractors and subcontractors obtain tax-exempt status on certain purchases related to construction projects. By using FormSend, businesses can streamline the process of requesting and managing these certificates, ensuring compliance and efficiency in their operations.

-

How does airSlate SignNow facilitate the use of Exemption Certificates?

airSlate SignNow provides an easy-to-use platform that allows users to create, send, and eSign Exemption Certificates For Construction Projects With FormSend quickly. The intuitive interface simplifies the document management process, helping users save time and reduce errors associated with manual handling.

-

What are the benefits of using the Exemption Certificate For Construction Projects With FormSend?

Using the Exemption Certificate For Construction Projects With FormSend can signNowly reduce tax liabilities for construction projects, allowing businesses to allocate resources more effectively. Additionally, it enhances compliance and reduces paperwork, making it easier to manage documentation across various projects.

-

Is there a cost associated with obtaining an Exemption Certificate For Construction Projects With FormSend?

While the cost of obtaining an Exemption Certificate For Construction Projects With FormSend may vary based on state regulations and specific project requirements, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Investing in this solution can lead to long-term savings by minimizing tax expenses.

-

Can I integrate airSlate SignNow with other software to manage Exemption Certificates?

Yes, airSlate SignNow can seamlessly integrate with various software applications, enhancing your ability to manage Exemption Certificates For Construction Projects With FormSend. These integrations allow for better workflow management, data synchronization, and improved document tracking across platforms.

-

How secure is the process of handling Exemption Certificates With FormSend through airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security measures to protect sensitive information associated with Exemption Certificates For Construction Projects With FormSend, ensuring that your documents remain confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for managing Exemption Certificates?

airSlate SignNow offers a variety of features for managing Exemption Certificates For Construction Projects With FormSend, including customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and help businesses maintain organization in their documentation processes.

Get more for Exemption Certificate For Construction Projects With FormSend

- Bookofthehundredsv41jesusjudgment law form

- Chapter 67a property maintenance code gloucester township form

- Montgomery county maryland department of police false alarm form

- Bike ban form

- Approved amendmentscity of san jose form

- City of lima ohio stormwater management form

- Bill no bl2001 648 nashville tennessee form

- Stevens county ordinance no an ordinance relating to the form

Find out other Exemption Certificate For Construction Projects With FormSend

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors