California Installments Fixed Rate Promissory Note Secured by Residential Real Estate California Form

What is the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

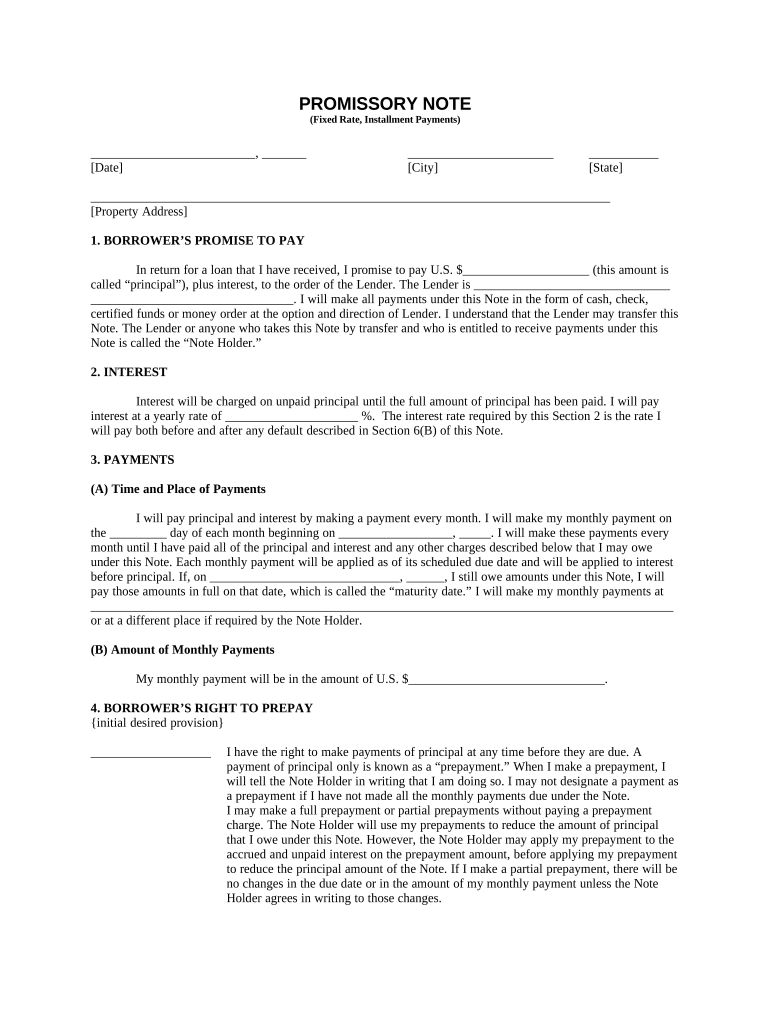

The California Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by real estate in California. This type of promissory note specifies the borrower's obligation to repay the loan in fixed installments over a predetermined period. The note is secured by the residential property, meaning the lender has a claim to the property if the borrower defaults on the loan. This document is essential for both parties, as it provides clarity on repayment terms and legal protections in the event of non-compliance.

How to use the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

Using the California Installments Fixed Rate Promissory Note involves several steps to ensure that both the borrower and lender understand their rights and obligations. Initially, the lender must provide the borrower with the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan. Once both parties agree on the terms, they must complete the promissory note, ensuring that all required fields are filled out accurately. After signing, the document should be stored securely, as it serves as a legal record of the agreement.

Steps to complete the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

Completing the California Installments Fixed Rate Promissory Note requires careful attention to detail. Here are the steps involved:

- Gather necessary information, including the names and addresses of both the borrower and lender.

- Specify the loan amount, interest rate, and repayment terms, including the number of installments and due dates.

- Include any additional terms, such as late fees or prepayment penalties.

- Both parties should review the document for accuracy before signing.

- Sign the document in the presence of a notary public if required, to enhance its legal standing.

- Distribute copies to all parties involved and store the original in a safe place.

Key elements of the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

Several key elements must be included in the California Installments Fixed Rate Promissory Note to ensure its validity and enforceability:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Repayment Schedule: Detailed information on installment amounts and due dates.

- Secured Property Description: A clear description of the residential property securing the loan.

- Default Terms: Conditions under which the borrower may be considered in default.

Legal use of the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

The legal use of the California Installments Fixed Rate Promissory Note is governed by state laws regarding promissory notes and secured transactions. It is important for both parties to understand that this document must comply with California's legal requirements to be enforceable in court. This includes ensuring that the note is signed by both parties and that all terms are clearly defined. Additionally, the lender must properly record the security interest in the property with the appropriate government office to protect their rights in the event of default.

State-specific rules for the California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

California has specific rules that govern the use of promissory notes secured by residential real estate. These rules include:

- Compliance with the California Civil Code, which outlines the requirements for promissory notes.

- Proper disclosure of all loan terms to the borrower, ensuring transparency.

- Adherence to state regulations regarding interest rates and fees, which may be subject to limits.

- Requirements for notarization, depending on the amount of the loan and the nature of the transaction.

Quick guide on how to complete california installments fixed rate promissory note secured by residential real estate california

Complete California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Manage California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California on any platform using airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to edit and eSign California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California with ease

- Find California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature via the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, either by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California and guarantee excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California?

A California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California is a legally binding document that outlines a loan made by a lender to a borrower, secured by real estate property in California. This agreement specifies payment terms, interest rates, and other important conditions.

-

How does the California Installments Fixed Rate Promissory Note work?

In a California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California, the borrower agrees to repay the loan in regular installments over a specified period. The agreement ensures the loan is secured by the residential property, giving lenders peace of mind regarding repayments.

-

What are the benefits of using a California Installments Fixed Rate Promissory Note?

Using a California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California provides clarity and security for both parties. It ensures that repayment terms are clear and that the property serves as collateral, reducing risks for lenders.

-

Is the California Installments Fixed Rate Promissory Note customizable?

Yes, a California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California can be customized to fit the specific needs of borrowers and lenders. You can tailor terms, including interest rates and payment schedules, to accommodate individual agreements.

-

How do I execute a California Installments Fixed Rate Promissory Note?

To execute a California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California, both parties must review and sign the document, ideally in the presence of a notary. Once signed, the note becomes a legal obligation enforceable in court.

-

What integrations does airSlate SignNow offer for managing promissory notes?

airSlate SignNow integrates seamlessly with various tools to help manage California Installments Fixed Rate Promissory Notes Secured By Residential Real Estate California. It connects with popular applications like Salesforce, Google Workspace, and others to streamline document management and workflows.

-

What is the pricing structure for using airSlate SignNow for promissory notes?

The pricing for using airSlate SignNow to create and manage California Installments Fixed Rate Promissory Notes Secured By Residential Real Estate California is based on a subscription model. Plans vary depending on the features you need, ensuring a cost-effective solution for any business size.

Get more for California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

Find out other California Installments Fixed Rate Promissory Note Secured By Residential Real Estate California

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online