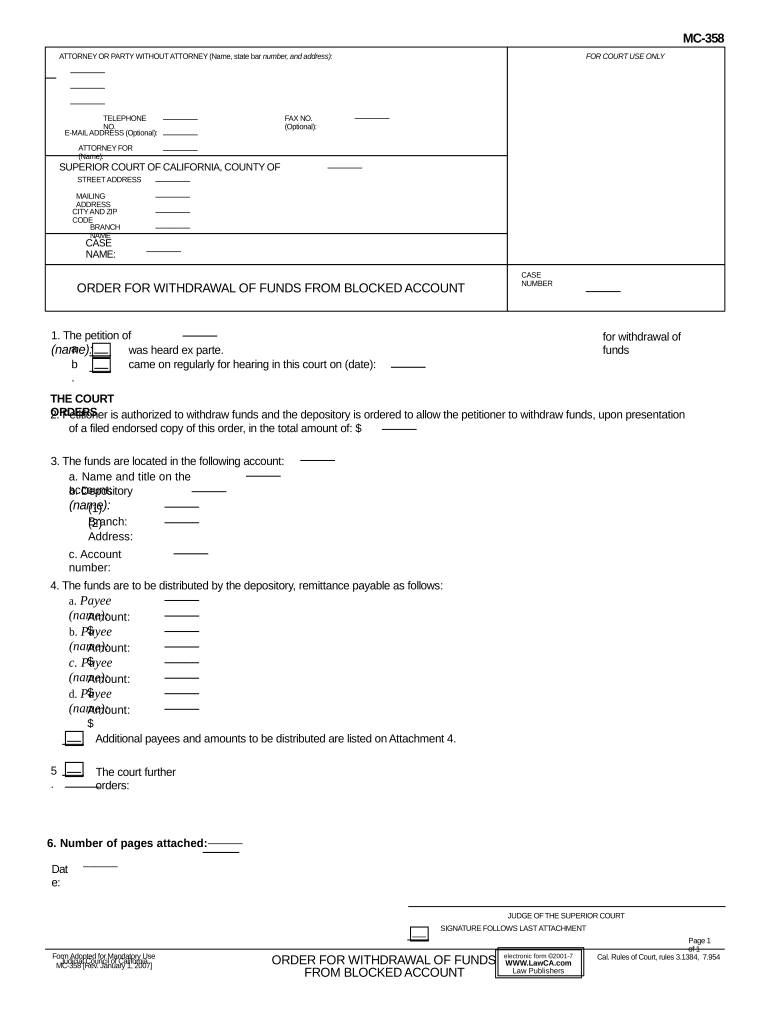

Blocked Account Form

What is the blocked account?

A blocked account is a financial arrangement where funds are held in a secure account and are not accessible for withdrawal until specific conditions are met. This type of account is commonly used in various legal and financial contexts, such as immigration processes or to ensure compliance with certain regulations. The funds in a blocked account remain untouched, providing a guarantee to the relevant authorities that the money will be available when needed.

How to obtain the blocked account

To obtain a blocked account, individuals typically need to follow a specific application process. This may involve the following steps:

- Research the requirements for opening a blocked account specific to your situation or institution.

- Gather necessary documentation, such as identification and proof of funds.

- Complete the required application form, which may be available online or at a financial institution.

- Submit the application along with any supporting documents to the designated authority or financial institution.

Steps to complete the blocked account

Completing the blocked account process involves several key steps:

- Fill out the blocked account form accurately, ensuring all information is correct.

- Provide any additional documentation required, such as proof of identity and financial statements.

- Review the terms and conditions associated with the blocked account to understand your obligations.

- Submit the completed form and documents to the appropriate institution or authority.

Legal use of the blocked account

The legal use of a blocked account varies depending on the context. In many cases, it serves as a safeguard for funds that must remain available for specific purposes, such as visa applications or legal settlements. It is essential to comply with all legal requirements associated with the blocked account to ensure its validity and avoid potential penalties.

Required documents

When applying for a blocked account, you will typically need to provide several documents, which may include:

- Government-issued identification, such as a passport or driver’s license.

- Proof of funds, such as bank statements or financial guarantees.

- Completed application form for the blocked account.

- Any additional documents specified by the institution or authority.

Form submission methods

Submitting the blocked account application can usually be done through various methods, including:

- Online submission via the financial institution's website or designated portal.

- Mailing the completed application and documents to the appropriate address.

- In-person submission at a branch or office of the institution handling the blocked account.

Quick guide on how to complete blocked account 497299324

Effortlessly Prepare Blocked Account on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Blocked Account on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Simplest Way to Alter and eSign Blocked Account with Ease

- Locate Blocked Account and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which requires only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Modify and eSign Blocked Account to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is CA withdrawal and how can airSlate SignNow help?

CA withdrawal refers to the process of withdrawing funds from a California-based account. With airSlate SignNow, businesses can streamline document signing related to CA withdrawal requests, ensuring that all forms are completed accurately and efficiently. Our platform provides an easy-to-use solution that simplifies this process.

-

Is airSlate SignNow suitable for businesses dealing with CA withdrawal?

Yes, airSlate SignNow is designed for businesses of all sizes that require a digital signature solution for various document types, including those related to CA withdrawal. Its user-friendly interface and robust features make it an ideal choice for handling CA withdrawal paperwork effectively.

-

What are the costs associated with using airSlate SignNow for CA withdrawal?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost-effectiveness of our solution makes it feasible for businesses focused on managing CA withdrawal efficiently without incurring high fees. You can choose a plan that best suits your document signing needs.

-

Can I integrate airSlate SignNow with other tools for CA withdrawal processes?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow related to CA withdrawal. Whether you use CRM systems, cloud storage, or project management tools, our platform can be integrated to ensure smooth document handling.

-

What features does airSlate SignNow provide for managing CA withdrawal documents?

airSlate SignNow includes a variety of features such as templates, custom branding, and automation tools specifically tailored for CA withdrawal documents. These functionalities help reduce errors and speed up the signature process, making it easier for your team to manage withdrawal requests.

-

How does airSlate SignNow enhance security for CA withdrawal documents?

Security is a top priority with airSlate SignNow. We implement industry-leading encryption and compliance measures to protect your CA withdrawal documents throughout the signing process. You can rest assured that sensitive information is handled with the utmost care and security.

-

Can I track the status of my CA withdrawal documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your CA withdrawal documents. You can easily see who has signed, who needs to sign, and when documents have been completed. This transparency ensures that your withdrawal processes remain organized and efficient.

Get more for Blocked Account

Find out other Blocked Account

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document